Why are teachers pension plans in trouble?

Listen

George Bezanis teaches world history at Central High School. (Emma Lee/WHYY)

The state runs two public employee pension plans that share a parallel narrative. One plan is for teachers and school employees, called PSERS. The other is for other state workers, called SERS.

Ninth in an occasional series of podcasts and web “explainers.” To listen to the podcast, click the audio player above.

The state runs two public employee pension plans that share a parallel narrative. One plan is for teachers and school employees, called PSERS. The other is for other state workers, called SERS — which, in addition to rank-and-file state employees, covers state troopers, lawmakers, judges, top executive branch officials and state university staff members.

Collectively these pension plans currently have a $53 billion dollar unfunded liability that’s causing major headaches at both the state and local school district level.

How did the state get into this mess?

You have to go back to the late 1990s. The economy was booming. The state was running a surplus, and the public employee pension funds were flush with cash.

By the summer of 2001, state lawmakers voted to boost pension benefits, bumping up the pay-out rate and cutting in half the amount of time it took to become eligible for a pension.

But, then, the bottom fell out.

The attacks of 9/11 came, the economy took a downturn, and surpluses were quickly drained.

In 2003, Ed Rendell came into the Governor’s mansion with big plans to boost classroom education spending. And through his two terms in office, neither he nor the legislature made funding state pensions a priority.

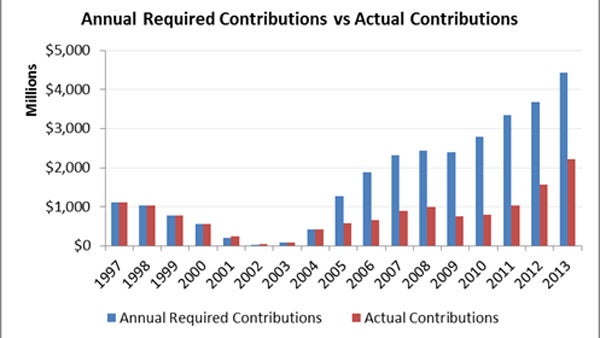

They made their “required payments,” but only by fiddling with numbers.

In reality, based on actuarial need, the state continually hasn’t kicked in enough money to cover its growing debt, the single biggest reason for the dire straits the state currently faces.

Source: Pew Charitable Trusts, Pennsylvania state pension plan annual required contributions vs. actual contributions.

Compounding the issue, many school districts used the state’s influx in classroom spending to boost employee salaries — which, because pension payouts are based on a percentage of an employee’s final pay, drove up the state’s debt.

Rendell and state lawmakers believed that the market would rebound, and a surge in the stock market would forgive their underfunding.

Through it all, to this day, state workers made their required contributions, which for teachers is 7.5 percent of salary.

By 2007, with Wall Street booming, Rendell’s bet seemed like it just might pay off. But the Great Recession of 2008 swiftly eroded the value of the state pension fund, leaving state lawmakers with a daunting bill they could no longer ignore.

In 2010, Rendell and the legislature took a step to rectify the problem.

They passed Act 120, a bill which undid the generosity of 2001 pension boost for new hires, and pushed up the retirement age.

But many lawmakers, especially conservatives, say Act 120 didn’t go far enough, and in Gov. Tom Corbett’s years in Harrisburg pushed to end the state pension system altogether. Several pieces of legislation were developed that would move new teachers and state workers into 401(k)-style plans that don’t guarantee a set retirement payout.

Even with Republican majorities in both the state house and senate, Corbett and proponents of that tack, though, couldn’t muster the votes to make those bills law.

Through his tenure, like Rendell, Corbett found priorities other than fully funding the state’s pension debt, such as cutting taxes for businesses.

What’s the impact of the state’s current pension liability on the rest of the state budget?

Pick your favorite issue or cause in Pennsylvania: public education, services for the poor, tax breaks for businesses.

Chances are, there’s going to be a whole lot less money for any of these moving forward, because the state’s pension bill is growing exponentially.

The state splits the employer pension contribution with school districts, picking up a little less two-thirds of the cost.

By 2019, the state will need to spend $3.3 billion to meet its total pension obligation — double what it paid last year. These payments undercut the state’s ability to contribute additional funds to other state priorities without cutting other programs or raising taxes.

