Could one billionaire leaving New Jersey blow a hole in the state budget?

Listen

In this Tuesday

David Tepper, the self-made hedge fund manager from New Jersey who Forbes says is worth at least $11.4 billion, is moving to Florida.

And that has Garden State finance officials on edge, because Tepper will be taking his income taxes with him, which could mean that a sizable piece of the state budget just crossed state lines.

“We may be facing an unusual degree of income tax forecast risk if news reports are true that the person ranked by Forbes Magazine as the wealthiest New Jersey resident has shifted personal and business domicile to another state,” said budget officer Frank Haines in a recent hearing in the state Senate.

While the amount Tepper paid in taxes last year is unknown to the public (the government is required to keep private tax information private), a resident that rich could pay tens or even hundreds of millions of dollars in income taxes if they paid New Jersey’s highest rate, 8.97 percent.

“A one percent forecasting error in the income tax estimate is worth $140 million,” said Haines.

In other words, it ain’t chump change.

News of Tepper’s singular influence on the state budget caused a stir in the world of financial journalism, with cable news talking heads referring to it as the “Tepper Effect.”

But could the departure of one person — albeit a very wealthy person — really punch a hole in the state budget so large that the average taxpayer would feel it?

“I seriously doubt that one person moving would have a serious impact,” said Richard Keevey, a senior fellow at Rutgers’ Bloustein School of Planning and Public Policy. He also was the budget director for two former New Jersey governors. “Now if a whole bunch of those people took off and left the state, that would obviously be a problem.”

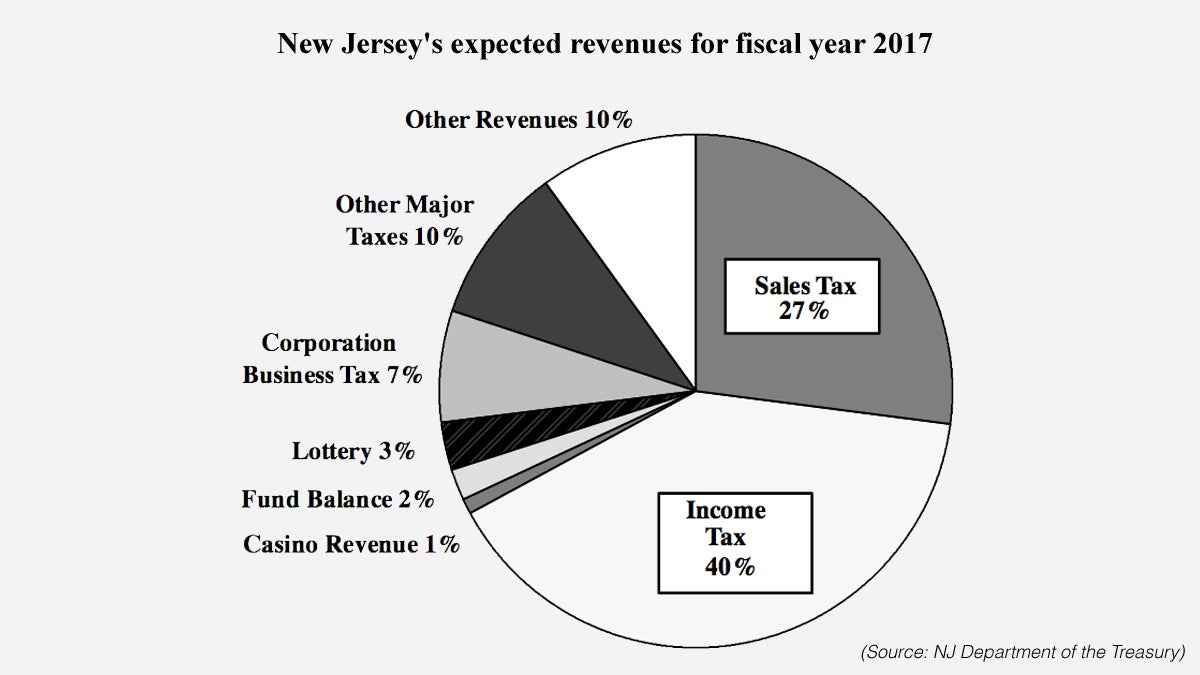

New Jersey relies on income tax revenue to fund 40 percent of its budget. Keevey said income tax revenues are volatile and hard to predict from year to year because they depend on how taxpayers fared at work and on the stock market.

“One year for example, I think it was in year 2008, because of the national recession our income tax dropped $2 billion,” he said. “Obviously that creates a big budgetary issue as to what we do to fill in that gap.” On the flip side, income tax revenues could surpass projections in a good year.

On top of all that, there’s no telling who will move into or out of a state in any given year.

According to U.C. Berkeley law professor David Gamage, New Jersey bets big on income taxes, but it isn’t the only state to do so.

“New Jersey relies more on income taxes than the typical U.S. state,” said Gamage, “but not out of bounds for what many large urban blue states — New York, California, Massachusetts — are doing.”

Tepper’s hedge fund, Appaloosa Management, which also reportedly relocated its headquarters to Florida at the end of last year, did not return several requests for comment.

Whether Tepper’s move will squeeze New Jersey’s budget or not remains to be seen.

Even as New Jersey’s tax structure seesaws with the movements of its richest residents, that has not caused income tax revenues to drop in the past few years, according to Moody’s analyst Baye Larsen.

“Despite any inflows or outflows of high wealth individuals, the state is continuing to grow its personal income and grow its income taxes at a reasonable rate,” said Larsen.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.