Rigged New Jersey tax-lien auctions ‘harmed thousands’ of homeowners

For at least 11 years, bidders on tax-sale certificates in New Jersey systematically rigged municipal auctions, defrauding thousands of already hard-pressed homeowners or businesses.

First revealed in August 2011 as the result of an ongoing FBI investigation, the extent of the conspiracy grows with every new guilty plea. The latest admission came just before Christmas from Mercer S.M.E. Inc. of Burlington, N.J. the 11th company or individual to plead guilty.

Tax-lien certificates provide a lifeline for municipalities, which often need outside help to collect back taxes. They sell these rights to bidders by auctioning certificates on delinquent properties.

As described by federal authorities, the conspirators distorted this market, piling exorbitant surcharges on property owners who might otherwise have paid quickly.

One result is that some New Jerseyans unfairly lost property or overpaid to keep it, said Michael Perle, one of the attorneys coordinating a federal class-action suit naming four dozen individuals or companies as conspirators. Although local tax collectors run the auctions, they are not targeted in the suit, he said.

“We see the municipalities as victims here, too,” Perle said.

While collecting interest and fees from delinquent taxpayers, holders of the tax certificates also pay municipalities a share of the proceeds, he said. But those amounts also are part of the bidding process, so collusion among bidders probably cost towns money, Perle said.

While obtaining admissions of violations of the Sherman Antitrust Act, the U.S. Department of Justice has left it to the victims to pursue civil claims for restitution. Each new plea announcement has forced a rewrite of the lawsuit to include the latest revelations about participants and their actions.

Both the federal investigation and the civil suit present straightforward allegations.

Conspirators agreed among themselves to charge the highest possible interest rates to people already having trouble paying their taxes. In the words of the suit, this “harmed thousands of distressed homeowners throughout the state of New Jersey.”

Because the Justice Department does not reveal details of ongoing investigations, attorneys in the civil suit have been negotiating settlements with some conspirators who already have pleaded guilty, trying to learn more details. Already, the plaintiffs contend that some of the conspirators’ discussions took place at meetings of the National Tax Lien Association, based in Washington, D.C.

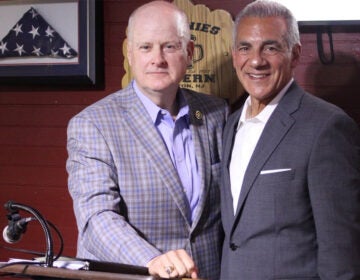

One of the lawsuit defendants, John Garzone, is a past president of both that association and Plymouth Park Tax Services, also known as Xspand,. No one from that company has pleaded guilty, but it has acknowledged being under investigation.

Now a subsidiary of JP Morgan Chase, Plymouth Park was previously owned by former New Jersey Gov. Jim Florio. Its board included a former Pennsylvania governor, Mark Schweiker. Florio sold the company in 2006 to Bear Stearns, a giant investment bank that soon collapsed in the Wall Street meltdown and was acquired by Morgan.

In 2011, Morgan announced it would “begin exiting” the New Jersey tax-lien business because it “wasn’t central” to its operations. But that was just weeks before the Justice Department announced the first guilty plea from the ongoing investigation.

Bradley Westover, who took over as the NTLA’s executive director in October 2011, said the group itself promotes proper bidding practices and was not involved in any of the irregularities.

“If some very foolish people had conversations over cocktails or whatever, that’s something they did on their own,” Westover said.

New Jersey is not the only place where the tax-lien market was compromised. In the past three years, other guilty pleas have resulted from investigations of rigging of tax-lien bids in Illinois, Maryland and San Joaquin County, Calif.

“The thing that distinguishes New Jersey is that these are municipal auctions, often very small, not county level or larger,” Westover said. “When Palm Beach County, Fla., holds an auction, there are hundreds of bidders and maybe 20,000 liens, not six liens and six bidders.”

As laid out in court documents, these schemes have been straightforward and the victims — hard-pressed homeowners and local governments – have been easy marks.

