Philly is spending millions to help low-income residents resolve tangled titles

The money is part of the Neighborhood Preservation Initiative, and will go to four legal aid groups with a history of helping people claim legal ownership of their homes.

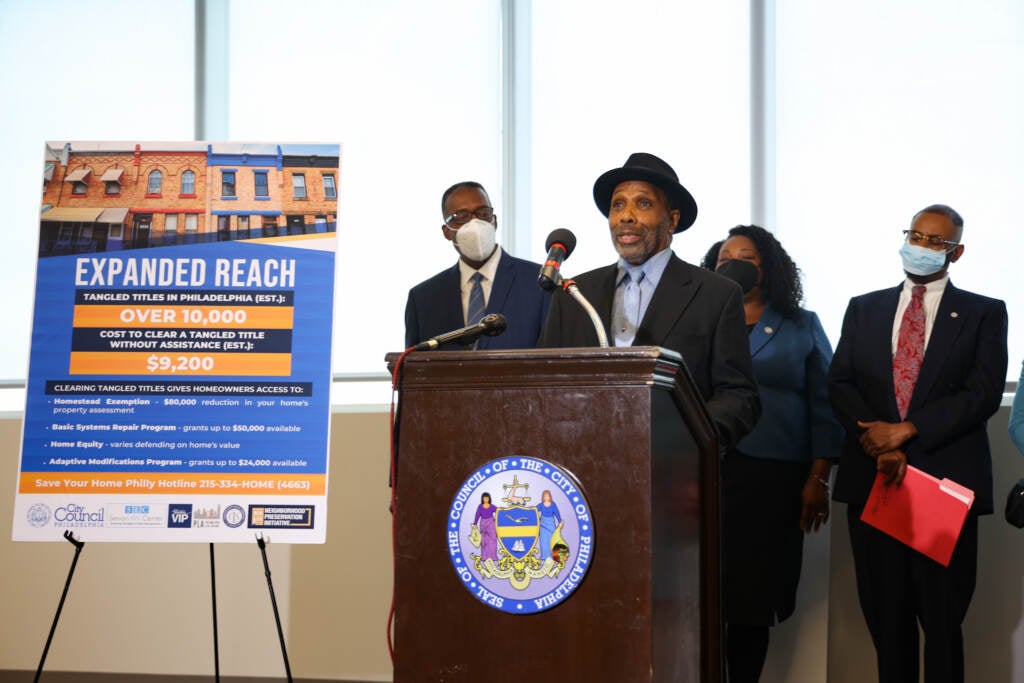

Philadelphia City Council announced a $7.6 million investment in legal assistance for residents dealing with tangled titles on Sept. 7, 2022. (Kimberly Paynter/WHYY)

As part of a broader neighborhood improvement initiative, Philadelphia is spending $7.6 million to help certain people resolve their tangled titles for free.

The money comes courtesy of the Neighborhood Preservation Initiative, and will go to four legal aid groups that have a history of helping low-income residents who don’t have legal ownership of the houses they call home, most commonly because they simply moved in after a parent or relative died.

They are: Community Legal Services, Philly VIP, SeniorLAW Center and Philadelphia Legal Assistance.

“We are now able to make the largest, most significant investment in helping families across the entire city of Philadelphia eliminate tangled titles, gain ownership and move on to have more generational wealth for them and their loved ones,” said City Councilmember Katherine Gilmore Richardson during a Wednesday news conference in West Philadelphia, an area of the city with one of the highest tallies of tangled titles.

Philadelphia is home to more than 10,000 tangled titles, affecting real estate worth more than $1.1 billion, according to research from the Pew Charitable Trusts.

Gilmore Richardson spent years — and thousands of dollars — resolving a tangled title after her mother died without establishing a clear path to claiming legal ownership of the lawmaker’s childhood home in the Wynnefield neighborhood, an experience she has called “arduous,” but worth it.

Based on her struggle, Gilmore Richardson said it’s critical for more people to have access to attorneys who can guide them through what is typically a long, expensive and complicated process.

Without assistance, clearing a tangled title costs an average of $9,200, according to Pew.

“I was paralyzed with fear,” Gilmore Richardson recalled during Wednesday’s news conference.

In addition to costing families generational wealth, a tangled title often prevents people from selling the property, taking out a home equity loan, obtaining homeowner’s insurance, or participating in home repair programs, such as the Philadelphia Basic Systems Repair Program (BSRP).

Advocates say these restrictions can put a home at risk of deterioration, foreclosure, and deed theft, potentially destabilizing neighborhoods while reducing quality of life.

To Council President Darrell Clarke, helping people resolve tangled titles is part of his initiative to help preserve neighborhoods across the city.

“And the most significant part about preserving neighborhoods is preserving the house that you live in currently,” said Clarke.

The $7.6 million is expected to be the first, but not the last investment the city makes to resolve more tangled titles. Clarke said one goal of the Neighborhood Preservation Initiative is to clear the city’s backlog.

WHYY is one of over 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic justice. Follow us at @BrokeInPhilly.

WHYY is one of over 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic justice. Follow us at @BrokeInPhilly.

Subscribe to PlanPhilly

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.