Seeking way to soften U.S. tax bill blow, N.J. lawmaker calls for change on state tax rules

The legislation would eliminate the $10,000 limit on property taxes New Jersey residents can deduct on state income tax returns.

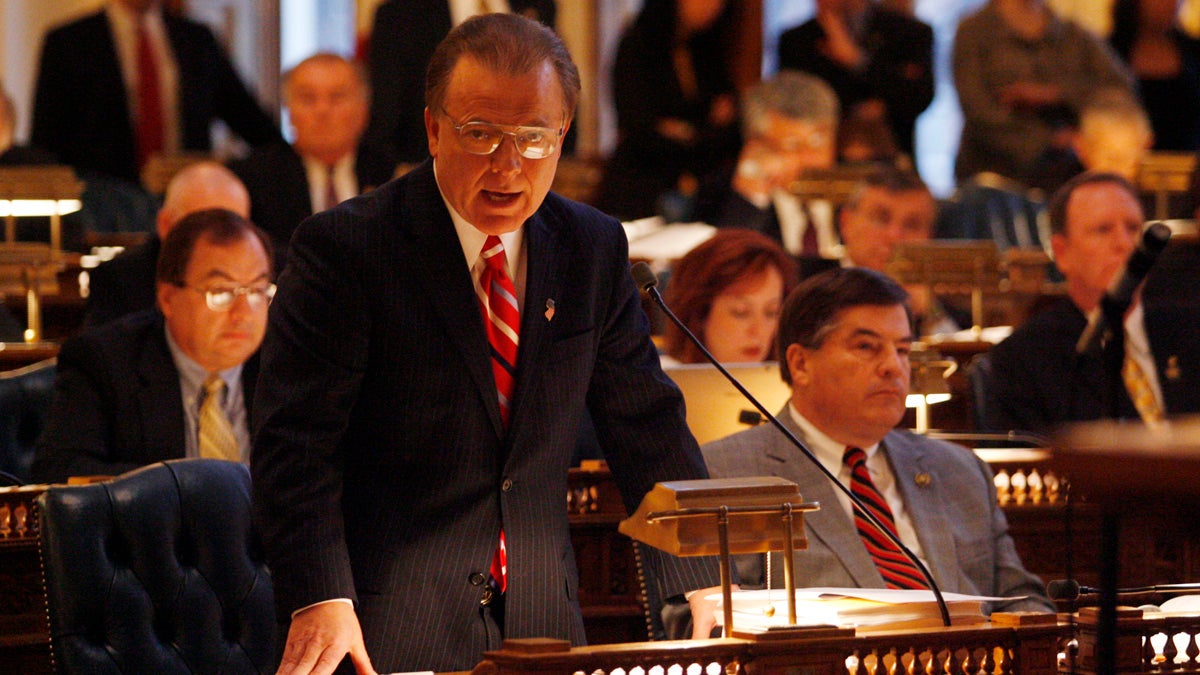

New Jersey Sen. Joe Pennacchio says a plan to end the limit on property tax deductions on state returns will give New Jerseyans some tax relief. (AP file photo)

A New Jersey lawmaker has introduced legislation that would eliminate the $10,000 limit on property taxes that can be deducted on state income tax returns.

Allowing the entire sum of property taxes to be deducted on New Jersey tax returns would soften the blow of the GOP congressional plan to limit federal tax deductions, said Sen. Joe Pennacchio, R-Morris. And he hopes Gov.-elect Phil Murphy supports it.

“If anything, it would show a consistency and an honesty with that issue,” he said. “You can’t blame Congress and the president for doing one thing, yet it’s in your power to do exactly the opposite in your state.”

Pennacchio, who said his plan is the most effective way to give New Jersey residents property tax relief, said he is seeking bipartisan support in the legislature to enact it before the end of the lame duck session.

“But I don’t know if we have enough time,” he said. “So it would be my hope that Gov. Murphy comes in along with the Legislature, and we are able to do this on a bipartisan basis and do it retroactively starting Jan. 1 of next year’s tax season.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.