‘Great victory for the people’: Delaware becomes 11th state to pass paid family and medical leave

Starting in 2026, new parents can get 12 weeks of paid leave. Workers can also get six weeks to deal with a serious health issue or to care for a relative.

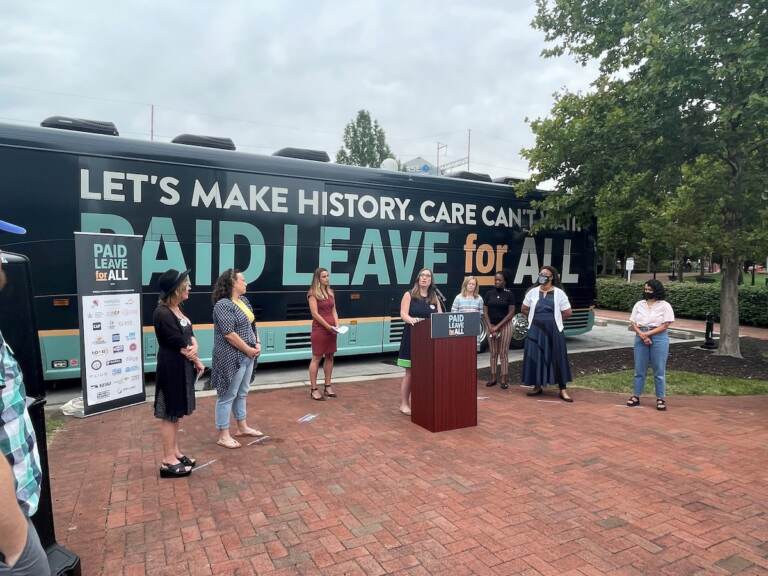

Delaware state Sen. Sarah McBride (at podium) and Dawn Huckelbridge of Paid Leave for All (in maroon dress) were staunch advocates of the measure. (Cris Barrish/WHYY)

Paid family and medical leave is coming to Delaware, with new parents, caregivers, and those with serious illnesses eligible to collect benefits in 2026.

Under the bill that passed the Democratic-controlled General Assembly this week along mostly party lines, Delaware will become the 11th state to require extended paid leave.

The money will come from a new state insurance account funded by a payroll tax that employees can split 50-50 with employees — like the Social Security payroll tax deduction. Employers, however, can shoulder up to 100% of the tax if they choose.

Starting in 2026, the program would guarantee:

- Twelve weeks of paid leave for new parents.

- Six weeks every two years for workers to address their own serious health conditions, caring for a family member with such a condition, or those affected by a family member’s military deployment.

No employee could take more than 12 weeks of total paid leave in a single year, however. The benefit is capped at 80% of an employee’s salary or $900 a week, whichever is lower.

Workers at companies with at least 25 employees would be eligible for all the benefits. Those at companies with 10 to 24 employees would only be eligible for parental leave, and companies with fewer than 10 employees would not be required to participate but could choose to opt into the plan.

An effort in 2021 that could not gain traction had called for the benefit to start no later than April 2024, and required all employers to participate.

New Jersey, New York, and Maryland are among the 10 other states with laws on the books to provide paid family or medical leave, but Pennsylvania is not. Maryland approved the measure last week, when lawmakers overrode a veto by Gov. Larry Hogan.

‘This is a great victory for the people of Delaware’

Delaware state Sen. Sarah McBride, the lead sponsor, called the measure a monumental one, especially for women.

“We have seen a significant transformation of the role of women in our society and in our economy,” McBride said Thursday on the Senate floor before the final vote. “And now my mother with her grandchildren can look at them and know the possibilities and opportunities before them are limitless.”

“It’s time for the laws of the state of Delaware to reflect that progress, to ensure that everyone in our society can participate in our economy and not be forced to choose between their family and their job, between their health and their paycheck, to help honor and foster the opportunities.”

Dawn Hucklebridge, director of the Paid Leave for All advocacy group working to get a federal law passed, applauded Delaware’s move. Hucklebridge led a rally with McBride last year in Wilmington.

“This is a great victory for the people of Delaware,’’ Hucklebridge said in an interview on Friday while noting that a “huge coalition of faith groups and businesses and all kinds of community organizations’’ in Delaware worked for the bill’s passage.

“This is an affirmation of how common sense and how widely supported paid leave is. And it’s something that we should have everywhere now.”

Since 2019, full-time state government and school employees in Delaware have been eligible for 12 weeks of paid parental leave at 100% of their salary, at no cost to the worker.

The new measure, which Gov. John Carney plans to sign, requires the money for the insurance fund to start being collected in January 2025, with benefits kicking in by January 2026.

Companies that already have a leave plan that’s comparable to or exceeds the benefits in the bill would not have to participate.

To establish and replenish the new insurance fund, employers would pay a total of 0.8% of their payroll to the fund — 0.40% for personal medical leave, 0.32% for parental leave, and 0.08% for caregiver and military leave.

Companies could deduct half of the contribution — 0.4% for employees at companies with 25 or more workers — from each covered employee’s paycheck or pay the entire 0.80% themselves.

The total cost per $1,000,000 of annual payroll is $8,000. If a company opts for splitting the cost with employees, someone earning $50,000 a year would have $200 deducted from their check annually.

Saturdays just got more interesting.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.