Pew study finds LOOP program in use around Center City

The Longtime Owner Occupants Program, a relief measure passed by City Council in 2013 to ease sudden tax spikes for some homeowners after a citywide reassessment of property values, is in use most substantially in the neighborhoods around Center City, a Pew study has found.

The report, released earlier this month, is intended to measure the impact of the Actual Value Initiative (AVI), the Nutter administration’s attempt to correct property value after decades of erratic assessment, bad records, and disparate tax bills for similar properties. AVI took effect in 2013, decreasing property-tax bills for some and raising them for others.

Some tax bills rose drastically, and those were the target of LOOP. The program limits the increase in year-over-year tax bills by freezing the tax liability of participants at a rate three times greater than the previous year’s bill. So if a house was assessed at $100,000 before AVI and $450,000 after AVI, the homeowner would only be required to pay taxes on $300,000 of value under LOOP. The tax reduction lasts for ten years.

The program is available to homeowners who have occupied their houses for 10 years or more, and who make no more than 150 percent of Area Median Income. Median income for the Philadelphia area, which includes the surrounding suburban counties, is around $55,000 for an individual, so the program is open to individuals making up to around $82,000. (Median income within Philadelphia is about $37,000.)

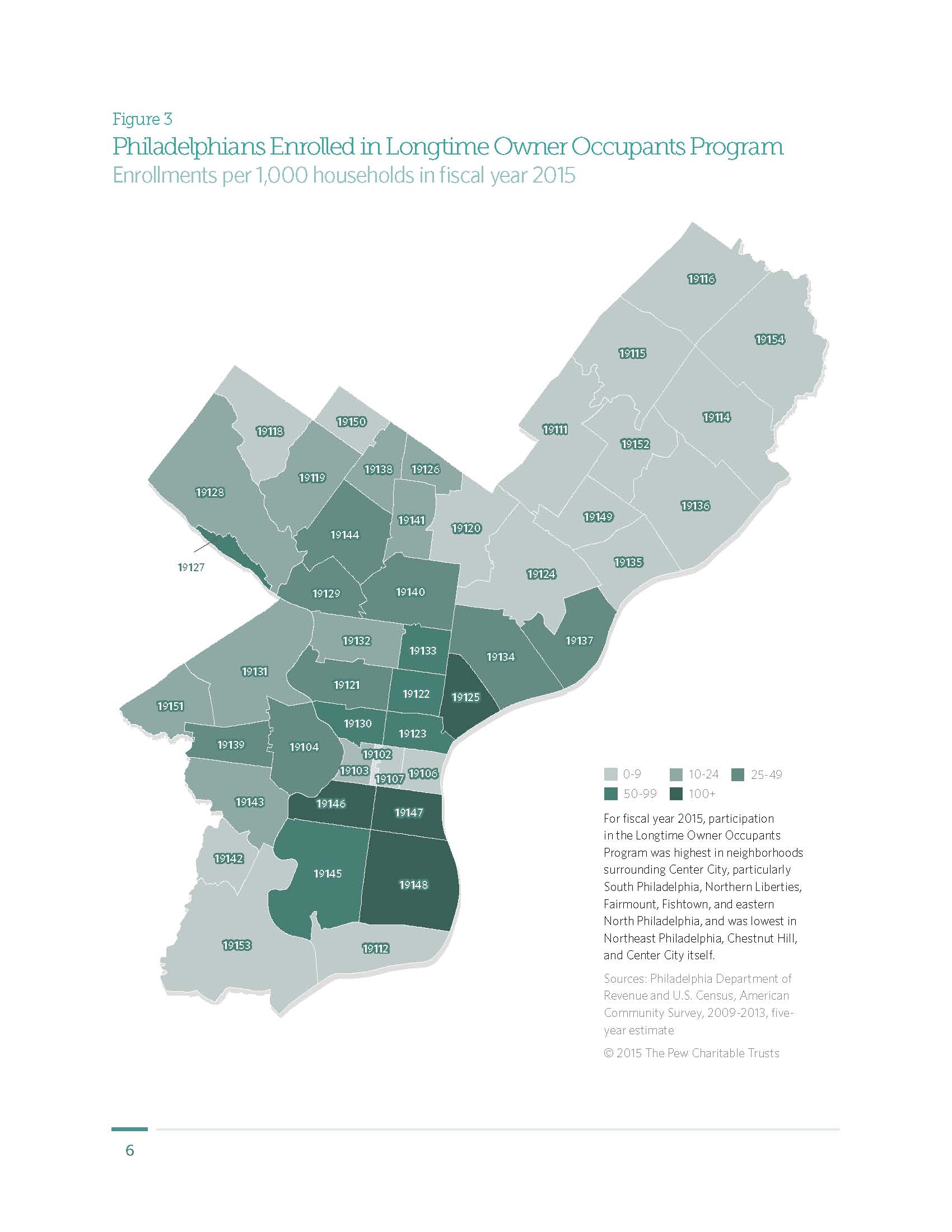

The Pew report, written by researcher Emily Dowdall, shows that the highest rates of participation in LOOP are in South Philadelphia and Fishtown. Four zip codes in South Philadelphia alone (19145, 19146, 19147, 19148) accounted for nearly half of all LOOP participants. 19148, the large area south of Tasker Street and east of Broad, had the highest total number of LOOP participants with 3,241, according to data provided by Pew. The area also had the highest total number of properties—nearly 14,000—with values that rose by 300 percent or more under AVI.

Fishtown had 1,190 LOOP participants out of 6,640 properties that more than tripled in value under AVI.

South Philly and Fishtown also had some of the highest rates of LOOP participation as a portion of the number of residential properties that tripled in value. There could be a million reasons for this, but it’s worth noting that these areas are represented in City Council by Kenyatta Johnson, the lead sponsor of the LOOP bill, and Mark Squilla, who was among the most vocal about potential AVI drawbacks in Council and in community meetings.

The LOOP application deadline was extended at the beginning of 2014 and then made available again the following year.

LOOP participation was particularly low, relative to the number of properties that tripled in value, in the 19102 zip code, a thin area bounded roughly by Broad and 16th, Callowhill and Pine streets. Presumably because that area of Center City has relatively few owner-occupied homes, only 11 properties enrolled in LOOP out of more than 700 that tripled in value. Participation was also especially low in Strawberry Mansion and Allegheny West.

Pew points out that rates of participation in LOOP are likely lower than they could be. It is likely that many eligible residents still don’t know the program is available. High participation in South Philly and Fishtown is likely correlated to the reality that these parts of the city continue to experience the most intense increases in property values. One shortcoming of the data Pew based its analysis on is that the city only provided information about how many residential properties tripled in value overall, not which of these were owner-occupied properties, or those more specifically eligible for LOOP participation.

A previous Pew report found that the initiative had actually dumped more of the overall tax burden onto residential properties while lightening the load for commercial properties. The city had initially planned to use AVI as the starting point for yearly assessments of every property. But partially thanks to delays at the Board of Revision of Taxes, which processes assessment appeals, property won’t be reassessed again until 2017.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.