Putting word out on free tax-prep, full refunds and how to avoid scams

Nonprofit group wants to alert lower-income residents to free services, how to get the refunds they’re entitled to, and how to spot scams.

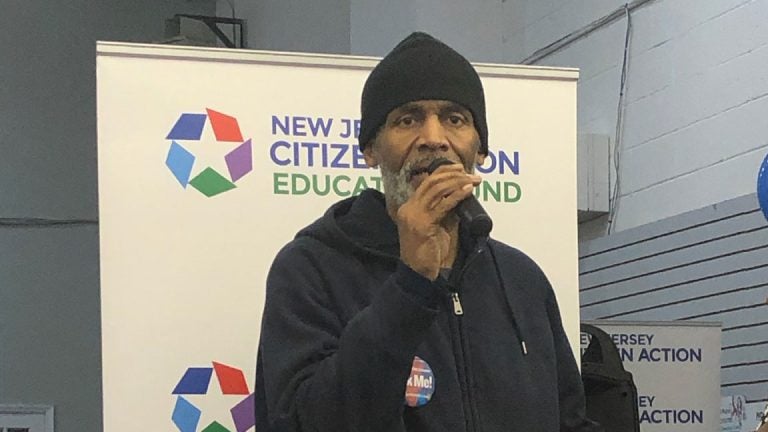

Winston George of Irvington discussed the free tax-filing help he received from NJ Citizen Action. (Citizen Action)

This article originally appeared on NJ Spotlight.

–

When Winston George turned to a for-profit service last year to file his income-tax returns, he was charged a fee to put his refund on a prepaid card and only learned later the refund could have been deposited directly into his bank account for free.

To some, the nearly $50 fee levied on top of the $211 tax-preparation charge might not have made a big dent in their personal finances. But for Irvington resident George, who works as a UPS package handler, it was a big hit.

“That isn’t a lot of money, but when you’re living check to check, everything adds up,” George said.

This year, George is filing his tax returns through New Jersey Citizen Action (NJCA), a group that provides free, bilingual tax-preparation services to thousands of lower-income residents throughout the state under a program affiliated with the Internal Revenue Service.

In addition to offering free tax-filing services to groups that often end up paying fees to for-profit tax preparers for the same services, NJCA provides the same tax help to seniors. The group also does outreach to inform people of the Earned Income Tax Credit (EITC), a tax break offered by both state and federal governments that benefits low-wage workers.

NJCA kicked off this year’s tax season — and the availability of its services — with an event at its downtown Newark tax-filing headquarters, drawing both Lt. Gov. Sheila Oliver and Newark Mayor Ras Baraka. But it also used the event to air warnings about scams and predatory practices related to tax season that are often directed at low-income residents, who can least afford to suffer such losses.

“People need to be very vigilant and watch out,” said Leila Amirhamzeh, NJCA’s director of development.

Concern about predatory practices

Scams and predatory practices have long been a concern for groups like NJCA, which has secured more than $80 million in refunds for thousands of lower-income residents over the last 13 years. The group’s services, which are provided through the federal Volunteer Income Tax Assistance program, are available to residents who make up to $56,000 annually.

A report issued last year by the U.S. Government Accountability Office (GAO) raised several concerns about the fees that tax preparers charge after undercover investigators were not provided detailed information in a majority of the visits they made to tax-preparation sites. That followed a 2014 GAO report that found a high frequency of refund errors in returns filed by for-profit tax preparers. Of the cases that were closely scrutinized, the mistakes ranged from being off by $52 to more than $3,700.

But some losses suffered by low-wage taxpayers are self-inflicted as a result of their not benefiting from federal and state Earned Income Tax Credit programs. The EITC works as a refundable credit for low-wage workers; unlike a nonrefundable credit, the EITC lets recipients take the full amount they qualify for even if their credit is larger than what they owe in taxes.

Many Democrats and Republicans alike support the EITC, believing it to be a strong incentive for keeping low-wage workers employed and off government-assistance programs. New Jersey has one of the United States’ most generous programs with recent increases having raised the state benefit to 39% of the federal benefit.

Tax payers who are over 25 qualify for the credit if they meet annual income limits that range from $15,000 for single filers with no children to as high as $50,162 for single filers with three or more children, and nearly $56,000 for married filers with three or more children. More than 560,000 New Jersey residents qualify for the credit, with average benefits worth over $1,000.

Millions of dollars unclaimed

But Amirhamzeh said New Jerseyans who qualify for the EITC leave millions of dollars unclaimed every year.

“This is a big loss for New Jersey, and New Jersey families,” she said.

Part of NJCA’s mission is to spread the word about the credit and make sure everyone who qualifies for the EITC is filing their taxes properly.

Estheurys Alcantara, a Newark crossing guard with four qualifying children based on their ages, spoke about her own experience at the NJCA event. Alcantara, who filed her tax return through NJCA in 2019, said her combined state and federal EITC was worth nearly $8,000 last year, and she said she wasn’t hit with any of the fees that for-profit companies have charged her in the past as she collected her refund.

Newark Mayor Ras Baraka suggested services like NJCA’s provide a boost to both residents and the city itself when the refund dollars are spent locally, including at the downtown retail stores located in the same neighborhood as the tax-filing center. Some studies show that EITC recipients like Alcantara typically use their refunds to pay bills or buy consumer goods, with a multiplier effect as high as 3-to-1 for every dollar provided through the EITC.

“That’s huge,” said Baraka, who is among those who have called for expansion of the EITC.

Confusing tax code changes

Meanwhile, changes to the tax code at the federal level have impacted state taxpayers in different ways in recent years, causing some confusion. While personal exemptions were eliminated and a federal write-off for state and local taxes is now capped at $10,000, the standard deduction has been widened.

Lt. Gov. Sheila Oliver urged lower-income taxpayers during Friday’s event to take advantage of services like NJCA’s, saying many residents likely qualify for a number of different credits or tax breaks that can result in a refund for them.

“Don’t think because you don’t earn a huge salary that you’re not eligible for some of those things,” Oliver said.

- Follow this link for more information on the free services offered by NJCA.

- You can find IRS advice about tax scams here.

- Information on the NJ Earned Income Tax Credit is provided by the Divison of Taxation in the state Treasury.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.