Center City report finds $1 billion in retail demand

Just in time for the holidays, the Center City District (CCD) released a 24-page glossy report on the state of retail its purview, finding downtown Philadelphia blossoming as a “24-hour downtown” with few counterparts in the United States outside New York.

CCD reports $1 billion in retail demand “driven by the downtown core and its surrounding neighborhoods” and $8.5 billion in planned investments for Center City before 2019.

All this is supported by almost 300,000 downtown workers, an historic number of tourists, and residents of the “core Center City” area—Vine to Pine, Schuylkill to the Delaware—who have average household incomes of more than $111,000. The report estimates that demand created by residents in the heart of Center City is $121.9 million annually, office workers in the heart of Center City generate $175.7 million, and overnight visitors $411.7 million. This is complemented by a transit network that deposits a couple hundred thousand people onto Center City’s streets every weekday and the general pedestrian-orientation of downtown, which makes casual shopping and dining so simple.

Here are a three of PlanPhilly’s takeaways from the Center City District’s latest:

Walnut Street Commercial Corridor Expanding Outward

In late October CBRE reported that Philadelphia’s average prime retail rents stabilized after an 87.5 percent increase over the last five years. (Miami is the only city with faster growth in this category, although Boston and New York are right behind.) As the real estate services company explains it, prime rents are the top rents paid for the highest quality spaces in the hottest locations. High end retail in Center City went gangbusters in the last half decade.

The total number of establishments is pretty much the same as in CCD’s 2014 report, and the breakdown of national chains to independents is exactly the same (23 percent to 77 percent). But the footprint of the traditional high-end commercial hub west of City Hall on Walnut Street is now super-sized, spreading to Chestnut Street and to the numbered streets that connect the two east-west roadways. The report trumpets the coming of Warby Parker and Soulcycle to that corner of downtown.

The Rise of East Market:

Since the decline of the downtown department store era, Market Street east of City Hall and the blocks to the south have been unable to match their western counterparts. But now retail and office space is making a comeback. The neighborhood is even getting a full-fledged grocery store in MOM’s Organic Market.

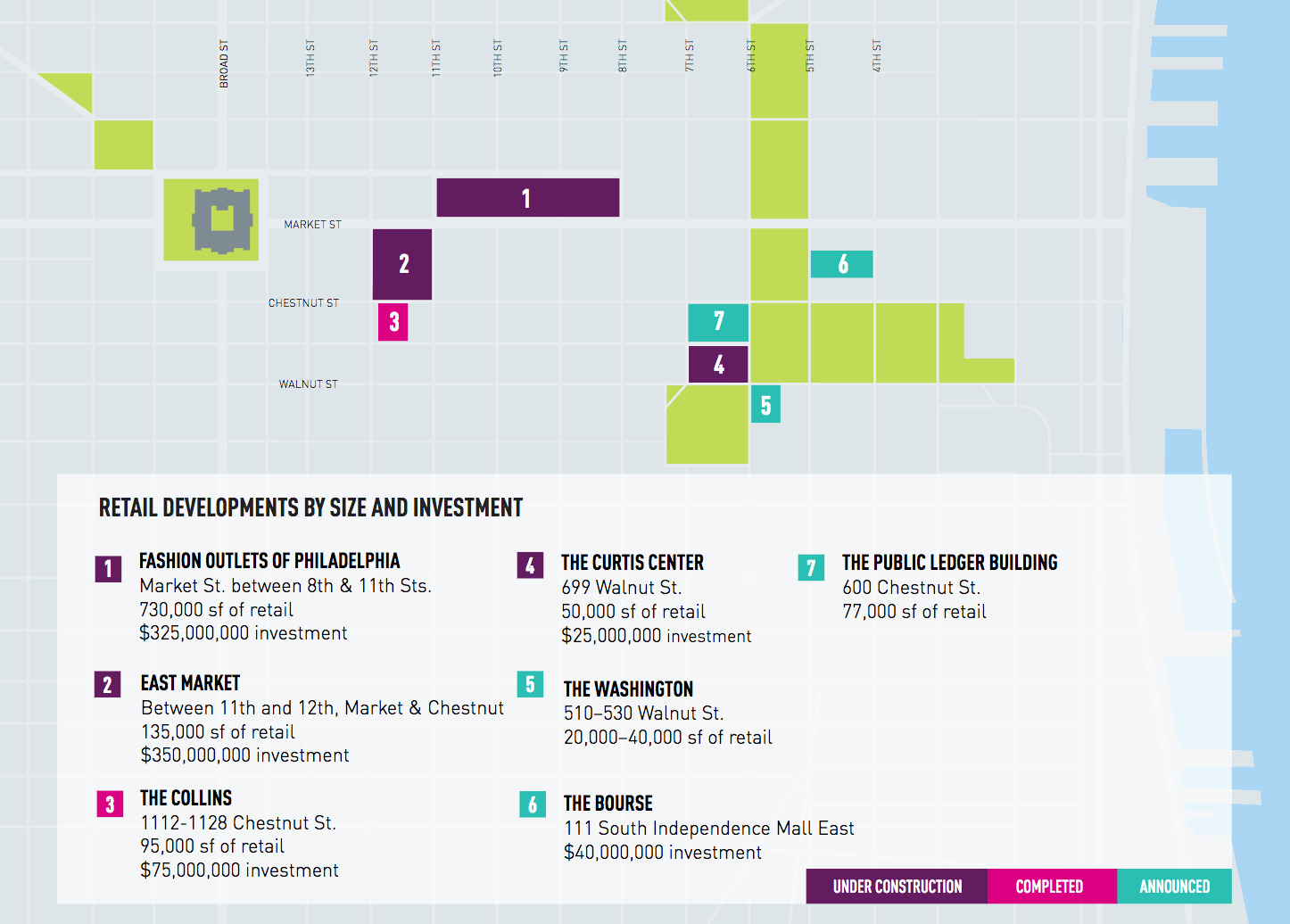

Because of once-high levels of commercial vacancy, national tenants with a desire for more floor space find the East Market Corridor appealing. CCD highlights three major retail-driven developments that will be coming online in the next few years—most notably the reconstruction of The Gallery as the Fashion Outlets of Philadelphia—which is all part of a massive investment on this long-neglected corner of downtown. (Notably office vacancy is currently higher on the west side of City Hall than the east.)

