What is Act 1 and how did it impact property taxes and school funding?

Marc Gosselin, Principal of Anna Lane Lingelbach Elementary School in Philadelphia with students during lunch. (Photograph by Jessica Kourkounis)

Act 1 is a property tax relief bill passed by the Pennsylvania legislature in 2006 and amended in 2011.

Fifteenth in an occasional series of podcasts and web “explainers.”

What is Act 1?

Act 1 is a property tax relief bill passed by the Pennsylvania legislature in 2006 and amended in 2011. It greatly expanded rebates and exemptions for senior citizens and provided rebates for other homeowners. It also set a cap on the amount a school district can raise property taxes without first getting voter approval.

The cap is calculated with an eye toward allowing school districts to cover normal inflationary cost increases. If a school district wishes to raise taxes above that cap, the increase must be voted on in a district-wide referendum. Districts may avoid the referendum if they qualify for one of four exceptions related to increased costs for special education, school construction, employee retirement funds, and certain school debt scenarios.

What are the concerns about property taxes in Pennsylvania?

On a per-person basis, Pennsylvanians pay slightly less in property taxes than the national average. However, school property taxes vary widely among districts from 0.07 percent of personal income all the way up to 8.2 percent. A study by the Pennsylvania Budget and Policy Center found that 30 out of the state’s 500 school districts have high (greater than 4 percent of average personal income) property tax rates.

How did Act 1 impact property taxes?

Act 1 doubled the number of seniors eligible for property tax rebates and increased the number of senior and disabled households that do not pay any property tax.

Other homeowners saw an average rebate for school property taxes of $187, which varied from $52 to $641 among districts. The rebates were funded by tax revenue from casinos, which totaled around $650 million in 2013.

In Philadelphia, Act 1 directed that casino revenues be used to reduce the wage tax, for both residents and commuters, rather than the property tax.

How did Act 1 impact school funding?

Act 1 capped the amount that school districts can raise from additional local property taxes, and was amended in 2011 to make the cap stricter.

Pennsylvania school districts rely more heavily on local sources for funding than other states. In 2012-13, local sources provided 58 percent of Pennsylvania’s school district funding (compared to 46 percent nationally), and 88 percent of this local revenue came from property taxes.

