Is the ‘gig’ economy forcing changes in workforce classification?

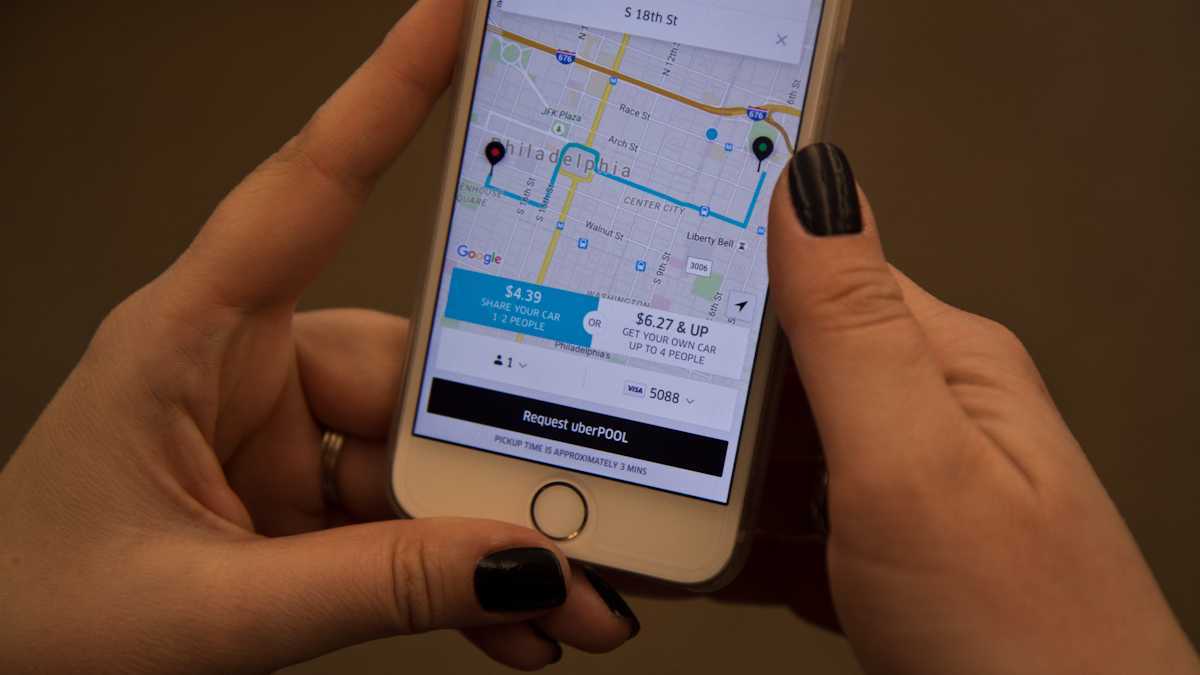

(Kimberly Paynter/WHYY, file)

“Gig workers” — the term often used to describe members of today’s workforce who provide services on a “per job,” or per “gig,” basis — are becoming more prevalent with the penetration of disruptive technologies within the American economy.

These technologies (coupled with a less-than-robust macroeconomic environment) have led to a dramatic increase in the number of people providing services on a per-gig basis. Examples include Uber and Lyft drivers, Handy household service providers, and TaskRabbit errand runners. This growing segment of the workforce was estimated to generate “$1.1 trillion in combined gross income — 6 percent of U.S. gross domestic product,” according to MBO Partners’ 2016 report, “America’s Independents: A Rising Economic Force.”

To date, companies like Uber have classified drivers not as employees but as independent contractors, a classification that yields dramatic cost reductions. When making use of independent contractor arrangements, a company does not pay employer payroll taxes, unemployment charges, or worker’s compensation insurance fees. Neither is a company required to comply with employment discrimination or wage and hour statutes and regulations for workers correctly classified as independent contractors, although some laws such as the Pennsylvania Human Relations Act and the Civil War-era statute prohibiting discrimination in the making or enforcing of contracts still would apply. Also, independent contractors generally are not eligible for the company’s fringe benefit offerings.

Companies, of course, are not at leisure to pick and choose between classification methodologies. The U.S. Department of Labor, the Internal Revenue Service, and various state and local government agencies have increasingly challenged the independent contractor classification of workers, as have many workers themselves by filing private lawsuits. There are a variety of factors applied by different government agencies as well as courts in determining whether an individual should be treated as an employee or an independent contractor. Of course any analysis of worker classification must take into account the specific facts and circumstances at issue. Generally the more control a company exerts (or has the authority to exert) over a worker, the more likely that the worker should be classified as an employee.

Enter new-economy companies like Uber, who deploy newfound technologies in matching service seekers with service providers, for a fee. The relationship between companies like Uber and its drivers is unusual, and presents new, non-traditional elements of control among companies and workers. For instance, drivers supply their own equipment, choose how often they wish to work, and generally are free to decline work without repercussion, all indicators of an independent contractor type of relationship. However, drivers are subject to Uber background checks, do not set prices, and can be suspended or terminated due to poor customer ratings, which are indicators of more of an employment type of relationship.

As the gig industry has grown, it has drawn scrutiny from governmental authorities, who pose questions as to whether the workforce has been afforded adequate workplace protections under wage and hour laws. Similarly, taxing authorities are inquiring as to whether appropriate tax treatment has been elected. Some workers themselves also have sought to challenge their independent contractor classification, filing class and collective action wage and hour lawsuits. Because the gig economy exhibits characteristics of both employment and freelance arrangements, and because the number of workers participating in such work arrangements has substantially increased, the question of whether the gig economy represents an entirely new form of work arrangement is now hotly debated.

Challenges to the classification of gig workers as independent contractors have found their way to courts throughout the country, including one now being litigated in Philadelphia. In Razak v. Uber Technologies, Inc., the U.S. District Court for the Eastern District of Pennsylvania refused to dismiss the putative class and collective action lawsuit brought by UberBlack workers under federal and state wage and hour laws challenging their classification as independent contractors. The parties will now undertake costly pre-trial discovery.

Improper workforce classification can have devastating consequences for companies, who can be subject to severe fines, penalties, and claims (often not covered by Employment Practices Liability Insurance policies) that can literally lead to bankruptcy. It is critical that companies with gig-type workers carefully weigh the factors associated with making the determination as to employee or independent contractor classification.

Adding to the uncertainty is the new administration in Washington, D.C., although increasingly state and local governments have entered the fray on this front as well. In late 2016, New York City passed the Freelance Isn’t Free Act which provides for certain protections for gig economy workers.

Companies in the gig economy would be well served to closely monitor ongoing litigation, as well as federal, state, and local legislative and regulatory developments in evaluating whether a change in workforce classification may be appropriate.

—

B.J. Hoffman is a partner at Citrin Cooperman in Philadelphia, and Andrea M. Kirshenbaum is chair of the Wage & Hour Practice Group and principal at Post & Schell P.C. in Philadelphia.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.