N.J. considers easing tax burden by allowing residents to help pay for town services

Gov. Phil Murphy wants towns to be able to establish charitable funds to pay for local services. Homeowners would get credits on their property tax bills for contributions.

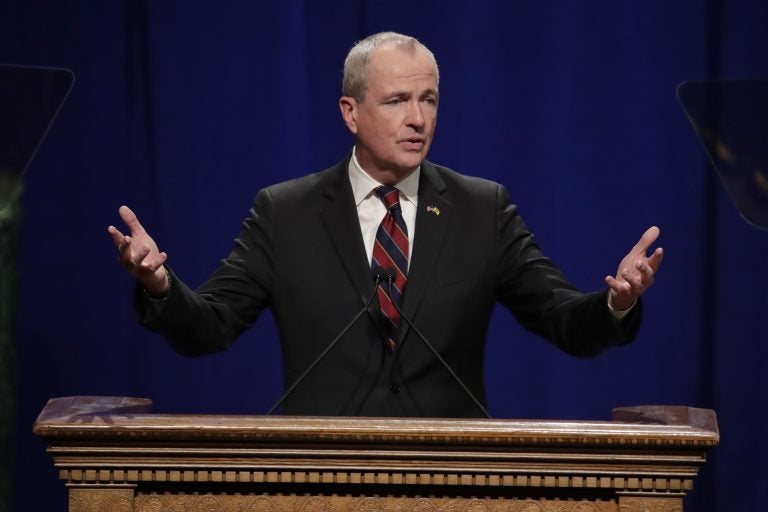

New Jersey Gov. Phil Murphy wants towns to be able to establish charitable funds that pay for local services. Homeowners would get credits on their property tax bills for any amount they donate. (AP Photo/Julio Cortez)

New Jersey Gov. Phil Murphy is urging the Legislature to send him a bill that would help homeowners cope with the new $10,000 federal limit on state and local property tax deductions.

Murphy wants towns to be able to establish charitable funds that pay for local services. Homeowners would get credits on their property tax bills for any amount they donate.

“Certainly, this is no replacement for meaningful property tax relief. I get that. We all know that there are no easy fixes,” Murphy said. “But while we commit to the long-term effort, let’s also commit to providing common sense and immediate relief for out taxpayers.”

Other states have similar programs, he said.

Senate President Steve Sweeney said he’s working on legislation that would authorize local governments to create those funds.

“It would go to roads or it would go to sanitation. Just like in the red states where you’re sending kids to public schools and you’re getting a deduction for that,” said Sweeney, D-Gloucester. “That’s a government function. Schools are a government function.”

The plan won’t derail long-term efforts to deal with the property tax issue, said Assembly Republican Leader Jon Bramnick.

“Based on the history of this state, I’ll take whatever I can get now, and I certainly would work toward the greater goal, but I’m not going to ignore a possible way of taking a deduction because it’s just short-term medicine,” he said.

Property taxes in New Jersey are among the highest in the nation, averaging more than $8,500 statewide.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.