‘Immediate relief’: Delaware joins forces with nonprofit to erase $50M of residents’ medical debt

Gov. Meyer’s administration is partnering with Undue Medical Debt, which buys overdue accounts at a penny on the dollar, or less.

Listen 2:09

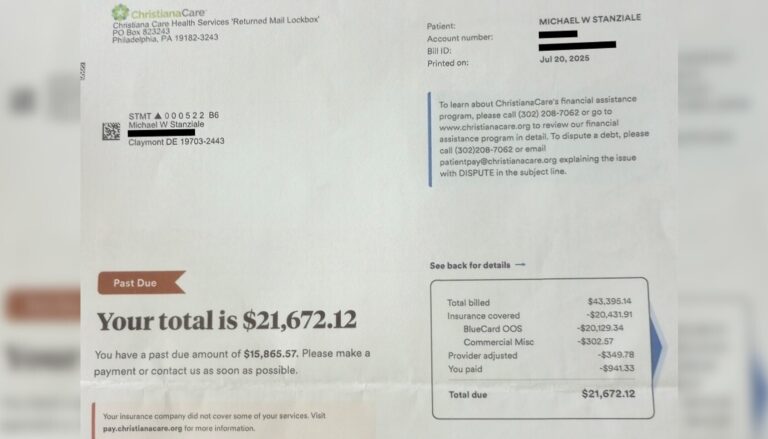

Mick Stanziale is paying $100 a month toward his ChristianaCare bill for a heart catheterization and followup care. (Courtesy of Mick Stanziale)

What are journalists missing from the state of Delaware? What would you most like WHYY News to cover? Let us know.

Mick Stanziale, who has debilitating cardiac issues and can’t walk 50 feet without getting winded, pays $100 a month toward his $23,000 in medical bills.

At that rate, the 64-year-old Claymont man would pay off his debt in about two decades.

Stanziale’s whopping financial obligation stems from a January 2024 heart catheterization and followup care that his insurance only partially covered. He’s no longer able to work for Home Depot or Lowe’s, his most recent employers, so now Stanziale lives on about $2,000 a month — $1,700 from Social Security and $300 from a small 401(k) account.

Paying for rent, utilities, food and medicine eats up almost all of his income, but each month Stanziale takes pains to send off the $100 check to ChristianaCare, Delaware’s dominant health care provider. He also makes small payments to a fire company for a short ambulance ride he needed last year.

That’s all he can afford.

“The catheterization started the snowball effect,” Stanziale said. “It’s been crazy. Cut me close.”

Stanziale’s predicament — barely making ends meet while saddled with crushing medical debt — is one shared by thousands of fellow Delawareans.

While the exact amount owed to hospitals, doctors and other medical providers is unknown, the federal Consumer Financial Protection Bureau has reported that in 2020 about 17% of the state’s roughly 1 million residents had $401 million in medical debt on their credit reports.

But Delaware has taken some major steps to relieve the burden so many bear.

Two years ago lawmakers passed a bill, signed by then-Gov. John Carney, that forbids hospitals and other large health care facilities from charging interest and late fees and requires facilities to offer monthly payment plans that don’t exceed 5% of the patient’s monthly income.

That law also forces hospitals and other providers, including ambulatory and surgical centers, to wait at least 120 days after the first bill is sent to the patient to sell debt to a collector, and to notify the patient 30 days before doing so. It stops debt collectors from trying to foreclose on a patient’s property or garnish their wages or other income.

This year legislators went further, prohibiting the reporting of medical debt to consumer reporting agencies and barring it from being factored into someone’s credit report.

Now Gov. Matt Meyer, who succeeded fellow Democrat Carney in January, has partnered with a nonprofit to erase $50 million in medical debt for residents at a cost of $500,000 to taxpayers.

While state officials realize $50 million is only a small fraction of the debt owed by Delaware patients, the Meyer administration is viewing this effort as a pilot program they might seek to expand.

“Eliminating medical debt restores hope, stability, and dignity to people who’ve been unfairly burdened for seeking care,” Meyer said.

The initiative, Meyer said, will help his administration “break down structural barriers that keep people from getting ahead and building the secure, healthy lives they deserve. We’re building a state where your worst day doesn’t define your future.”

The state’s partnership is a three-year deal with New York-based Undue Medical Debt, which buys bundled medical debt portfolios from providers like hospitals, providers and collection agencies at a penny on the dollar or less, depending on how long the debt has been unpaid. Undue has contracts to abolish patients’ overdue debts with about 25 states and localities nationwide, including New York City, Pittsburgh, Connecticut and New Jersey, where more than $1 billion in debt has been forgiven since last year.

