Top Pa. House Republican touts expanding private school tax credits in visit to Philly

Listen

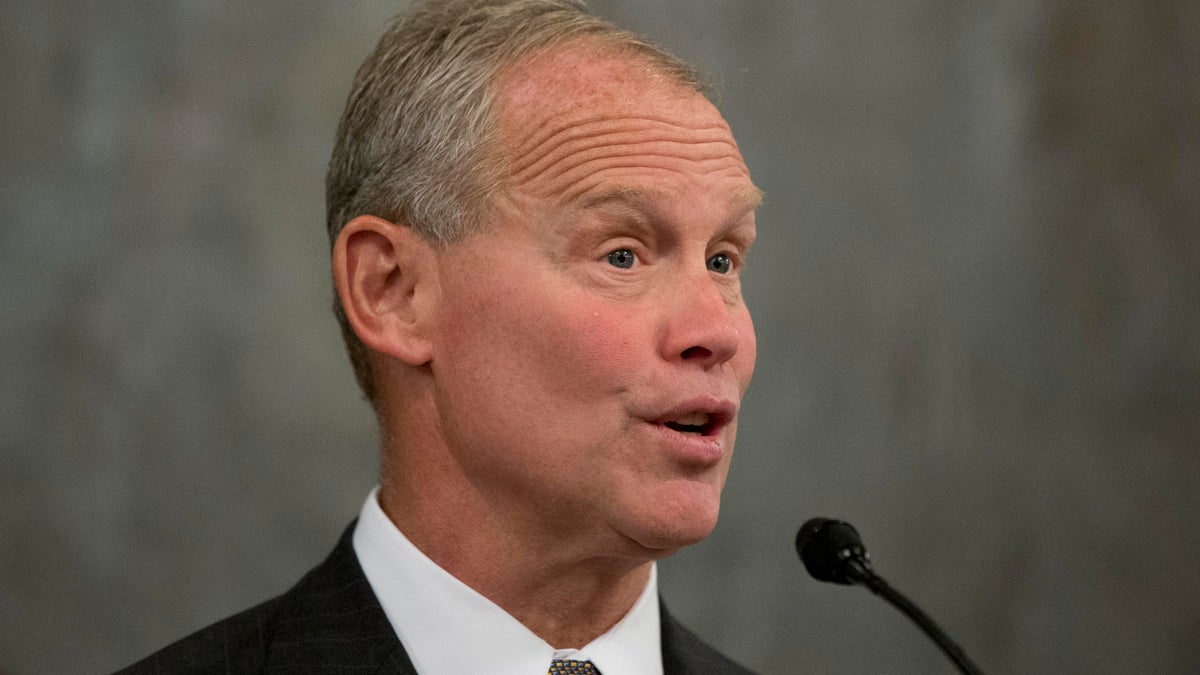

Pennsylvania House Speaker Mike Turzai (Emma Lee/WHYY)

Critics question systemic affects, accountability

Thomas Short loves that his two sons attend St. Thomas Aquinas Elementary school in South Philadelphia.

He says it makes a world of difference for his boys — fearing they would falter in a less structured environment.

Short’s perception of the nearby neighborhood public schools is low.

“They’re not trying to develop the person as much as just trying to get them through to the next grade,” he said. “I don’t know why I’m saying that. It’s just my opinion. Maybe that’s how the public schools used to be back in the day when I went.”

Short’s family lives on his $1,000 a month disability check. The only way he’s able to afford Catholic school tuition is because he takes advantage of a scholarship program that’s funded by state tax credits. Tuition for two children normally runs north of $9,000 per year.

With the scholarship, he pays just $1,500.

“Without this, [they’re] not going here,” he said.

It’s these tax credit programs that brought Pennsylvania Speaker of the House Mike Turzai, R-Allegheny, to South Philadelphia Wednesday.

“It’s really been an important part of allowing school choice in the Commonwealth of Pennsylvania,” said Turzai.

So what are these tax credits?

There’s two different programs: The Educational Improvement Tax Credit and the Opportunity Scholarship Tax Credit.

