Financial Perspectives: Social Security hints for married couples

Due to the economy, the lack of pensions or medical benefits, or just the plain desire to remain in the workforce, many people are working into their mid-60s and beyond.

For quite a while, it seemed like the conventional wisdom was to begin collecting Social Security at 62. However, now that people are living longer, the need for a more thoughtful strategy is now necessary, particularly for married couples.

Many married couples do not realize that there are completely legitimate ways to maximize the benefits they receive from Social Security. The strategy that is used most often involves the spousal benefits that each married person is eligible to receive with their benefits. Let’s use the following examples to illustrate how these strategies work:

Tom and Tina live in Torresdale and are both 63. Tom is retiring from the Water Department and will receive a primary insurance amount (PIA) of $2,400 per month. Tina works as a hairdresser one day per week. Since she stayed home with their kids her primary insurance amount is only going to be $750. If the both retire, Tom will receive $2,400 and if Tina applies she will receive $1,200 per month for a total of $3,600.

Since Tina’s benefit is smaller than her spousal benefit, she will automatically receive her spousal benefit. Since both will begin collecting before retirement benefits before their full retirement age (FRA), they will be limited to the amount of earnings they can make before their benefits are adjusted (this was discussed in detail in a column in early May).

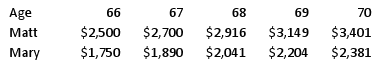

Now let’s look at an example where a couple plans to work past their FRA. Matt and Mary from Mayfair are 66 and have reached their full retirement age. Matt has plans to work full-time in his position until age 70. Mary wants to slow down to a part-time schedule. Here is a breakdown of their Social Security benefits from age 66 to 70:

If Matt waits until age 70, he would be eligible for $3,401 per month. For each year that Matt delays taking his benefit, his primary insurance amount increases by 8 percent. The same would be true for Mary, and if she waited until age 70, her benefit would be $2,381.

They have a couple of choices, Mary can begin collecting her $1,750 now or delay and take her benefit later at some point between 67 and 70. If Mary begins collecting now, she will forgo the higher benefit payment down he road.

The other option is one that is not readily known. Matt can file for his benefit and immediately suspend his payment. This means that he applied for his benefit, but will not take the payments. By doing this he has opened the door for Mary to collect a spousal benefit off of his benefit. This means that Mary can apply for and receive her spousal benefit of $1,250 per month calculated off of Matt’s benefit. Since both will not be opting to receive their own benefits until age 70, they will be able to earn the delayed credits provided by Social Security and still collect the spousal benefits for Mary based on Matt’s benefit.

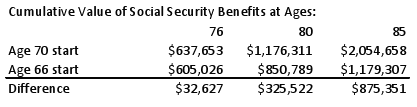

This can only be done when both spouses have reached their FRA. Clearly this strategy is best for a couple that has longevity on their side. If Mary and Matt had a shorter life expectancy, they would likely want to begin collecting their benefits at their FRA. When you run the math (assuming a 1.5 percent annual cost of living increase), the breakeven age is 76. Below is an example of the cumulative effect of taking Social Security at age 66 versus 70.

Waiting until age 70 and receiving the spousal benefits based on the higher benefit amount at 66 is definitely a strategy that produces a higher lifetime value.

The Social Security Administration website has a number of calculators that you can consult to try and replicate certain scenarios. If you are not comfortable with the calculators, you can seek assistance from a professional.

Jim Heisler is a Certified Financial Planner with Family Wealth Services in Holmesburg. You can read all his Financial Perspective columns here.

Registered Representative, Securities offered through Cambridge Investment Research, Inc., A Broker/Dealer, Member FINRA/SIPC and Investment Advisor Representative, Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Family Wealth Services, LLC and Cambridge are not affiliated.

Jim Heisler, CFP®, CDFA™, CASL™ Family Wealth Services, LLC is located at 8275 Frankford Ave. (215-332-4968)

The views expressed are not necessarily those of Cambridge and should not be construed as an offer to buy or sell any security. These situations are hypothetical in nature and do not represent a specific client.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.