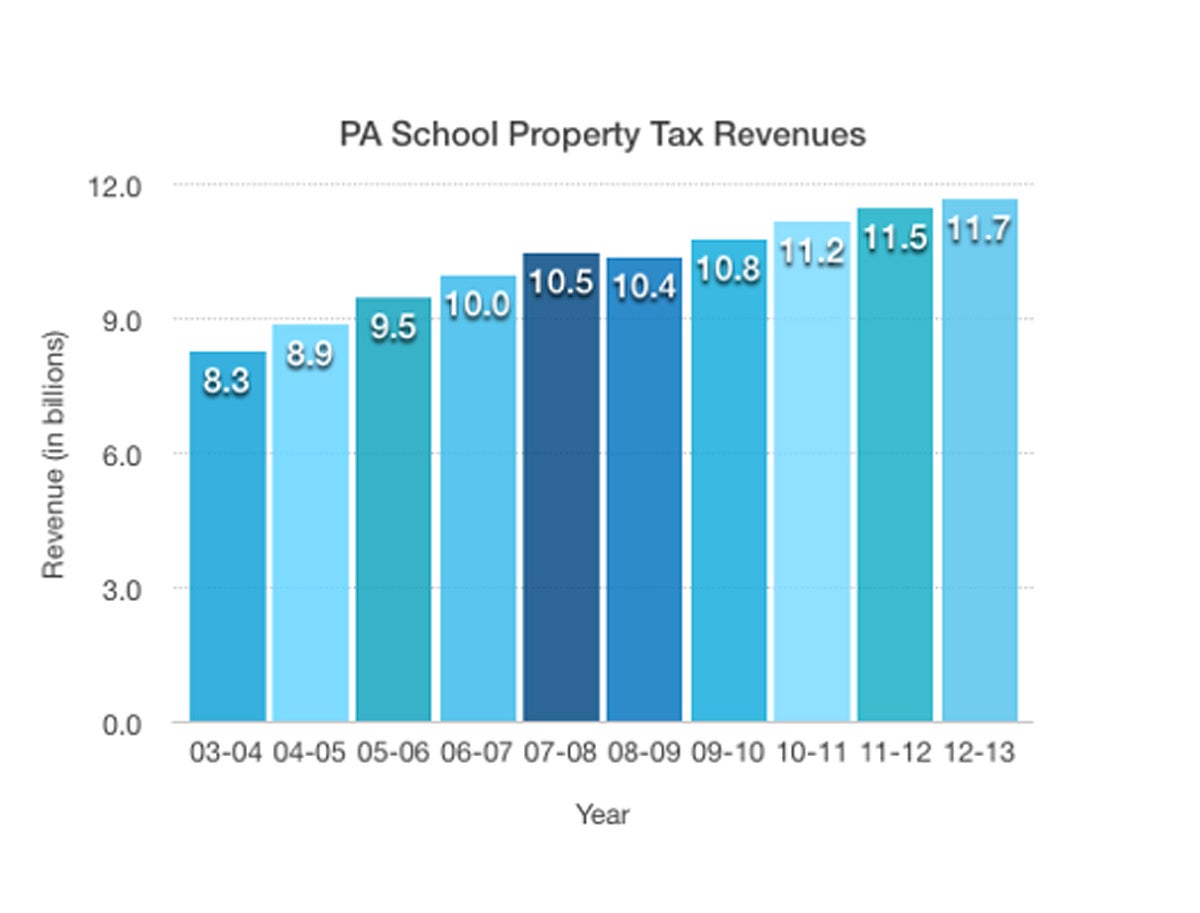

In the first six years after former Gov. Ed Rendell signed Act 1 into law, school property tax revenue rose far more slowly than in the previous five years (a $1.2 billion increase compared to $2.3 billion). However, some of the decrease is likely due to the recession rather than Act 1.

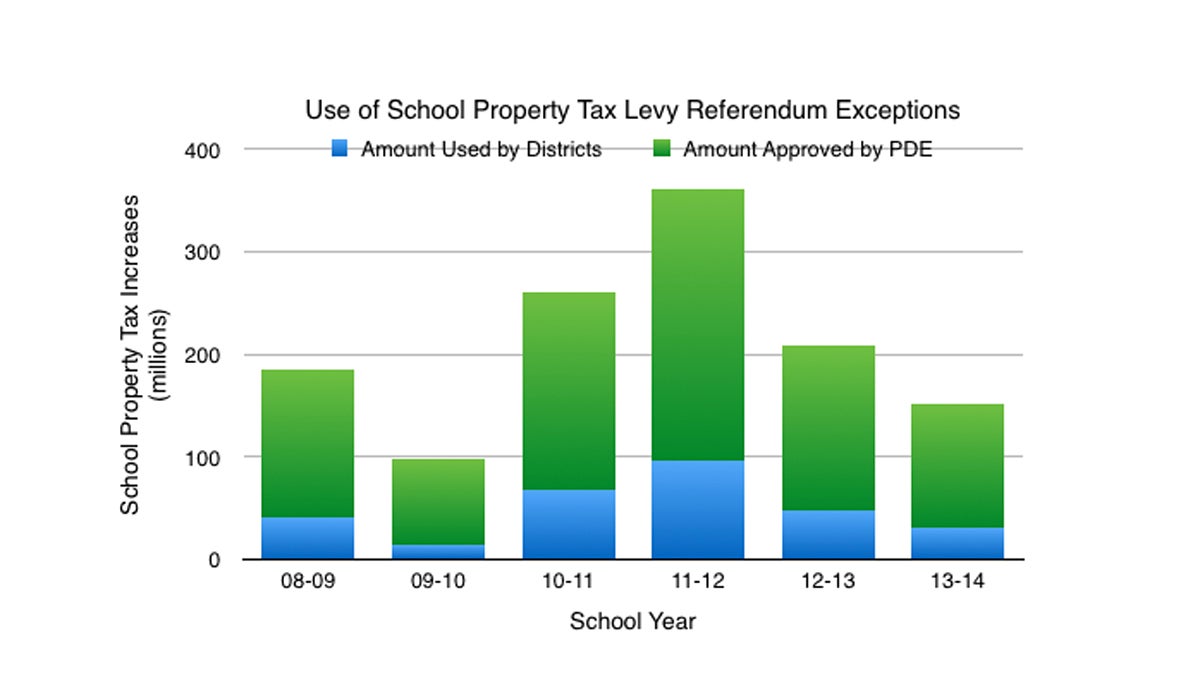

In every year since 2008, on average about 30 percent of districts have been granted exceptions to the cap — though not all receive exceptions large enough to cover their full requests. Most of the exception funding was not ultimately used, as displayed in the chart below.

Among the districts that were not granted exceptions, only 14 chose to run referendums between 2006 and 2012. Only one such referendum passed, and that was before the recession.

What cost challenges are school districts facing now?

A 2015 survey of 321 school districts by the Pennsylvania Association of School Administrators and the Pennsylvania Association of School Business Officers found that the vast majority of respondents had faced increases in their state-mandated costs for pensions, health care, charter payments, and special education. Post-recession increases in state aid to school districts have mostly gone towards pensions.

As Act 1 curtailed the extent to which districts could raise revenue from local sources, the survey found that most school districts have been forced to cut staff and programs to make ends meet. The cuts fell disproportionately upon impoverished school districts, even as the poorest districts hiked property taxes more than wealthier ones. Of the districts polled, 99 percent of respondents said they expect the situation to get worse in future years.

In the Multiple Choices podcast, Keystone Crossroads senior education writer Kevin McCorry joins with Paul Socolar, publisher and editor of the Public School Notebook, and Notebook contributing editor Dale Mezzacappa to explain and explore the history, complexities and controversies of public education funding in Pennsylvania.

Allison Welton is a former intern for the Philadelphia Public School Notebook.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.