From day care to avoiding debt: Child tax credits quietly underwrite family expenses

The monthly cash has helped parents cover basics such as child care costs and plan for the future. Will the program be extended in D.C.?

Listen 4:23

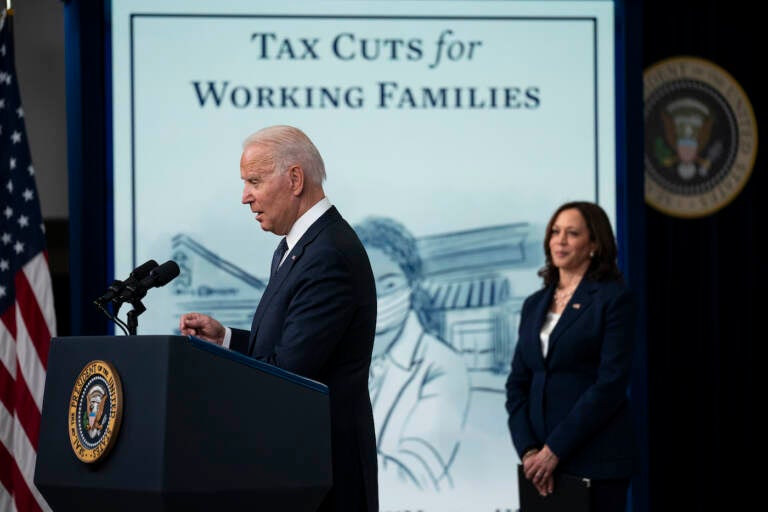

Vice President Kamala Harris listens as President Joe Biden speaks during an event to mark the start of monthly Child Tax Credit relief payments, in the South Court Auditorium on the White House complex, Thursday, July 15, 2021, in Washington. (AP Photo/Evan Vucci)

For South Philadelphia dad Abraham Schenk, 37, the expanded child tax credit came through just in time.

Schenk and his family moved to the city about a year ago from Virginia for his wife’s work, and he stayed home with his then-preschool-age daughter due to the pandemic. This summer, he got a job offer from a state agency, and had about a month to figure out how to piece together afterschool care.

The $300 a month, deposited directly into the family’s bank account, “was critical as far as being able to afford that,” said Schenk. Having not worked for a year, it was that, or “having to add more child care expenses to our already maxed-out credit cards,” he said.

The pandemic scrambled the economy, dumped workers from their jobs, and upended child care arrangements. But it also led to the United States’ first stab at a nearly universal child allowance.

It costs a two-parent, middle-class family $12,980 a year to raise a child, according to the United States Department of Agriculture. Starting in July, the new federal safety net program rolled out to alleviate some of the burden.

Eligible parents or guardians who did not opt out started receiving $300/month for each child claimed on a tax return who was under 6, and $250 for those ages 6 to 17. As of October, the IRS had paid out more than $61 billion directly to parents. Approximately $558 million went to Pennsylvania in that month alone, benefiting over two million children in the commonwealth, according to the U.S. Treasury.

The expanded tax credits have been touted by President Joe Biden’s administration as a game-changer that could drastically reduce child poverty, but the benefit also covers a wide swath of incomes, with nearly 90% of all families eligible, according to the IRS. Married couples filing jointly can earn up to $150,000 per year before the benefit begins to phase out.

Schenk said his family income approaches that cutoff, but the money makes a difference, helping to pay for contributions to retirement and college savings accounts.

“Even with us in a fairly high income, we’re still pretty close to paycheck-to-paycheck and so any amount really helps,” he said.

While some low-income families have faced hurdles to getting the benefits, many related to the way the money is routed through the IRS, that same system efficiently doled out cash to many parents and caretakers.

From patching the roof to planning for wealth

Five months after payments started, around a dozen parents told Keystone Crossroads they are spending the money on child care, bills, home repairs, and investments for their kids.

Meaghan Washington, a communications professional living in West Philadelphia, is putting the tax credits towards stock portfolios she started for her kids. As a single mother with two young children, Ife, 3, and Naïm, 2, she recently got serious about investing. She bought a duplex in Overbrook to earn passive income, and listens to podcasts like “Earn your Leisure” for money tips.

“These are things that I probably wouldn’t have been able to do if this credit wasn’t awarded, if the pandemic hadn’t happened, if I hadn’t stumbled upon this quest for financial literacy and education,” said Washington. Her goal is to create “generational wealth” for her family starting when her kids are young.

“The Black community … we haven’t had a fair shot at truly creating wealth historically,” she said. Washington saw the pandemic payments, including stimulus and the tax credits, as an opportunity to jumpstart that process.

Others say the program has offered immediate help with day-to-day expenses.

Amy Ruffo lives in Lancaster with her husband and 15-year-old daughter, and puts their $250 monthly allotment towards groceries, utilities, car insurance and other regular expenses.

