The wonkiest way ever to see that New Jersey’s economy is improving

Non-recurring revenue sources

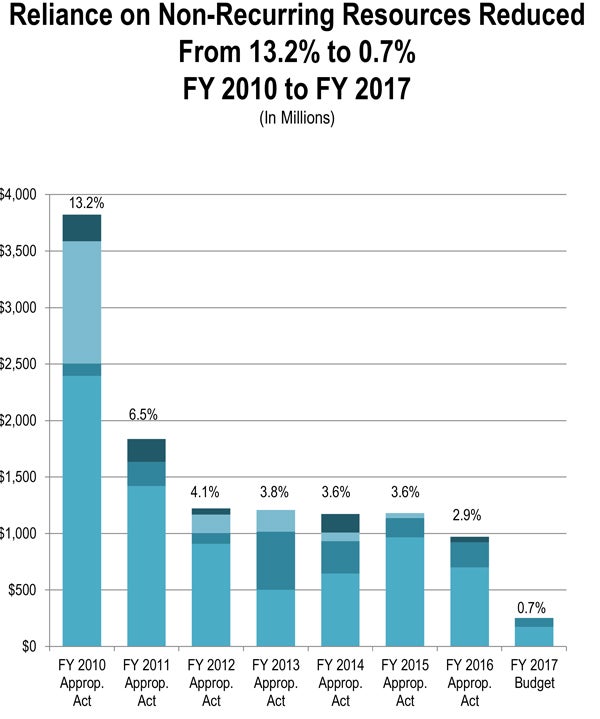

A breakdown of the number of non-recurring revenue sources — commonly referred to as “one-shots” — that Gov. Chris Christie is relying on to balance the $34.8 billion budget he’s proposed for the fiscal year that begins July 1.

One-shots can cover a number of different policy decisions that have an impact on the state budget, including fund raids and diversions, as well as tax increases and spending cuts.

The state keeps track of the one-shots as part of the annual budget process, and this year’s list shows they would make up less than 1 percent of total spending, the lowest figure in any of the seven budgets Christie has proposed during his tenure.

Why it’s important: Though a modest number of one-shots is expected in any state spending plan, an overreliance on such revenue measures is usually a sign that the state is experiencing budget problems. Ideally, annual spending would line up with recurring sources of revenue; one-shots show an imbalance between how much the state is spending and how much it is taking in from stable revenue sources.

Major Wall Street rating agencies also pay attention to how many one-shot items are in the budget in a given year as they grade the state’s creditworthiness. New Jersey’s credit is among the worst of all U.S. states, and an overreliance on one-shot revenue sources has been noted by rating agencies in past notices issued to potential investors.

What the latest one-shot list shows: Christie’s proposed budget for the next fiscal year is counting on $251.5 million in one-shot revenue sources, according to documents provided to NJ Spotlight by the state Department of Treasury. That’s down significantly from the $972 million in one-shots for the prior fiscal year.

The one-shots represent just .7 percent of proposed total spending, down from nearly 3 percent in one-shots proposed for the 2016 fiscal year.

Notable one-shots remain: Though the list of one-shots compared to prior years is much smaller, some notable items still show up. For example, Christie’s proposed budget counts on using $20 million from the Clean Energy Fund, which generates revenue from a tax paid by New Jersey electric and gas users that is supposed to support programs to reduce energy use or promote clean energy.

But determining what is a one-shot also depends on the definition the state uses, so some fund diversions don’t make it onto the formal list at all.

For example, Christie has actually proposed diverting more than $100 million from the Clean Energy Fund during the 2017 fiscal year, but not all of that revenue makes the official list, including $62 million going to New Jersey Transit.

Mid-year adjustments also don’t make the list, such as Christie plans to delay nearly $400 million in property tax relief payments between the 2013 and 2014 fiscal years. A diversion of funds from the Lead Hazard Control Assistance Fund is also not on the official one-shot list.

Still, the list remains a measuring stick used to compare the current proposed budget against budget practices in prior years.

Why things are improving: As state tax collections have rebounded in the wake of the Great Recession, there’s been less of a need for one-shots to balance the budget. During the heart of the economic downturn, the last state budget drawn up by then-Gov. Jon Corzine relied on one-shots to support more than 10 percent of total spending. That figure included nearly $2 billion in temporary federal stimulus aid that helped stave off massive spending cuts that would have impacted crucial services like education and hospital aid. Corzine also raised another $1 billion through temporary tax-policy changes, including instituting a new income tax rate on earnings over $1 million.

Christie also used stimulus aid as a source of revenue, but only during his first year in office. The temporary tax-policy changes enacted by Corzine were also allowed to expire. So, as state revenues have improved, spending once supported by the stimulus aid and revenue from the temporary tax-policy changes is now largely backed by general state revenues instead.

Other reasons for improvement: Improved tax collections have helped his administration whittle down the list of one-shots, but Christie has also remained disciplined when it comes to overall spending in recent years. For example, total spending would increase by a modest 3 percent under the governor’s proposed budget.

A series of business-tax cuts that Christie enacted beginning with the 2012 fiscal year have also played a role. The cuts included a series of changes to the tax code, such as reducing the minimum tax on “S” corporations and changing to a single sales factor formula for calculating corporate taxes to encourage more investment.

By design, those changes were expanded in phases over several years. But each expansion of the tax cuts resulted in less money coming in than the prior fiscal year, creating a one-shot for budgeting purposes. Now that the cuts have been fully phased in, they no longer create a one-shot to account for in the budget.

___________________________________________________

NJ Spotlight, an independent online news service on issues critical to New Jersey, makes its in-depth reporting available to NewsWorks.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.