N.J. goes after employers who misclassify workers as independent contractors

Governor says misclassification is ‘an unfair business practice and it is illegal,’ as new report proposes remedies for growing problem

Workers labor at the construction site of a condominium building in the Newport section of Jersey City, N.J., Wednesday, May 2, 2018. (AP Photo/Julio Cortez)

This story originally appeared on NJ Spotlight.

With the rise of the gig economy, the misclassification of workers as independent contractors, rather than employees, is a growing problem in New Jersey and the nation, impacting many thousands of workers and cheating the state out of tens of millions in tax payments each year.

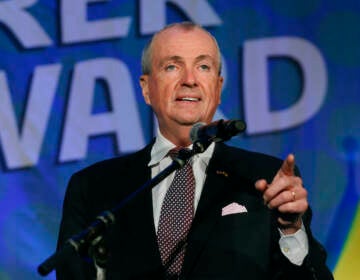

A new report from Gov. Phil Murphy’s Task Force on Employee Misclassification, released on Tuesday, proposes more than a dozen remedies to the problem. The governor told a convention of union workers in Atlantic City that his administration is already implementing some of those reforms. Others will require legislation.

Murphy, who issued an executive order creating the task force in May 2018, also on Tuesday signed into law S-2557, which gives the state Department of Labor and Workforce Development the authority to shut down a job site when an employer violates state wage laws or assess a civil penalty of $5,000 per day.

“Misclassification is an unfair business practice and it is illegal,” Murphy said. “If you are a contractor engaging in these practices, we are either, A, going to bring you into compliance or, B, we are going to put you out of business. By the way I hope it’s the former … but we will not hesitate to go to door B.”

The misclassification of a worker as an independent contractor “deprives workers of a suite of rights guaranteed to employees,” the report states. These include the ability to earn overtime for working more than 40 hours a week, to get workers’ compensation benefits if injured on the job, to get unemployment benefits, to receive earned sick leave and to take job-protected family leave.

Robbing the state of revenue

“Misclassifying workers as 1099 employees denies them benefits, robs the state treasury of needed revenue, and makes it harder for law-abiding businesses to compete,” said Robert Asaro-Angelo, the state labor commissioner.

A labor department audit last year found that 12,315 workers were misclassified, $462 million in wages were underreported and $13.9 million in contributions to unemployment, disability and family-leave insurance funds were not properly made. That audit was of just 1 percent of employers.

“The true costs of misclassification are much greater,” the report states. “It is clear that New Jersey has lost tens of millions of dollars every year since 2000 in foregone state income taxes, and unemployment and disability contributions due to misclassification in all industries.”

In his remarks at the New Jersey State Building & Construction Trades Council’s annual convention, Murphy painted the problem as a huge one for workers.

“When you extrapolate that 1 percent … the department estimates that misclassification cost workers more than $46 billion in wages and benefits in 2018 alone,” Murphy said. “These are wages that make a difference … in the lives of working families to put food on the table to save for a kid’s education or for retirement or to enjoy a family vacation at the Shore.”

The report does not include that $46 billion figure. If accurate, it would indicate that misclassification is a huge problem. In 2017, total payroll across all industries in New Jersey was about $219 billion, according to the DOL’s Quarterly Census of Employment and Wages.

Affecting Social Security, health coverage

Rebecca Kolins Givan, a professor at Rutgers University’s School of Management and Labor Relations, said there are other ramifications for workers and government. Employers are not paying Social Security taxes for contractors, so contractors must do so for themselves. And employees who would be eligible for health benefits from an employer may not get those when classified as a contractor, meaning they may wind up on Medicaid or receive some other taxpayer-funded charity care.

The question of whether a worker is an employee or independent contractor might seem to be answered intuitively, but there are some definitions that give a clear legal framework to the classifications. States’ and federal rules do not necessarily agree, but essentially it boils down to whether the worker or employer has control over his work and whether the work being done is core to a business, Givan said.

In New Jersey, according to state officials, misclassification is especially prevalent in construction, janitorial services, home care, transportation, trucking and delivery services and other labor-intensive, low-wage sectors.

Givan noted that there is a whole new class of businesses, including the ride-sharing service Uber, that have made the use of contractors a key part of their business model.

Mostly, though, she said misclassification is becoming more prevalent because lax enforcement of wage laws makes it profitable for employers to do so.

“The lack of enforcement leads employers to be bolder,” Givan said. “It’s not so risky to misclassify workers if there is no penalty.”

More enforcement

That’s why the new law Murphy signed and the 16 recommendations from the task force are deemed necessary. Administration officials said they have already taken action on half those suggestions. For instance, the report states that the DOL has signed a memorandum of cooperation with the U.S. Department of Labor to increase coordination and information-sharing and signed a similar memo with officials from Pennsylvania and Delaware maximizing the states’ enforcement efforts through referrals, data sharing, and joint investigations. In addition, the DOL has begun training Division of Consumer Affairs investigators in misclassification and sent a letter to 20,000 accountants who may work with or advise businesses to educate them on the issue.

Murphy told the convention about other steps his administration has taken that have “strengthened our enforcement efforts.” The DOL has hired a new assistant commissioner dedicated to the wage and hour law division, as well as adding eight prevailing-wage investigators. The new state budget also includes a $1 million increase for wage and hour law enforcement, he said. The state attorney general’s office also has a new joint civil rights and labor enforcement section to pursue civil actions against employers who flout wage laws.

“It’s not enough to have good laws on the books,” Murphy said, “if you don’t have a governor and a leadership who will step up and enforce them.”

He cited actions taken by the attorney general’s office to get a guilty plea from a contractor who “cheated his workers out of $200,000 in wages,” the DOL to bar two companies from public works because of wage law violations in two other states, and require a third company to give $150,000 to laborers for having underpaid them.

Givan said states that are concerned about the issue must act because there is little enforcement of wage-related issues at the federal level.

Little federal oversight

“It’s clear the federal government is not going to be taking actions to protect workers so it depends on the states,” she said. “Federal oversight has gone down to basically nothing.”

Among the task force’s recommendations are:

- Increase education and public outreach, including a hotline, webpage and email address for reporting misclassification;

- Require state contractors to confirm that they are aware of the legal standard for properly classifying workers;

- Revoke or suspend licenses of those who do not comply with labor laws.

The task force also made several recommendations for legislative actions. These include requiring the posting of notices about reclassification, requiring companies that misclassify workers to pay the cost of an investigation into their practices and attorney fees, and increasing fines and other penalties for the practice. While Murphy and Democratic legislative leaders do not have the best working relationship, Murphy said he is “committed to working with the Legislature” to get the measures enacted and Sen. President Steve Sweeney (D-Gloucester) and other lawmakers are union members likely to support these suggestions.

“If we have to put the hammer down on those who refuse to get the message and continue to exploit their workers and ignore their rights, we will insure we have the strong rules and strong laws necessary for us to go right at them,” Murphy said. “We have made it a top priority to take on the practice of misclassification … it’s a practice that this administration wants to see stopped.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.