Before the pandemic, her husband left a corporate job and it took about a year for him to make reliable money working as a consultant. Ruffo, who had been a stay-at-home mom, got a job as an administrative assistant at a liberal arts college in order to get the family health care, but said it’s not enough to cover the family’s expenses.

“Knowing every month you have this much money to spend … psychologically, it does make a difference,” she said of the monthly deposits. “We notice it, in a way we didn’t notice it previously.”

The child tax credit already existed, but the American Rescue Plan Act fundamentally changed how it works. The old program functioned more like other tax credits. When filing taxes, a person would see it increase their refund or reduce their bill. The maximum amount was $2,000 per child if applied to a tax bill, or $1,400 if paid out as a return.

In March, Congress approved an expansion, both in terms of eligibility and the amount offered per child. The law removed the minimum income threshold and increased the amount to $3,000 per child per year, or $3,600 for children under six. Instead of coming as one lump sum at tax time, half of the amount would be deposited in advance in parents’ bank accounts in monthly installments, July through June. (The rest will be credited during the 2021 tax filing process).

Breaking up the payments was meant to change how they are used.

“The goal of these monthly payments is to deliver cash to families to pay expenses as they come up,” said Patrick Cooney, a professor studying poverty and policy with the University of Michigan.

Families may cycle through periods of debt and repayment through the year, but making payments monthly can help smooth that income volatility, according to Cooney, helping parents avoid racking up debt over basic expenses.

Some parents of young children told Keystone Crossroads that it has been especially helpful when it comes to covering child care costs associated with working full-time.

Tom Stanley, who works for the University of Pennsylvania’s Development and Alumni Relations office, said it covers one more day of day care per week for his daughter.

After cutting out extras like dining out during the pandemic, Stanley said the money helps round out their budget so they don’t have to forgo anything else. “Without this monthly payment, money would be much tighter,” he said.

For Leanne Finnigan, a librarian who lives in Germantown, the money covers the window of time between when her daughter’s preschool ends, at 3 p.m., and her work ends, at 5 p.m. Child care for those hours costs $300/month.

Finnigan shares that expense with her daughter’s dad and puts the rest of the monthly cash in savings.

One need she is planning for: repairing a hole in the roof above her daughter’s bedroom, which she has patched repeatedly but needs professional attention.

“This just pads my bank account in a way that it doesn’t feel as dire to just spend that money,” said Finnigan.

The most frequently reported expenses parents in Pennsylvania put CTC payments towards are food and essential bills, according to research by the Washington University in St. Louis. More than 40% of survey respondents also put the money towards paying off debt.

Will it continue?

The fate of the monthly payments remains uncertain. The Biden administration initially proposed extending the program until 2025, but reduced the scope to a single additional year amid ongoing negotiations around the president’s proposed social spending bill, the Build Back Better Act.

“We’ve got to get as much done as possible right away,” said Deputy Secretary of the Treasury Wally Adeyemo, when asked to explain that change while promoting the bill in Philadelphia in late October.

The act has not been brought to a vote, with some centrist Democrats expressing concern about its cost. After passing Biden’s infrastructure spending bill, Democratic leaders promised to pass the $1.75 trillion social spending bill using their narrow majorities in the House and Senate following a final estimate from the Congressional Budget Office.

Republicans have stood in opposition, criticizing pandemic social spending as wasteful and too broad. None voted for the American Rescue Plan Act which created the program.

Public opinion surveys show the expanded child tax credit is popular. In September, 59% of U.S. adults supported the program, although there is a significant difference when it comes to party affiliation, according to a Reuters/Ipsos poll. The number was 75% for people who identified as Democrats, but 41% for people who said they are Republican.

For families receiving the money, the looming uncertainty is part of the calculus.

Washington has concerns about how the program would be paid for long-term, but said if it continues she would keep investing for her kids. But she’s reluctant to get used to the money. “If it were to end it would be unfortunate, but it wouldn’t be the end-all-be-all for me,” she said.

That ambivalence is not isolated. While polling shows that current support for the program is strong, the number of people in favor of making it permanent is lower in both parties, according to the Morning Consult.

The fact that the American government, which has traditionally spent less of its GDP on direct assistance to families than other wealthy countries, created this program at all also takes some adjustment.

“I’m still kind of shocked that this was done,” said Finnigan. If it continues, she said it would change her understanding of what the government is willing to do for children.

During the pandemic, the work of parenting became much more visible as families were forced to juggle virtual school, child care, and work. Finnigan said when the payments came along it felt like a recognition of that work. “I hate that it feels like a reward,” she said, “but we’re just so not used to … being treated well by the government.”

WHYY is one of over 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic justice. Follow us at @BrokeInPhilly.

WHYY is one of over 20 news organizations producing Broke in Philly, a collaborative reporting project on solutions to poverty and the city’s push towards economic justice. Follow us at @BrokeInPhilly.

Get more Pennsylvania stories that matter

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.