School funding formula likely an area of concern as N.J. budget appropriations process begins, analysts say

Gov. Murphy has proposed an N.J. state budget. Now comes the hard part. Legislative hearings begin this week.

The Statehouse in Trenton, N.J. is pictured in this file photo. (Mel Evans/AP Photo)

New Jersey Governor Phil Murphy has outlined what he thinks state spending priorities should be. Now comes the hard part, getting that passed by the state legislature. The New Jersey state budget appropriation process begins on Monday when the General Assembly Budget Appropriations Committee is scheduled to hold three public hearings on the state budget.

Three more hearings in the Assembly are scheduled for Wednesday.

It comes almost a week after Gov. Murphy released his $48.9 billion state budget proposal, which includes about $20 billion in municipal and school district aid.

And some political analysts predict that state lawmakers will pass a final budget that consists of many components of Murphy’s proposal by the July 1 deadline.

“We know the vast majority of what Governor Murphy has proposed will wind up in the final adopted budget,” said Micah Rasmussen, executive director of the Rebovich Institute For New Jersey Politics. “And we can say this with confidence for a number of reasons: one, the governor and the majority [party] in the legislature are the same party.”

“The legislative response so far, at least from the Democrats, has been positive … and third … is that it’s a ‘good news’ budget. Revenues are strong. And there aren’t the kind of tough cuts that legislators would want to second guess,” he added.

Rasmussen also suspected that members of the public would likely have questions about the school funding formula when they show up to appropriations committee hearings this week.

Murphy’s budget cuts spending in about 200 school districts, despite the state bringing in $4.6 billion over projected revenue, Rasmussen said.

According to Rasmussen, New Jersey brought in much more revenue than projected, thanks to an infusion of federal coronavirus funding, loans borrowed through state legislature and a growing economy.

“The [school funding] formula has resulted in some increased aid to some districts and some decreased aid in other districts. And so I think there are winners and losers. And I think you’re going to hear from a fair number of the losers as the budget process unfolds,” Rasmussen said.

And some Republican state lawmakers have also weighed in.

“There’s no financial reason to cut school aid to districts when we’re flush with cash, especially when teachers are struggling to make up for pandemic-related loss now that students are back in the classroom,” said Sen. Sam Thompson (R-12).

Another topic of concern in the state budget process has been affordability and property taxes.

Elected officials on both sides of the aisle have stated that these issues are their top priorities this year.

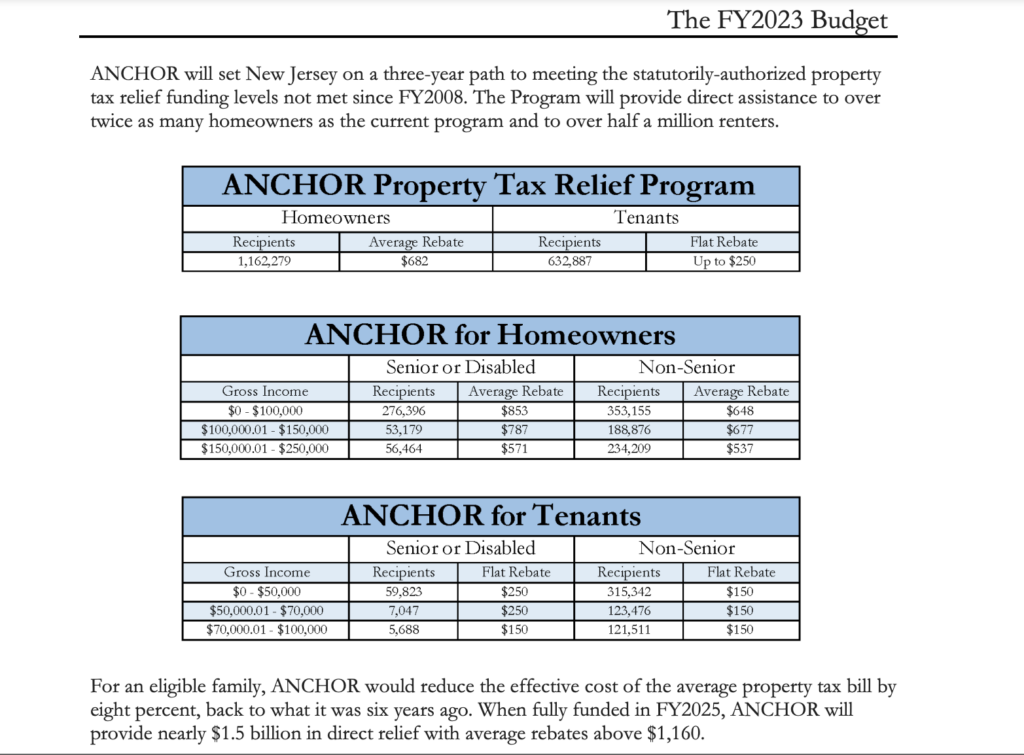

The Murphy Administration said it planned to address property tax relief and affordability in several ways, including introducing the ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) Program and the Affordable Housing Production Fund.

During his annual budget address, Murphy said the ANCHOR Program would “deliver direct property tax relief to nearly 1.8 million middle and working-class and senior households,” and he said it would save New Jerseyans $900 million this year.

GOP lawmakers will likely contest elements of Murphy’s proposal, including the ANCHOR program. Some Republican legislators have introduced tax rebate measures, like a $500 tax credit ($1,000 for people who are married) and a $500 gas rebate, that would put more money back into the pockets of New Jersey taxpayer, they said.

“Our millionaire governor simply isn’t feeling the pain that the average family is feeling due to rising gas prices and inflation. How many billions does Governor Murphy need to keep in the State bank account when people are suffering? People need those extra tax dollars returned to them,” said Sen. Ed Durr (R-3).

In the last general election, Durr unseated longtime Senate President Stephen Sweeney. He gained notable recognition for spending less than $10,000 in campaign financing.

Rasmussen said the Republican-led rebates are similar to some of Murphy’s proposals (though there are some differences in income eligibility).

“My money would be that it would wind up looking more like the governor’s proposal,” Rasmussen said. “That doesn’t mean that Republicans don’t deserve some of the credit for that. But it also doesn’t mean they deserve all the credit for that, because this is an idea that is as old as time itself.”

Several U.S. states, including the Garden State, now sit on a surplus of cash, following the throws of the coronavirus pandemic.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.