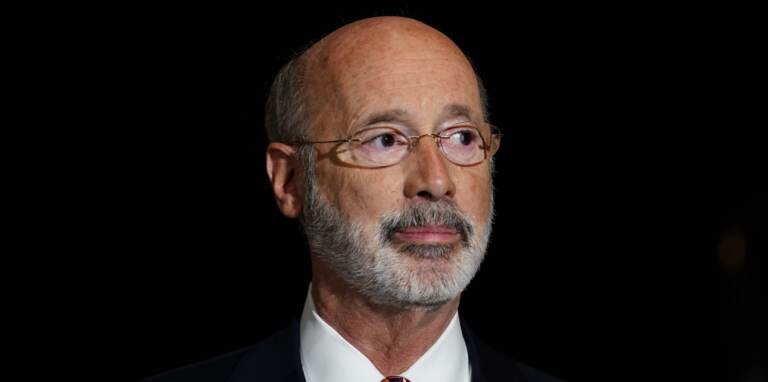

Gov. Tom Wolf, Democrats outline a proposal for $1.7 billion in pandemic funds

The plan includes spending money on workers, environmental programs, and a one-time property tax subsidy for lower-income homeowners and renters.

File photo: Pennsylvania Gov. Tom Wolf speaks during a rally at Sharon Baptist Church, Friday, July 9, 2021, in Philadelphia. (Matt Slocum/AP Photo)

This story originally appeared on WITF

Pennsylvania’s governor and his Democratic allies in the Legislature on Wednesday laid out a proposal to spend federal pandemic relief money on workers, environmental programs, and a one-time property tax subsidy for lower-income homeowners and renters.

The plan was announced less than a week before Gov. Tom Wolf is expected to present his 2022-23 state budget proposal to the Republican-majority General Assembly. Lawmakers would have to approve the spending for the plan to take effect.

“We need to do something right now to address the needs of Pennsylvanians,” Wolf said at a news conference in the Capitol flanked by Democratic lawmakers.

Wolf pointed out that the state still has $2.4 billion in federal money from the American Rescue Plan, signed by President Joe Biden last March, which is now sitting in a restricted spending account. The state originally received $7.3 billion from the plan, $4.9 of which has already been earmarked or spent in the last year. In all, Wolf said, the money is just “sitting around” and not helping people recover from the pandemic when it could do some good.

House Democratic Leader Joanna McClinton (D-Philadelphia) added the need for recovery money remains high, despite the state and federal government rolling out a number of pandemic aid and recovery programs since the start of the pandemic two years ago.

“There are so many working parents across the Commonwealth trying to move ahead in life. We can rescue them now. Why wait until the next pandemic, until the next set of unprecedented times?” McClinton said.

Republican lawmakers, however, have maintained that keeping the money in reserve is necessary to help balance the state’s budget through the next two-and-a-half years. Spending it now will force the state to confront a stubborn deficit sooner, they say.

“The proposals by the governor and Democratic leaders were developed in a fiscal fantasy land where concern for future fiscal years apparently doesn’t exist,” a joint statement by Speaker of the House Bryan Cutler (R-Lancaster), House Majority Leader Kerry Benninghoff (R-Centre) and GOP House Appropriations Chairman Stan Saylor (R-York) read.

The group were hinting at a November report by the Independent Fiscal Office, which warns if state spending isn’t kept in check, Pennsylvania may be careening toward a budget shortfall within the next few years. The money Wolf wants to spend, however, is entirely separate from the funding typically used to balance the state budget and must be spent down by 2024 according to U.S. Treasury rules.

Wolf criticized the Republican stance as doing nothing to help people, saying “right now, nothing is the only plan I’ve seen from the other side.”

“Nothing is unacceptable. These investments are needed right now to put money back in the pockets of Pennsylvanians struggling with rising costs,” Wolf said.

The $1.7 billion Democratic proposal’s largest category is $500 million to help families pay for child care, household expenses and classes, training and licenses to obtain greater skills and boost their incomes.

Wolf and the Democrats also want to provide $225 million in small business grants of between $5,000 and $50,000. The money would help pay for operating expenses, technical help, training, and advice on how to stabilize and expand. An estimated 11,000 businesses would qualify, and firms owned by women and minorities, as well as rural companies, would get priority.

The property tax relief would provide nearly a half-million lower-income homeowners and renters with an average of almost $500, a one-time addition to the existing property tax rent rebate program.

The state’s health care sector would get $325 million, much of it to help recruit and retain employees of long-term care facilities.

Wolf’s plan also would spend $40 million to expand county-based mental health programs and send $35 million to student loan forgiveness programs at the Pennsylvania Higher Education Assistance Agency.

The Growing Greener program, agricultural conservation, and other efforts toward conservation, recreation, preservation, and community revitalization would get a $450 million boost.

Wolf’s proposal for spending state tax dollars will be laid out in the governor’s budget speech Tuesday.

Last week, Wolf signed fast-tracked legislation to spend $225 million in federal pandemic relief, mostly for hospitals to give workers retention and recruitment payments.

The Associated Press contributed to this story.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.