Meehan seeking tax legislation changes on energy credits, medical deductions

U.S. Rep. Pat Meehan expects to vote for the Republican tax overhaul, but he wants changes to encourage clean energy investment and preserve deductions for medical expenses.

Listen 3:55

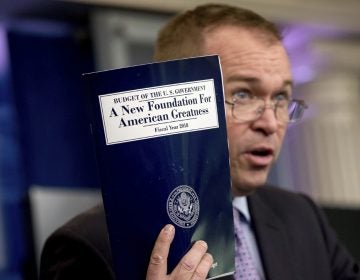

With Pennsylvania state Sen. Daylin Leach likely out of the field, Democratic leaders are searching for a new candidate to challenge Republican U.S. Rep. Pat Meehan (right) in the 7th Congressional District. (AP Photo/J. Scott Applewhite)

As Republicans in Congress push toward an overhaul of federal taxes, representatives in the Philadelphia suburbs are considering how the House and Senate proposals will play in their swing districts with an election year approaching.

The House and Senate tax packages have differing provisions, and lawmakers will now try to work out a version acceptable to both.

I caught up with U.S. Rep. Pat Meehan, a Republican who represents parts of Delaware, Chester, Montgomery, Berks, and Lancaster counties.

Meehan said he expects to vote for the final package, though he said he’ll fight to have some provisions included.

One is the continuation of tax credits for investments in clean energy, which would benefit battery manufacturers in the region.

Another is the restoration of the deduction for large medical expenses, which Meehan said is important to senior citizens in his district.

“Those who are with chronic diseases or who may have long-term care situations, they’ve learned to rely on that deduction, and I think it’s important, and I’m going to continue to fight to see if we can get that in,” Meehan said.

A break that lasts?

Meehan said he thinks most families in his district will see a tax benefit. When I noted that many of those breaks are set to expire in a few years, he said that’s “a function of the way you have to make bills pass in Washington, D.C.”

“There’s every expectation that the commitments that have been made to individuals will be continued beyond the five-year period,” he said.

The expiration of those tax benefits for families was included in the Senate bill because — under the rules set in the budget reconciliation process — the tax package as a whole can’t add more than $1.5 trillion to the deficit.

Speaking of the deficit, I asked what he thought of the bipartisan Joint Committee on Taxation’s determination that, even taking into account economic growth spurred by the business tax cuts, the tax plan would add $1 trillion to the deficit.

Meehan said a little better-than-expected economic growth will take care of that.

“All we have to do is get to a small percentage of additional growth, and we’re going to push beyond the level at which some of these predictions are being made,” Meehan said. “I have every sense that we’re going to get to that 3 percent growth model, and we’re going to grow ourselves into a very positive tax situation.”

Democrats say the plan is a giveaway to the wealthy, and candidates are lining up to take Meehan on next year.

I asked if Meehan expected a tough battle to keep his seat.

“They’re all going to be tough battles,” Meehan said of the mid-year congressional elections. But, he said, he’s working on issues such as restoring funding for the Children’s Health Insurance Program, which brought him to Children’s Hospital of Philadelphia on Monday.

He promised “to work in a bipartisan way” to maintain funding for the program.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.