Delaware gets an 'F' for its financial health

A nonprofit that says it promotes transparent government financial information has given Delaware an F grade for its financial health.

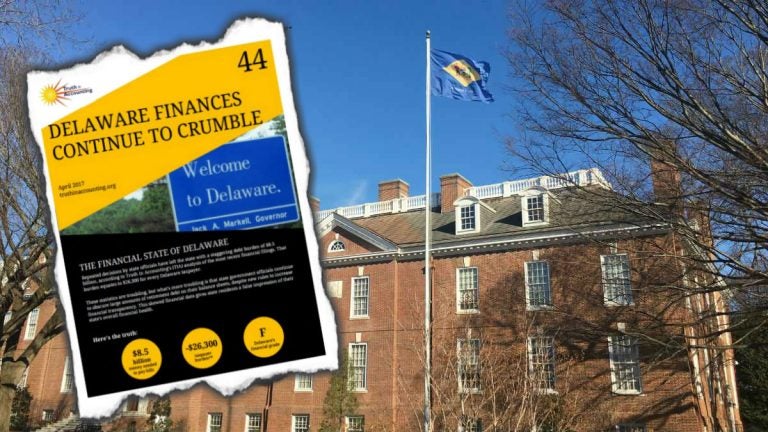

(inset photo courtesy Truth In Accounting; Leg. Hall photo: File/WHYY)

A nonprofit that says it promotes transparent government financial information has given Delaware an F grade for its financial health, ranking it 44th in the nation overall.

Only nine states received A’s and B’s, with Alaska leading the scoreboard.

Now in its 8th year, the report released by Truth in Accounting concludes Delaware is $8.5 billion in debt, causing a tax burden of $26,300 per taxpayer.

Furthermore, the non-profit claims the state is obscuring large amounts of retirement debt on its balance sheets.

“Delaware is kind of knocking on the door in how much debt it has accumulated,” said Bill Bergman, director of research for the non-profit. “It has effectively passed the cost of past government services onto future tax payers, which has consequences for future service delivery for poor people, as well as possibly higher taxes in the future.”

The findings were based on Delaware’s fiscal year 2016 audited comprehensive annual financial report and retirement plans’ actuarial reports.

The report finds Delaware accumulated $11.4 billion worth of bills for bonds, liabilities, unfunded pension benefits and unfunded retiree healthcare. Unfunded pension benefits cost $1.9 billion, while unfunded retiree healthcare cost $7.2 billion. Despite reporting most of its pension debt, the nonprofit claims the state hid most of its retiree healthcare debt—and hidden debt amounts to $5.5 billion.

State takes issue with findings

Secretary of Finance Rick Geisenberger said Delaware meets all reporting standards required by the Government Accountability Standards Board. Beginning in calendar year 2018, retirement debt will be reported on its balance sheet. There currently is a footnote on its financial statements about what those obligations are.

Geisenberger points out that Delaware still is one of 10 states to receive a Triple A bond rating from all three bond agencies, and he also said he has concerns about the report’s methodology.

“The two biggest issues are the analysis, which takes the state’s obligations and divides by the number of Delaware tax payers, doesn’t recognize that small states in particular have hundreds of thousands of taxpayers that reside in our neighboring states that work in Delaware, not to mention in Delaware’s case more than 1.2 million payers of the state’s business franchise taxes and fees—so when you don’t include those in your analysis you’re going to end up with high per capita number,” he said.

“The other major problem is they don’t take into account that a small state like Delaware is spending most of its money at the state level, and not at the county, municipal and school district levels. So when you just look at our state obligations they may look high, but if you look at entire state, county, municipal and school district levels, because there’s so little indebtedness at those other levels you end up with higher numbers.”

Geisenberger agrees retiree healthcare is a challenge, however.

Lawmakers respond

State Sen. Harris McDowell, D-Wilmington, who co-chairs the state’s finance committee, agrees with him.

“This issue has been asked and answered. Delaware’s balance sheets aren’t just solvent, they’re some of the strongest in the country,” he said in an email.

“You don’t have to take my word for it: look to the actual investors who put their money on the line. Delaware’s had a AAA credit rating from all three rating agencies for 17 years in a row. What’s more, those agencies specifically cite our pension system, which is funded better than nearly every other state, and our moderate debt. That’s in spite of the fact that our tax burden is the lowest in the nation. Cocktail napkin math doesn’t change that.”

Rep. Daniel Short, R-Seaford, said future debt obligations are not an uncommon problem for states, but believes the Delaware should be aware of its shortcomings. Given the state’s budget challenges, including tackling a $400 million deficit this year, he said it’s not surprising there are liabilities creating havoc for the state.

“Our focus should be on building a strong economic base where businesses will want to grow and locate here. In addition, I think the time is more than right to commit to establishing a Delaware Sustainability Fund in order to manage our state’s revenue stream volatility and eliminate our annual cycle of financial crisis management. Coupled with examining how to rein in out-of-control cost drivers like Medicaid and public education, the Sustainability Fund will help keep Delaware on the right financial path for years to come,” Short said.

“When you have new revenue you have to do something with it other than spend it. You ought to be looking at ways to economize your expenses and put some money away for the future. That’s what people do in their daily lives, I don’t know why we think we should be any different.”

State Auditor Thomas Wagner, R-Delaware, said the state should reevaluate how it handles benefits, retirements and pensions in the future.

“Many times those issues—salaries, benefits, into retirement—were pushed because they didn’t cost anything today and the costs were in the future, when quite frankly, someone else was in office, and I think it’s not a good way to govern. It’s a short term vision that throws your costs into the future, and government does have to reevaluate how we address that going forward,” he said.

“The end result of this is pointing out we contract for these things into the future, as a benefit for our employees, but in reality, there could be a substantial cost to that and that cost is into the future,” Wagner said.

He added that the private sector has changed its handling of retirement packages for workeres and the state should do the same. “We look to the future and say for the future tax payers we can’t afford that. We have unbelievable deficit issues and problems at a state level and some point in time somebody has to worry we’re taking on too much debt.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.