To keep up with rising pension costs, school districts across the state have been making tough choices, either cutting programs or hiking property taxes.

Just a few years ago, districts paid about 5.5 percent of employee salary to the pension fund. This year, they must pay 21 percent. Next year, 26 percent. The rate will peak at 32 percent in 2019.

What are the state’s options moving forward?

An ideological battle is brewing in the capitol.

In mid-May, Senate Republican leadership approved a plan along party lines that would bar new hires from receiving a pension; instead they’d receive a far less generous retirement package tied to the performance on the stock market.

Senate Majority Leader Jake Corman (R, Centre) has insisted on systemic changes before agreeing to any of Governor Wolf’s budget proposals — ones that center around boosting state education spending in classrooms.

But even if the state ditched the pension system in favor of a 401(k) system for new hires, that wouldn’t make a dent in the state’s debt in the short term. In fact, it would cost more state money because new employees wouldn’t be kicking into the pension pool that’s helping to pay current retirees.

This is why the Senate GOP bill also seeks to reduce unearned retirement benefits from many of the 370,000 current state government and public school employees — a proposal that, if passed, would face a stiff legal challenge based on contract law.

The school employees’ pension system (PSERS) says the Senate plan would ultimately deliver benefits about one-third the size of those earned by employees under the current defined benefit plan, which, on average, provide a $25,000 annual payout to a rank-and-file state employees and teachers.

“It’s a hard transition, so you have to work your way through it, but I think going to defined contribution plan is the way to go,” said Corman.

One of the more compelling reasons for ditching pensions is that it takes taxpayers off the hook for lawmakers playing politics.

The biggest reason why the state is facing a massive pension payment spike is because lawmakers, including Jake Corman, voted to increase benefits, and then immediately found other, more politically appealing issues to which to devote state dollars.

“The politics really encourage the underfunding of the plans and the over-promising of the benefits,” said Nathan Benefield, vice president of policy for the Commonwealth Foundation, a free-market Harrisburg think tank.

This put Pennsylvania 2nd-worst in the nation when it comes to making its pension payments. New Jersey takes top honors.

But ditching pension plans — like has happened in much of the private sector — puts all the risk on employees, who, as the private sector has shown, are pretty terrible at planning for their own retirement.

About half of the workers in the private sector have no retirement savings at all. Those who do, on average, have about $100,000 in the bank as they near the end of their careers. That’s far less than experts suggest.

Progressives argue that ditching pensions is like throwing the baby out with the proverbial bathwater, saying that the real retirement crisis is the collapse of retirement security in the private sector. They argue that the continued decline of guaranteed benefits will create a mass of retirees who are unable to support themselves without state assistance.

“When you get to retirees, you see the 1 percent economy on steroids,” said Steve Herzenberg, executive director of the Keystone Research Center, a progressive-minded Harrisburg think-tank. “From our perspective, actually, the state is in a much better position than individuals to manage financial market risk.”

Herzenberg supports a plan to keep guaranteed pension benefits, but shift a greater share of the market risk onto employees. When markets dive, teachers and state workers would be asked to contribute more to the fund, lessening the burden on the rest of the state budget.

Gov. Wolf’s position

Gov. Tom Wolf opposes any proposal to eliminate state pensions or reduce benefits for current employees.

“I come out of the private sector,” he said. “If had tried to go to a regulator and say, ‘I acknowledge I haven’t paid what I should have into the system, so now I think it’s only fair that employees take a bath,’ that wouldn’t work.”

Wolf plans to defray some of the coming pension increases by refinancing the debt, cutting Wall Street management fees, and dedicating funding to pensions from modernizing state liquor stores.

As painful as it may be, Wolf says the state just needs to pay its bill.

In the end, Pennsylvania’s current pension crisis essentially boils down to this question: Who should pay for the errant decisions of politicians?

Students, teachers, or taxpayers?

In the Multiple Choices podcast, Keystone Crossroads senior education writer Kevin McCorry joins with Paul Socolar, publisher and editor of the Public School Notebook, and Notebook contributing editor Dale Mezzacappa to explain and explore the history, complexities and controversies of public education funding in Pennsylvania.

Look for new installments of Multiple Choices every week for the rest of the spring, as the General Assembly reviews Gov. Wolf’s ambitious school funding and tax plan.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.