Tax on wealthy, business incentives emerging as top issues in N.J.

Raising taxes on the wealthy and renewing an expiring business incentive program are emerging as top fights as New Jersey's budget deadline approaches.

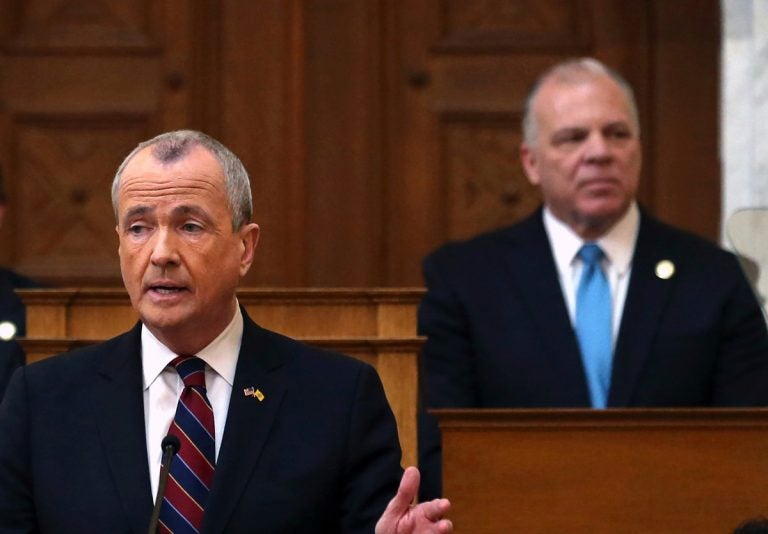

Senate President Steve Sweeney, (right), D-Gloucester, listens as New Jersey Gov. Phil Murphy speaks in the Assembly chamber of the Statehouse in Trenton. (Mel Evans/AP Photo, File)

Raising taxes on the wealthy and renewing an expiring business incentive program are emerging as top fights as New Jersey’s budget deadline approaches.

When the Democrat-led Legislature and Democratic Gov. Phil Murphy return from the brief Memorial Day break, they’ll be in the homestretch of budget talks and facing a July 1 deadline to enact a balanced spending plan.

Despite Democratic control of state government Murphy and Senate President Steve Sweeney, in particular, are clashing over Murphy’s proposal to hike income taxes on people earning more than $1 million.

The state’s business tax incentive programs also are slated to expire July 1. Murphy has called for capping the currently uncapped program, but the debate has been overshadowed by the work of a task force the governor established to investigate potential wrongdoing in the Chris Christie-era programs.

A closer look at the issues:

Tax people ‘like me,’ says Murphy

Murphy, a former Goldman Sachs executive and Obama administration ambassador to Germany, is renewing his calls for hiking the income tax on those making more than $1 million. His most recent pitch to voters came in a $1 million ad campaign by New Direction NJ, an advocacy group run by former campaign staff of Murphy’s. In the ad, Murphy calls on voters to push for taxing people “like me.”

The current top rate of 10.75% applies to incomes over $5 million and stemmed from last year’s budget deal between Murphy and lawmakers, but Murphy is pushing to apply that rate to those making more than $1 million.

Not so fast

Sweeney, who sets the agenda in the state Senate and has close ties to the southern New Jersey firms that Murphy’s tax incentive task force has been probing, has drawn a line in the sand on taxes.

“I’m not raising taxes, and we don’t need to,” he said in a recent interview.

Sweeney instead is pushing a slate of bills aimed at addressing the state’s core fiscal concerns: principally its massive unfunded public worker pension and health benefits liabilities. Sweeney wants to replace current pensions with a hybrid plan for workers with fewer than five years of service. But Murphy is all but certain to reject any measures opposed by public sector unions, which have panned Sweeney’s plan.

Tax credits

Murphy singled out tax credits as a major focus this year, appointing a task force to follow-up on a state comptroller’s report that found the agency administering those incentives did not always verify that firms were meeting required benchmarks.

The task force has since presented documents that raise questions particularly about how firms with ties to George Norcross got their awards. Norcross is executive chairman of insurance brokerage Conner Strong & Buckelew and chairman of Cooper University Health, both of which have been awarded millions in credits. He’s also an influential, though unelected, Democratic Party boss and donor. Norcross and the firms have denied any wrongdoing and are suing Murphy and the task force.

That fight has consumed debate, with lawmakers pledging to hold their own investigation into tax incentives, and has Sweeney backing his friend and patron Norcross.

Murphy says he wants to renew tax incentives, but with caps on the amount that could be awarded. Under the Christie-era programs, about $8 billion in awards has been approved. Murphy has said that’s a liability that could cost the state’s coffers when businesses redeem the credits.

Sweeney floated the notion of hitting pause on tax credits while the debate wages on.

“Is there potential for New Jersey not to have an incentive program for a little bit?” he asked. “There’s a possibility.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.