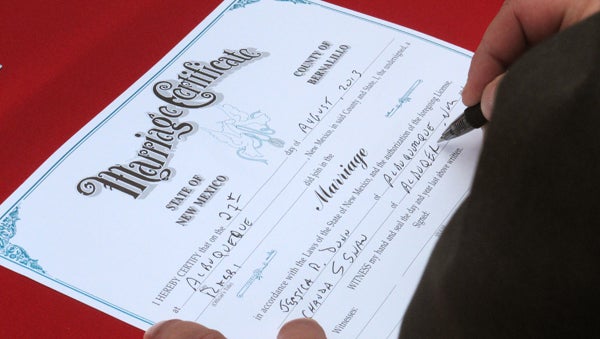

IRS will recognize same-sex couples married out of state

(Russell Contreras/AP Photo, file)

When the U.S. Supreme Court overturned key parts of the federal Defense of Marriage Act (DOMA) in June, it left many unanswered questions for same-sex couples. The decision meant that the federal government would now recognize marriages from states that allowed them.

But what if a couple moved to a state that didn’t, like Pennsylvania? Since the decision, federal agencies have been unveiling their answers one by one.

On Thursday, the IRS announced it will allow legally married same-sex couples to file their taxes together, regardless of where they live.

David Pudlin, a tax attorney in Philadelphia says the decision will give Pennsylvania couples many federal tax benefits.

“Taking the standard deductions, how employee benefits are treated, the Earned Income Tax Credit and the childcare tax credit,” for all those items, he said, filing as married typically produces a lower tax bill.

Several years ago, the federal government predicted that on the whole, the treasury would take in more money by allowing same-sex couples to file as married.

Statistically, many same-sex couples earn similar incomes. That means more will get hit by the so-called marriage penalty, where filing jointly leads to paying more taxes than by filing separately.

The IRS policy excludes civil unions, the type for partnership recognized in New Jersey

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.