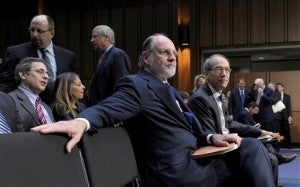

Jon Corzine and MF Global — what went wrong and were laws broken?

ListenHour 1

Former New Jersey governor Jon Corzine testified yesterday before the Senate Agriculture, Nutrition and Forestry Committee to explain the whereabouts of over $1.2 billion in client money missing from the accounts of the firm he headed, MF Global. The brokerage firm declared bankruptcy on October 31st after it bet heavily on the debt of some European nations by buying over $6 billion of dollars worth of their government bonds. Corzine assumed that these nations would not default on their loans but as the situation worsened in Europe the firm needed to put more money to finance its bet and used client funds to do it — and now that money is missing and MF Global is bankrupt. The deal has raised serious questions about how brokerage firms like MF Global are regulated even after the passage of the Dodd-Frank Act intended to reform the practices of banks and financial firms. Our guests AZAM AHMED and BENJAMIN PROTESS have been covering the story for the New York Times and they join us to explain it all. Then we’ll talk to economist ROBERT KUTTNER about the effectiveness of laws and policies intended to prevent financial fraud.

Listen:

[audio: 121411_100630.mp3]

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.