Investment returns of NJ’s state pension fund drop but that’s not what’s worrying some

Union members carry protest signs as they march outside the Mercer County Criminal Courthouse before arguments June 25, 2014, over Gov Christie's plan to use pension payments to balance the budget. (AP Photo/Mel Evans)

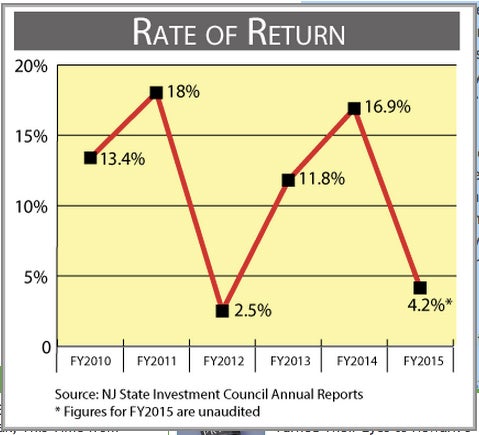

After seeing investment returns swell into the double digits for several years in a row thanks to a booming stock market, New Jersey public-employee pension system’s gains have come back down to earth.

After seeing investment returns swell into the double digits for several years in a row thanks to a booming stock market, New Jersey public-employee pension system’s gains have come back down to earth.

Preliminary figures released yesterday indicate the pension system’s investments earned just over 4 percent during the state’s last fiscal year. Those returns fell short of the retirement system’s 7.9 percent assumed rate of return, and well below the gains of nearly 17 percent during the 2014 fiscal year.

“I don’t have any interest in sugarcoating this,” said Tom Byrne, chairman of the New Jersey State Investment Council, as he provided an overview of the unaudited figures for the last fiscal year during a public meeting in Trenton Wednesday.

Still, Byrne and other state pension officials pointed to some bright spots, saying the pension system did better than 70 percent of its peers while at the same time taking on considerably less risk. The three-year and five-year averages remain over 10 percent, said Christopher McDonough, director of the state Division of Investment, an agency within the state Department of Treasury that manages the pension system on a daily basis.

The more modest investment returns during the last fiscal year won’t have an immediate impact on the roughly 770,000 current or retired public workers, and no beneficiaries will see their checks shrink as a result of the down year.

But they do put more stress on a pension system that’s already carrying an unfunded liability of roughly $40 billion thanks to over two decades of underfunding by a string of governors, including Gov. Chris Christie.

For example, during the last fiscal year the Christie administration contributed just under $900 million into the pension system, far below what actuaries called for and less than half of the $2 billion Christie promised to contribute as part of a 2011 reform law.

With roughly $8 billion going out to beneficiaries each year, the booming investment returns in recent years had helped to soften the impact of Christie’s reduced state payments.

Questions about investment risks

The slowing investment climate – pension officials this week said they do not see signs of a quick turnaround – has also put the investment council’s oversight of the assets under a sharper microscope. That’s because public workers and their union leaders, as they’ve grown increasingly frustrated with the state’s lower payments and a recent state Supreme Court ruling that upheld them, have started to closely scrutinize exactly how the pensions fund’s dollars are being handled.

Workers have also been paying more toward their pensions thanks to the 2011 law.

“We know it’s underfunded,” Byrne said during the meeting to union members who attended the meeting. “We’re doing our best to make the investment part of this have a positive impact on the overall fund.”

One area that has drawn particular scrutiny from workers over the last year has been the pension system’s so-called alternative investments, including positions in hedge funds and private equity that are part of a broader diversification strategy aimed at protecting the retirement system against big fluctuations in the stock market.

But those investments entail paying fees to private fund managers – those fees totaled $600 million during the 2014 fiscal year counting carried interest — and public-worker unions say they are too expensive for a public pension system to carry. They’ve been calling on Treasury to conduct an independent cost-benefits analysis to demonstrate whether the pension system could hedge against risk without taking on the costly alternative assets.

Lawmakers, meanwhile, have also raised concerns about transparency and political contributions that some private fund managers have made to groups with ties to Christie.

But pension officials Wednesday said the alternative investments helped protect against bigger losses during the last fiscal year, generating returns of about 8 percent, or nearly double the gains earned by the overall investments. And dozens of those investments were up 20 percent despite the overall slumping stock market.

“Alternatives has outperformed (other asset classes) fairly significantly, indicating it has added value to the pension system,” McDonough said. “This is net of all fees.”

After the meeting, however, he said the total amount of fees paid to the private fund managers during the last fiscal year is not yet available.

Fees called too high

The fee issue came up at another point in the meeting when the investment council was asked to review a proposed investment in a private equity fund that has a good track record, but charges fees that can be over 20 percent if certain performance benchmarks are hit. Adam Liebtag, vice chairman of the investment council, objected that the fees are too high.

“I’m opposed to this one because of the fee structure,” said Liebtag, who is the AFL-CIO’s representative on the panel.

Also, McDonough updated the investment council on the division’s efforts to get rid of an investment in another private equity fund, New York-based JLL Partners. Though the $50 million stake was purchased a decade ago, the fund has drawn criticism for the business practices of one of the companies it purchased, Texas-based payday lender ACE Cash Express. Since payday lending is illegal in New Jersey, the pension system has been trying to shed its stake in JLL Partners.

But due to the complicated nature of the investment, it has taken time to find someone willing to pay “a price that meets our needs,” McDonough said. He added that he hopes a sale can be closed by the time the panel meets again in November

Beverly Brown Ruggia, a community reinvestment organizer for New Jersey Citizen Action, a group that has called on the pension system to get rid of the investment, applauded ed that news.

“But we also renew our call for the council to adopt a formal policy that ensures something like this never happens again,” she said.

Just as that headache seems to be coming to a conclusion, workers from the Palms Casino in Las Vegas aired concerns during the meeting’s public comment portion about how they are being treated by management at the casino, which is owned by TPG Capital, another private-equity fund the pension system has a stake in. The workers said their consideration of forming a union has drawn a strong response from casino management, including layoff threats.

“We would encourage New Jersey to reach out to TPG and encourage them to reach labor peace at their property,” said Jim Kane, a senior analyst with the Unite Here labor union.

Byrne, in response, told Kane he would review the workers’ concerns.

_______________________________________________

NJ Spotlight, an independent online news service on issues critical to New Jersey, makes its in-depth reporting available to NewsWorks.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.