Tourism is Growing, Convention Visits Are Not:

CCD reports that 41 million domestic tourists visited the Philadelphia region in 2015, with the majority coming from the Mid-Atlantic region. This accords with the findings of CBRE’s report, which described the city’s tourism market as attracting more domestic visitors than foreign. As a result, stays in Philly tend to be shorter than they are in cities like New York and Miami, which have a higher international profile. (The two nations that provide the most frequent visitors to the region are the United Kingdom and China, which combined make up nearly a quarter of international visitors.)

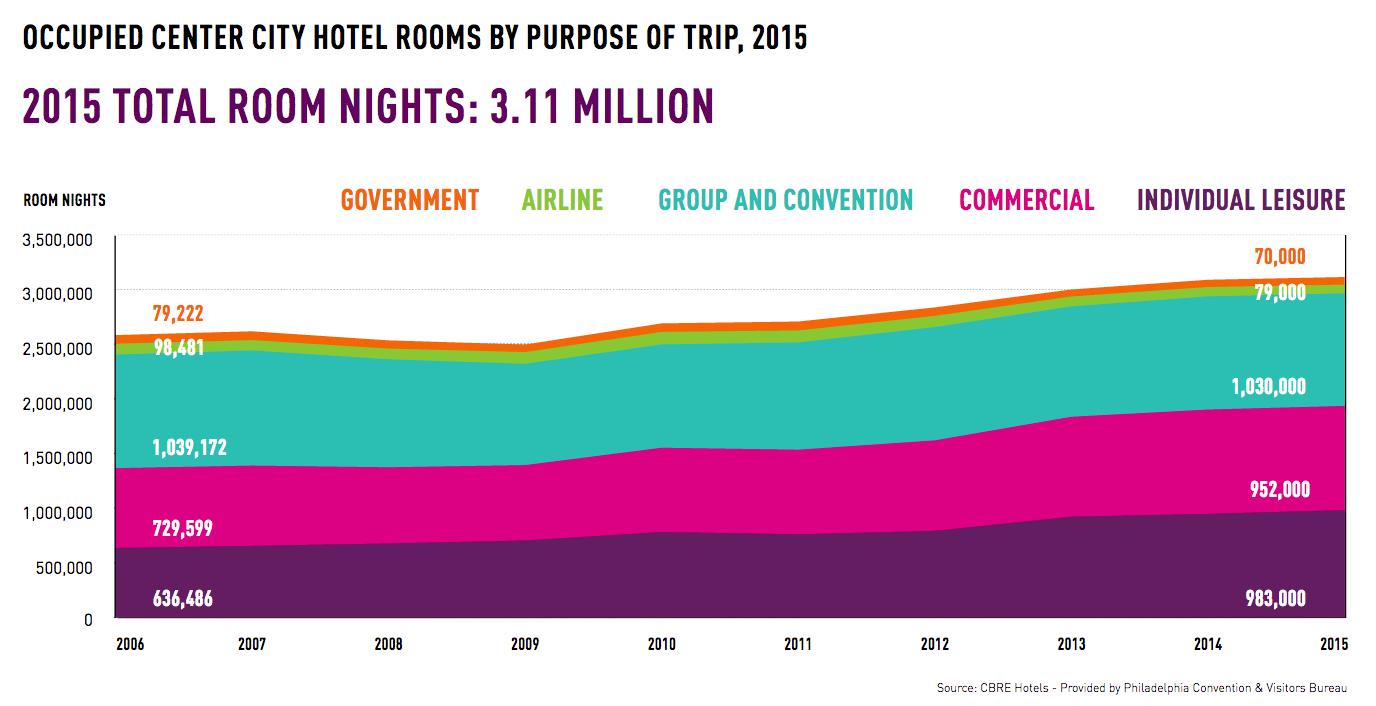

Nonetheless, 2015 set a record. CBRE found that the occupancy rate for Center City hotels in mid-2016 was the highest since 1948, while CCD reports that Philly is second only to New York in its Saturday hotel occupancy rate (89.6 percent). CCD is therefore bullish on the six hotels under construction and the four planned for Center City.

The total room nights in 2015 largest stemmed from commercial, leisure, and convention trade. The first two have grown impressively since 2006. Room nights generated by commercial visits grew from 729,500 in 2006 to 952,000 in 2015, while leisure visits grew from 636, 486 to 983,000.

But convention and group nights have remained flat since 2006, despite an enormous $780 million expansion of the Pennsylvania Convention Center. In 2006 convention and group driven business actually booked more visitors—1,039,172—than it did in 2015, the year the Pope visited, where only 1,030,000 were generated.

This may relate to a massive expansion in the square feet of convention space built across the country in the last 15 years. In 2000 there were 52.1 million square feet of convention space in the U.S., but today there are 71.2 million square feet—despite the fact that the demand hasn’t grown to the same degree. Convention centers from Las Vegas to Chicago to Philadelphia have seen declines in the number of hotel room stays generated as a result.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.