With new FEMA flood maps in hand, homeowners seek flood insurance answers

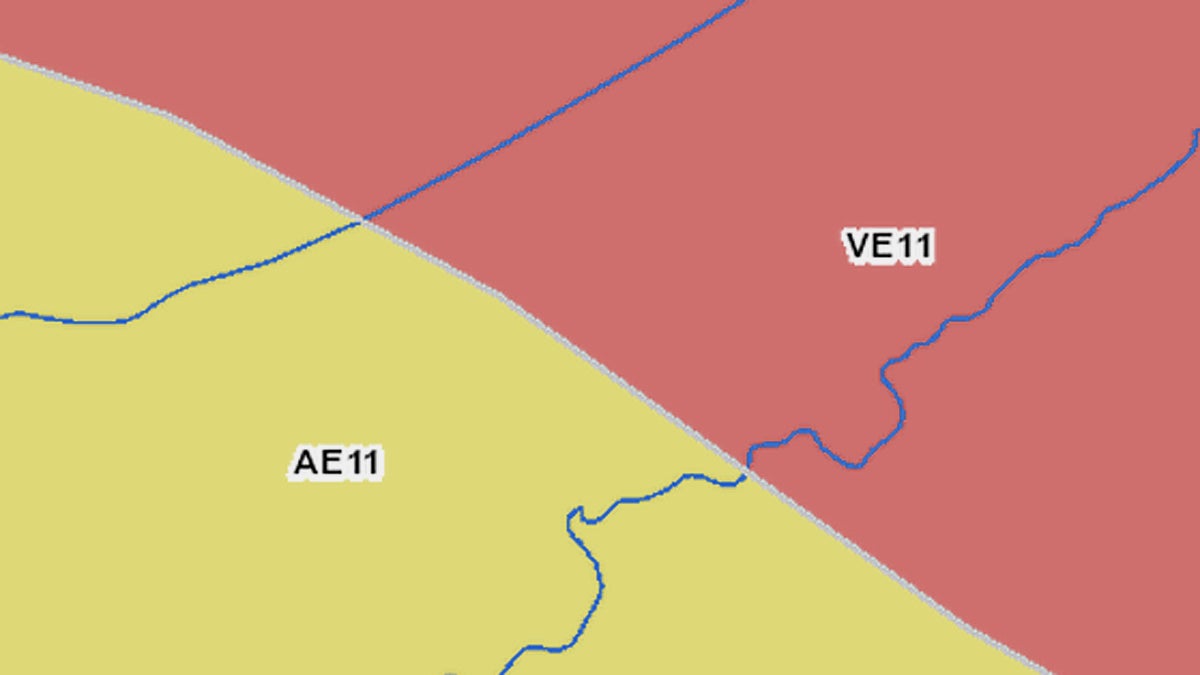

This close up of a new FEMA flood map shows two of the flood risk categories that influence how high flood insurance payments will be.

Lisa Stevens now knows that she needs to raise her home in Little Egg Harbor about two feet to comply with FEMA and New Jersey’s elevation requirements.

FEMA released updated flood maps for four counties in New Jersey this week. The maps tell homeowners their risk for flooding during a 100-year storm and recommend how high above sea level homes should be built to minimize flood damage. To the relief of many Sandy-damaged homeowners, the new maps drastically decreased the size of the areas deemed to be at the highest risk of flooding, compared with a version released last winter.

Raising a home two feet might not sound like much, but “the cost is the cost, if you’re going to raise two feet or you’re going to raise eight feet,” said Stevens. “You have to have an architect, obviously, [and get] an engineer report. You have to go through the same process.”

Does it make financial sense to spend the roughly $65,000 Stevens estimates it’ll cost to lift the house — or should she leave the house alone, but pay higher flood insurance because she’s below the recommended height?

To make that decision, Stevens needs to know what her premiums would be at each level going forward. When FEMA released the new maps on Monday, the agency also opened a hotline (877-287-9804) to give people that very information. Because people now know their current and advised elevations, they should be able to calculate their insurance rates.

“One caveat and disclaimer is that it going to be an estimate,” said FEMA’s Bill McDonnell Monday. “It’s going to be on the information that that resident provides, so if the information that they provide to the person on the call is inaccurate, they may get an inaccurate estimation.”

McDonnell also warned it could take some time for the hotline to become fully functional and that representatives might not have the newest rates yet. Most homeowners have flood insurance through the federal government’s National Flood Insurance Program, which is still finalizing rates based on the new maps and flood insurance reforms passed by Congress last summer. Those reforms phase out government subsidizes for flood insurance.

“If [hotline representatives] don’t have the chart with them as of right now because they’re still in the process of developing those new rates going forward, we will get [homeowners] an answer in a timely manner,” said McDonnell.

When Stevens called FEMA’s hotline, she was advised to call back next week. Two calls by NewsWorks went to voicemail.

How much will flood insurance cost?

For many homeowners, waiting for information on insurance rates has now taken the place of waiting on information regarding flood risk ratings and home elevation recommendations. It’s their new question mark, the next piece of the puzzle they’re awaiting to help them determine how they should rebuild their homes.

The new flood maps were “a good first step,” said George Kasimos, the founder of a Facebook group called Stop FEMA Now, which has 4,700 followers.

Kasimos lobbied for FEMA to shrink the highest-risk areas on an earlier version of its maps and was largely happy with Monday’s revisions.

But there’s a lot more work to be done, he said. His attention is now focused on rolling back increases in flood insurance premiums.

Under the new flood maps, Kasimos is supposed to elevate his Toms River home to roughly eight feet above sea level. If he doesn’t, his flood insurance payments will climb.

“I don’t have the exact number, but something about $8,000 [per year if he doesn’t raise his home],” he said. “Whether I’m paying $8,000 or $30,000, it’s just going to prolong foreclosure for some people.”

While many people’s insurance rates based on FEMA’s new maps are better than they would have been under the version released last winter, Kasimos thinks they’re still much too high.

His fight is just getting started, he said.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.