Philly’s racial wealth gap is wider now than in 1960. Here are programs working to fix it

New initiatives want to stop persistent wealth discrepancies between people of color and their white counterparts.

Listen 1:58

New programs at the national and local levels have found ways to address the widening wealth gaps. (Library of Congress, Copyright, 1883, by O.W. Gray & Son, Canva/Vicky Diaz-Camacho)

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

Philadelphia is one of the U.S. hotspots where the equity of a homeowner who is Black or Latino is much less than that of a white homeowner.

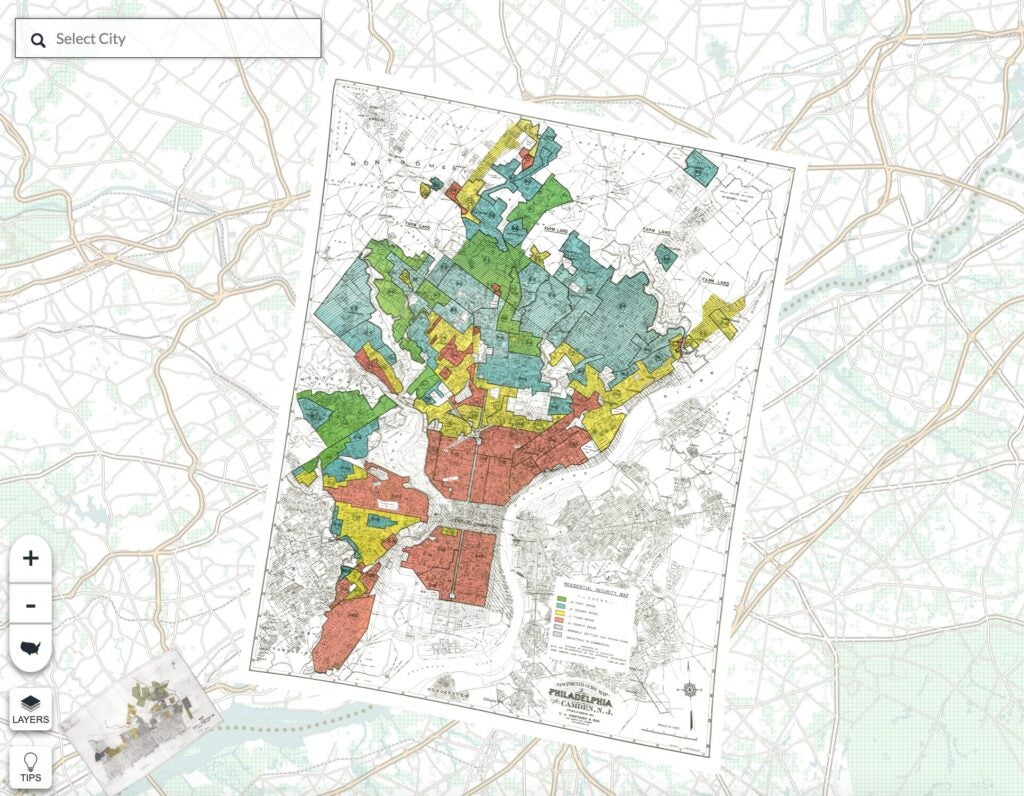

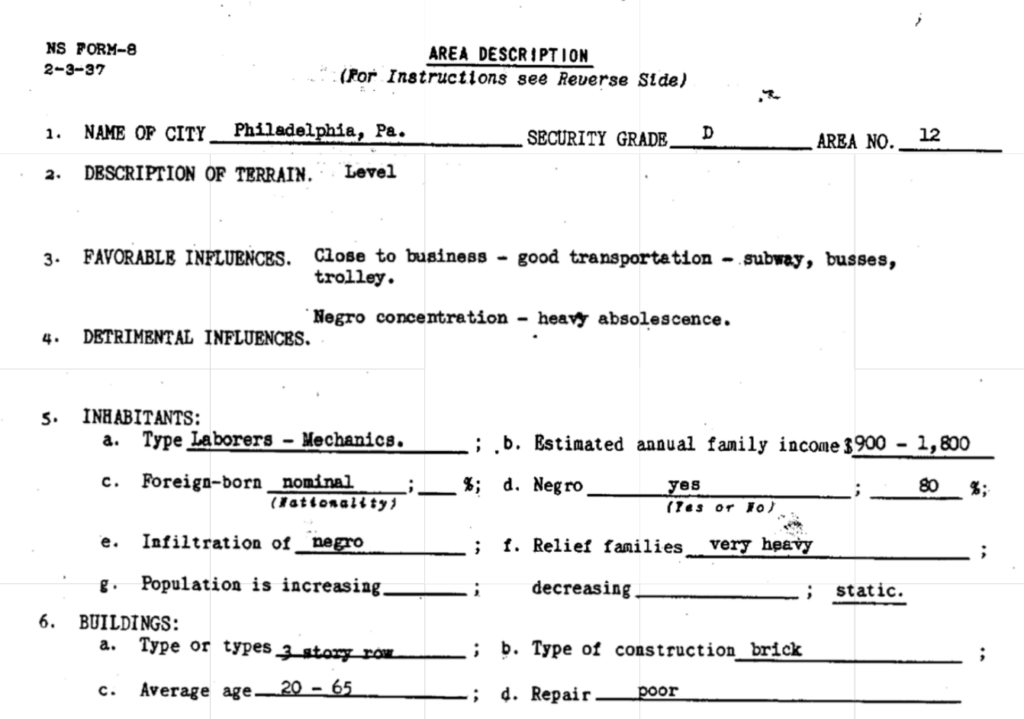

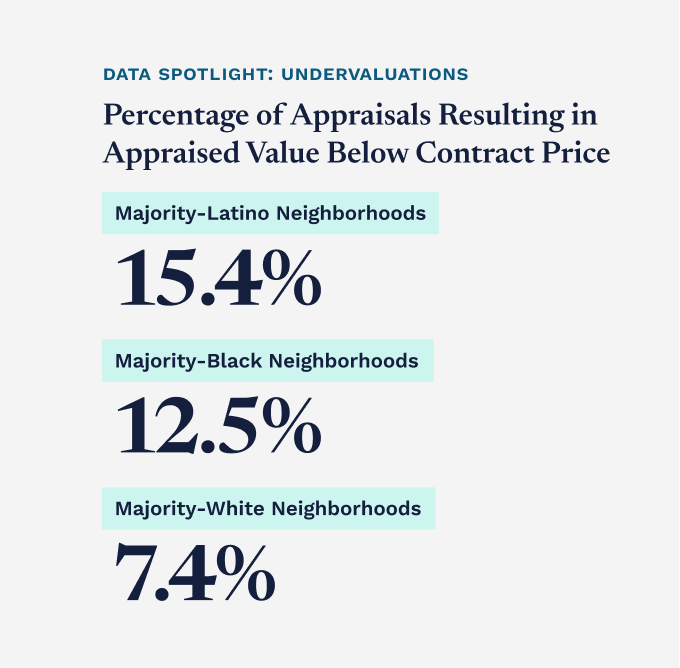

These discrepancies are largely concentrated in the real estate industry via mortgage rejection rates and property appraisals. The wealth gap is most pronounced among racial lines — be it banking, income or housing equity. A Federal Reserve Bank of Philadelphia report finds these issues are the residual effects of redlining and discriminatory housing policies.

“Today, the disparity between median Black and white wealth is as large as it was in the 1960s (adjusting for inflation),” the 2023 report reads.

Some organizations in Philadelphia are working to provide Black and other families of color equal opportunity to amass wealth through investment in minority developers. One example is PHDC’s Turn the Key Program, which offers first-time home buyers counseling and financial help to put money down on a house.

Advocates say this act alone helps more families of color have a chance to build generational wealth. But more coordinated efforts are needed to address the wealth imbalance and give back to communities of color, experts add.

Executive director of the Economy League of Philadelphia, Jeff Hornstein, said the impact of those old practices is apparent.

“The crazy thing is that those maps came out in the ‘30s, and you can pretty much map every disparity onto those maps right to this day,” he said.

