Philly City Council reaches deal on budget with property and wage tax relief

Budget negotiations were fraught with concerns over steep increases in property valuations that threatened big tax hikes for many Philly homeowners.

Philadelphia City Hall. (Mark Henninger/Imagic Digital)

Philadelphia’s City Council has come to a budget agreement that, after receiving the mayor’s expected approval, will make some of the biggest changes to the city’s tax structure in years.

At the center of the delicate compromise is a dramatic increase to the city’s Homestead Exemption. Currently, Philadelphia homeowners can apply to have $45,000 knocked off their property value assessment, which lowers their taxes by about $629 annually. Under the council’s new proposal, homeowners can receive an assessment reduction of up to $80,000, which could save them about $1,119 every year.

Among council members and Mayor Jim Kenney, there was consensus that at least some property tax relief was necessary in this year’s budget.

When the city reassessed property values this year after a three-year pause, some homeowners saw their values — and by extension, their property taxes — skyrocket, especially if their homes are in gentrifying areas. Residential property values across the city went up an average of 31%, but increased by a lot more in fast-changing parts of North and West Philly.

Officials broadly wanted to avoid hitting homeowners with unmanageable tax bills. But the question that dogged this cycle of budgeting was: How much relief can the city offer while still funding public services and other priorities?

Kenney’s Homestead Exemption proposal was more modest than the council’s — an increase from $45,000 to $60,000. He expressed continued support for relief ahead of City Council announcing its deal, but added that overall, he thinks higher assessments are a positive. “If you want to make an argument to me that having people’s property values go down is a good thing, I’d like to hear it,” Kenney said.

Some council members, like Kenyatta Johnson, had wanted even more tax relief. But Johnson said the goal of the deal is to help people grapple with the real estate tax valuation increases.

“We want to make sure that no one loses their home. We want to make sure as many people as possible are able to not be evicted as it relates to the significant increase in property tax.” He added, “I’m pretty confident that the package at least will provide some relief to individuals who will be impacted by the property tax increases.”

Without the changes to the Homestead Exemption, the taxes on the newly reassessed properties would have brought about $92 million more into the city’s general fund — money that public school advocates in particular pointed to as a critical source of stable funding.

School District of Philadelphia officials note they already made their budget for the next year using the mayor’s estimate that the city would kick $94 million into the district.

Along with the Homestead Exemption increase, the council’s budget deal proposes increasing funding for the Longtime Owner Occupants Program, or LOOP, by $10 million to $35.2 million total. The program is geared toward homeowners with low to moderate income in quickly gentrifying neighborhoods, putting a cap on the amount their property taxes can increase in a year.

Members also agreed to a slight reduction in the net income portion of the city’s business income receipt tax, and small reductions in the wage taxes for residents and non-residents.

The wage tax for residents will go from 3.83% to 3.79% under the proposal and the non-resident rate will also change from 3.448% to 3.44% if the proposal receives the expected final approval.

Councilmember Allan Domb is pleased by the reduction of the BIRT, or Business Income and Receipts tax, from 6.2% to 5.99% under the proposal. “I think it’ll positively impact tens of thousands of businesses and on the net income (portion) of the BIRT. And, you know, we have this consistent problem of providing family-sustaining jobs in the city.”

Domb believes the BIRT cut is only a start, “but it is a step in the right direction. We’ve been trying to do this for years, so it’s a good start. We need to do a lot more.”

Council’s progressive wing had concerns about funding stability.

Councilmembers Kendra Brooks, Helen Gym, and Jamie Gautier voted against the wage and business tax reductions. Gym voted against the BIRT, saying the tax money could have been used for the fight against violence. And what she called marginal wage tax cuts should have been devoted to the school district to prevent staffing cuts.

Council also added to the $184 million violence prevention fund proposed by the Kenney administration by just under $30 million — for projects that include $2.5 million for keeping recreation centers open on weekends to $5.8 million for the Defender Association, which provides an attorney to those who cannot afford one.

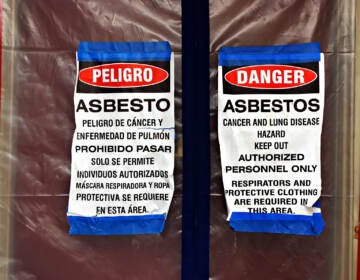

Council also added $15 million in rental assistance, $1 million for eviction protection, and another $1 million to the city’s cultural fund. The Free Library would get an additional $2.6 million over the mayor’s proposed budget along with $2 million more for asbestos inspections in school district buildings. The City Commissioners would receive $6 million more for the administration of elections if the budget agreement in council becomes law.

Budget approval by a committee of the whole council Wednesday evening will move on to a formal first reading in City Council Thursday, and likely final approval a week later, at the last council meeting of the fiscal year on June 23.

Politics have undergirded this budget cycle more than most years. At least five current council members are expected to run for mayor, and are eager to paint contrasting pictures of the ways they’ll do things differently when at the helm.

Asked about council’s tug-of-war over property tax relief, and the likelihood that home values will keep rising in the city, Kenney seemed happy to leave future tax questions to his successor.

“One of them,” he said, “will have to deal with that when they get here.”

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.