In both, the bulk of the money is allocated so the state can give businesses tax breaks if they donate money to organizations providing scholarships to help families pay private school tuition.

Both limit eligibility by family income, but the threshold is relatively high. A family with two children can’t earn more than $90,000 per year.

The EITC was passed in 2001, after then-Gov. Tom Ridge’s private school voucher initiative failed to garner enough support. In addition to the scholarship funding, EITC also directs a slice of money to organizations that support public schools, as well as pre-K funding.

The OSTC was passed in 2012. All of its funding goes to scholarship organizations. The only distinction is that OSTC money can flow only to families whose neighborhood schools fall in the bottom 15 percent of statewide standardized test scores.

Currently, the tax breaks are capped. In total, they can’t surpass $175 million per year— $125 million for EITC; $50 million for OSTC.

Turzai has a new bill that would raise the cap to $250 million — taking EITC to $175 million and OSTC to $75 million.

For Turzai and many other politicians, it’s a win-win proposition. Businesses love the credit, and more families like the Shorts can reap the benefits.

But there are critics.

“I see this as a carefully crafted law that was put into place to bypass the Pennsylvania Constitution’s prohibition of spending tax dollars on private and sectarian schools,” said Larry Feinberg, a Delaware County school board member and outspoken critic of the tax credits.

The U.S. Supreme Court ruled in favor of voucher programs in 2002, citing the fact that such programs allow participating parents to make their own choices.

At Wednesday’s press conference, Turzai cited that ruling to defend the tax credits.

“So it’s actually going to the kid. It’s not actually going to the school itself. So it follows the kid,” he said. “I think it’s actually a great opportunity.”

Like other critics, Feinberg laments that the programs ultimately reduce the funding that’s available to public schools.

“I don’t think the public understands that every penny of this tax credit money is money that never makes it into the general fund, and is therefore not available when [lawmakers] sit down to talk about the budget,” he said.

Pennsylvania’s revenue collections are behind $218.5 million through the first quarter of the current budget year, according to the state Department of Revenue.

Sources in the Democratic wing of the House especially questioned Turzai’s push to forgo an additional $75 million in revenue, in this context.

National comparison?

Compared with the rest of the country, Pennsylvania’s school tax credit program sticks out in a few ways.

Sixteen other states offer these sorts of credits. More than half require the private schools to take standardized tests in order to provide accountability to taxpayers. Pennsylvania does not.

St. Thomas Aquinas, for instance, does not administer the state’s PSSA test. Students there take the Terra Nova test, but results aren’t shared with the public.

The law in Pennsylvania also allows the scholarship organizations that act as intermediaries to keep 20 percent of the money as an administration fee.

In most other states, it’s 10 percent. In Florida, it’s 3 percent.

Pennsylvania also demands very little data from the program. So the public can’t know the specifics of the students who benefit — such as income levels or demographics.

But the lack of information concerning these programs is not unique to Pennsylvania.

“There’s not a lot of data out there,” said Josh Cunningham, a policy analyst with the National Conference of State Legislatures.

Pennsylvania does keep data on the businesses that donate, as well as the schools and organizations that benefit.

In 2014-15, the Business Leadership Organized for Catholic Schools received the most funding through EITC, at $3.57 million.

Other top recipients that year include some of the state’s most elite private schools, such as The Haverford School, The Shipley School and Episcopal Academy.

For OSTC, top recipients were BLOCS ($13.8 million), Children’s Scholarship Fund Philadelphia ($9.08 million), and Foundation for Jewish Day Schools of Greater Philadelphia ($3.08 million).

Any concerns about the tax credits, Turzai said, are dwarfed by the good they do.

“A school with love and security and this wonderful building, and the uniforms, and the opportunity to focus on a moral background, a Catholic background — some people want those opportunities.” he said. “And they should have some school choice.”

Turzai hopes the bill will pass before the next budget deadline. Gov. Tom Wolf opposes it. But as part of larger negotiations, he has approved raising the cap before. EITC went up $25 million in the last budget cycle.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.