Old policies prevented Black and other people of color from becoming homeowners for decades, and advocates say they are difficult to fix. To date, the Brookings Institute finds that white residents have seven times the wealth compared with Black residents, which impacts health, education and future stability.

But new programs at the national and local levels have found ways to address the widening wealth gaps.

The Philly 5000 campaign, for instance, set out to combat the fallout of disinvestment and address the barriers people of color face when trying to buy a home. The Wells Fargo Foundation backed the initiative with a $7.5 million grant to support 5,000 people of color in becoming homeowners.

The campaign, led by the Urban League of Philadelphia, partnered with other community organizations to connect people with resources that make homeownership easy to understand and a viable possibility.

Abraham Reyes Pardo, vice president of housing at the Urban League of Philadelphia, said help exists, but people are often unaware of what is available.

“We are not trying to take anything away from any other groups, but elevate other groups who are lagging behind in every statistic,” Reyes Pardo said. “When you are in a populated place like Philadelphia, where homeownership is rooted in the history of this city, where you have naturally occurring affordable housing, then that has to mean something in the context of accelerating the opportunities for families who are ready to go, and they might need one or two things to get there.”

However, homeownership is just one way to create wealth.

“There are other ways to think about wealth building, be it in the form of investment, or Baby bonds too,” said Katharine Nelson, director of research at the Housing Initiative at the University of Pennsylvania.

Baby bonds are a government policy proposed by New Jersey Sen. Cory Booker that provides each child in the U.S. an account with a seeded amount (between $1,000 and $3,000), according to the Samuel Dubois Cook Center on Social Equity at Duke University.

Andre Perry, a Brookings Institute fellow and author of “Know Your Price: Valuing Black Lives and Property in America’s Black Cities,” agreed.

“No one group should have their wealth concentrated in any one area,” he added. “Wealth is a determinant of so many other outcomes.”

Another factor he and other scholars identified was a need to reform property tax policy. In its current state, it has overburdened Black families over time. A Brookings Institute study found that “local property tax applied to the over-assessed value of Black-owned homes is 10% to 13% higher than for white-owned homes.”

Property assessments and appraisals can be over-assessed and undervalued, raising the cost of property taxes per year.

“There’s no easy way to get these imbalances balanced without doing something in terms of tax policy,” Perry said.

He emphasized the importance for Black families to diversify how they build their money and to stay aware of new policies or programs.

Changes are revving up at a national level, Nelson said.

“Some of the most exciting stuff out there is shared equity kinds of opportunities, land trusts [or] land being held in cooperative and nonprofit trust,” Nelson said. “It reduces the cost of homeownership and makes it more accessible.”

Another, in 2021, the Department of Housing and Urban Development launched the Interagency Task Force on Property Appraisal and Valuation (PAVE) to reduce discriminatory appraisals. Biased lending and appraisals showed that communities of color were not getting their return on investment.

Locally, people like Hornstein are pushing for concrete solutions, like putting money into the communities that need it most. He outlined two ways: government dollars and investment, and private-public partnerships.

For instance, the city’s Turn the Key program leveraged partnerships among River Wards Development Group and Penn Community Bank to make financing available for Black and brown developers.

Additionally, Hornstein said he sees an opportunity to use the surplus of Philadelphia’s budget, which amounts to $1 billion.

“I believe about half of that ought to be invested in closing the racial equity gap, through re-investing in disinvested neighborhoods,” he said.

However, he adds, it is essential to get community input on what solutions to bring to the table.

A new one comes this Spring.

The Economy League announced the launch of “Fair City,” a social entrepreneurship competition, this March, which invites community members, business owners and others to suggest how to address the racial wealth gap problem. It emerged after their analysis found a $57 billion property value gap among households who were Black or Latino and white households.

Now that they have a clear picture of the problem, they are focused on what to do next.

“If we want to have a vibrant economy in 25 years, when the country doesn’t look like me, we need to be doing everything possible to make sure that Black and brown Philadelphians … have access to opportunities to increase wealth or else we’re going to become, you know a slow growth or no growth,” he said.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.