With interest rates depressed on many other investments, municipal tax-sale certificates are a lucrative alternative, offering purchasers returns of as much as 18 percent interest on the back taxes, plus penalties.

The catch is that they are offered in dribs and drabs at municipal auctions throughout New Jersey. Under state law, municipalities must hold auctions at least annually, and tax collectors are required to put the available properties up for bid or face possible sanctions.

In these auctions, the bidder willing to accept the lowest interest rate is the winner. But if no one else bids, the rate stays at 18 percent. Across the nation, $4 billion to $6 billion worth of unpaid property taxes are offered for sale each year.

The system was established during the Great Depression, at a time when tax collections fell in many communities. Rather than stretch municipal resources to pursue delinquent taxpayers, 26 states, plus Washington, D.C., and the U.S. Virgin Islands, decided to auction collection rights to bidders.

Historically, New Jersey allowed bidders to charge up to 8 percent interest. During the 1980s, though, investors left the tax-lien market, lured by 20 percent interest rates on other investments. The Legislature responded, raising the allowable rate, which has remained at 18 percent even as interest on most other investments has flat-lined.

Plymouth Park has been one of major buyers of New Jersey tax-sale certificates, along with M.D. Sass Investor Services and related firms in New York; Crusader Servicing Corp., owned in part by Royal Bank America of Narbeth, Pa.; American Tax Funding of Jupiter, Fla.; BankAtlantic Bancorp, now known as BBX Capital, of Fort Lauderdale, Fla.

According to the suit, representatives of those firms attended “most, if not all” of the New Jersey auctions during the period under investigation. Before the proceedings, conspirators would divvy up the properties, ensuring that little or no competitive bidding took place, according to federal authorities and the civil plaintiffs. Crusader is among those that have pleaded guilty.

“The conspirators agreed to coordinate their bids and allocate the tax liens amongst themselves, at the expense of distressed property owners,” said Deputy Assistant Attorney General Scott D. Hammond, in announcing the Mercer company’s guilty plea.

While not one of the biggest players, Mercer participated in the conspiracy from 2003 to 2009, according to its guilty plea. Its background is more colorful than most of the other defendants.

According to court documents, Mercer was established to accept tax-sale certificates assigned by a nonprofit “spiritual oasis,” the Fountain of Life Center established by the Burlington Assembly of God.

The suit alleges that Mercer’s president, Susan Esposito, and another executive, David Boudwin, participated in various rigged auctions. They are among four dozen individual and corporate purchasers currently named as defendants. Some are affiliated with banks or investment funds.

The lawsuit depicts their impact on several property owners.

In 2005, Robert E. Rothman of New York, who has pleaded guilty in the federal case, bought a lien with 18 percent interest on an Ogdensburg property that owed $1,048 in water bills. As of November 2012, the total had risen to $21,284.

In 2007, Sass groups acquired liens at 18 percent on two properties owned by Frances and Donald Schmidt, who owed $4,234 in property taxes to Woolwich. Five years later, the bill was $75,019, according to the suit.

As with other municipal activities, the state Department of Community Affairs nominally oversees the auction system. Aside from holding seminars for collectors and reminding them to report suspected collusion to law enforcement, the department has not policed the local proceedings. DCA spokeswoman Lisa Ryan said the federal probe proves the system works.

“These prosecutions should be serving the dual purpose of punishing bad actors and chilling future unlawful activity,” she said. “No new laws are being pursued at this time.”

Aside from a 32-minute streaming video about anti-trust laws, the National Tax Lien Association plans to feature a Justice Department presentation at its 2013 national conference in Miami Beach, Westover said.

But its most basic advice to members who find themselves at an auction with only single bids on properties is “get out of the room as quickly as possible,” he said.

NJ Spotlight, an independent online news service on issues critical to New Jersey, makes its in-depth reporting available to NewsWorks. Joe Tyrrell is the founder of the New Jersey Foundation for Open Government, which unites civic groups, citizens and journalists to promote transparency and ethics.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.