Residents of Delaware can qualify in two ways:

- Have annual household income at or below 400% of the federal poverty level — $129,600 for a family of four, $62,000 for someone who lives alone.

- Have medical debt that’s at least 5% of their annual household income.

Undue plans to buy large portfolios of Delawareans’ debt — perhaps obtaining $1 million worth for $10,000, or less if it’s a few years old — and wipe out the bills of all the qualifying patients in the bundle.

So instead of getting letters, calls, emails and texts from a debt collector or a provider, the patient will get a letter from Undue, notifying them that their debt is zero.

People with debt don’t have to apply or do anything to have their debt canceled.

‘I’m going to pay them what I can afford per month’

While the Delaware-Undue collaboration aims to help some 17,000 people, it’s unlikely that Stanziale, who is making regular payments on a relatively new but hefty bill, could benefit unless ChristianaCare sells a bundle that includes his debt to Undue, or to a debt agency that sells it to Undue.

But the recent laws Delaware has enacted will keep the debt off Stanziale’s credit report and prevent ChristianaCare from requiring a higher payment for what its billing invoices say is a “past due” account.

Overall, Stanziale applauds the debt-canceling partnership as a good start for his home state, where he was a standout baseball player at former Claymont High.

“I like the idea. If it can help [me], it would be awesome, but I’m going to pay them what I can afford per month and right now it’s $100,’’ Stanziale said.

Even with Stanziale’s consistent payments, though, his bill isn’t going down.

“I’ve had so many doctor’s appointments over the last month and a half that it’s increased,” he said. “It’s crazy. But I’m going to contact them again and see what they say about [decreasing] my $100 a month because they keep sending me notes, you know, ‘Send this money.’”

‘A lot of folks wake up every day and think about medical bills’

Patients with burdens like Stanziale are what has driven Delaware to join forces with Undue, said Kevin Myers, deputy policy director for Meyer

“There’s a lot of folks that wake up every day and think about the medical bills that they are trying to and often can’t pay, or the hard choices they have to make,” Myers said. “Are they going to pay their rent? Are they going to pay for the car? Or are they going to pay for the bill that they didn’t choose to incur in the first place?”

“And there’s the financial stress of that and there’s also the emotional burden. And the governor thinks it’s really important that we’re taking this action to address both of those.”

Myers said 60,000 Delawareans have medical debt they have trouble paying.

The burden “falls most strongly on low-income folks, people of color and the uninsured, but we also know that it doesn’t just affect those categories,” Myers said.

“We have people that are on insurance that have medical debt because their insurance isn’t covering everything that they need. We have people that are coming from all walks of life that are impacted by this.”

‘The beauty is we’ll never collect a single dollar from anybody’

Allison Sesso, CEO of Undue, said she hopes hospitals sell their debt to her nonprofit instead of the debt collection industry.

“We have to go out and talk to hospitals and basically convince them that this is a better option,’’ Sesso said. “What we provide is a really nice alternative for hospitals to basically get the same value for the bad debts,’’ Sesso said. “But the beauty is we’ll never collect a single dollar from anybody.”

“As soon as we get those debts, we will just send a letter to [patients] and let them know that the debt’s been free and cleared. So we’re taking advantage of the market, but we’re applying it in this very unique way.”

“We feel like this program gives hospitals an opportunity to take care of a bad debt and do something positive for patients that often aligns with their existing discounted charity care that they already give to people in the community that they’re serving,” Sesso added.

State Sen. Spiros Mantzavinos, who represents Elsmere and nearby areas west of Wilmington, applauds the partnership. Mantzavinos sponsored the bills that prohibit interest charges on medical bills and keep the debts off credit reports.

“Medical debt is just unique debt. It’s debt that can incur through no fault of somebody,’’ he said. “You get sick, you get a catastrophic diagnosis, you’re in an accident. It’s something that people can’t control. And ultimately, it affects people’s quality of life and their financial stability. Studies show that people with medical debt forgo going to the doctors because of the fact that they have debt.”

Miriam Straus, a policy adviser with Community Catalyst, a Boston-based nonprofit that advocates for a more equitable health care system in America, said Undue has done good work relieving debt by joining forces with state and local governments. Strauss said it’s just as critical that hospitals uphold their commitments to provide charity care to people in need, and for states to hold them accountable.

“We want people to get immediate relief. That’s really important,’’ Straus said. “And we know that a lot of people put off care that they or their family members need because of cost. So if people have medical debt and that debt is relieved and it lets them get the care that they need in the future, that’s great.”

“We’re just looking at long-term solutions because sometimes that debt shouldn’t have accrued in the first place.”

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.