Murphy, N.J. lawmakers agree to raise taxes on millionaires

Democratic leaders in the legislature have resisted the tax hike since Murphy became governor, but say the pandemic changed their minds.

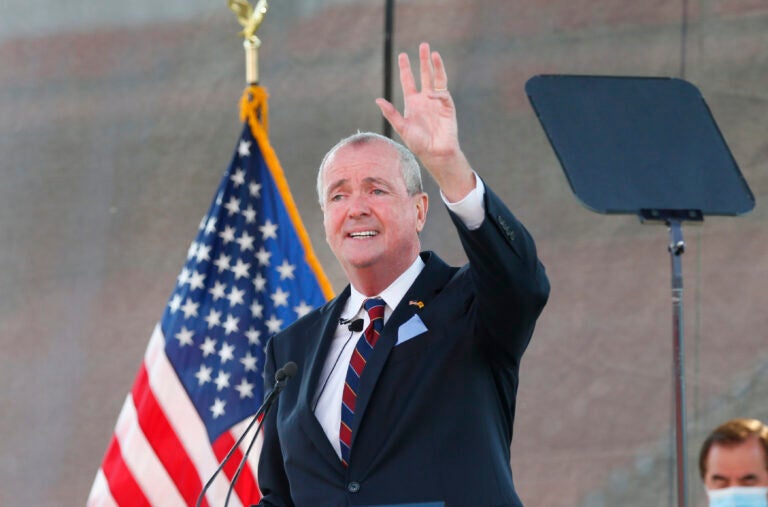

New Jersey Gov. Phil Murphy speaks to the press. (AP Photo/Noah K. Murray, File)

New Jersey millionaires are in for a tax hike.

Gov. Phil Murphy and top lawmakers in the Democrat-controlled state legislature on Thursday announced a deal to raise the income tax rate on people making more than $1 million and give $500 rebates to middle-class families.

“We do not hold any grudge at all against those who have been successful in life,” said Murphy, a former Goldman Sachs executive, who with his wife made $2.2 million in 2018 and more than that in previous years. “But in this unprecedented time when so many middle-class families and others have sacrificed so much, now is the time to ensure that the wealthiest among us are also called to sacrifice.”

Murphy had sought the so-called millionaire’s tax in his previous two budgets and has long called on wealthier residents like himself to pay their “fair share.” And even though some of the same leaders supported a millionaire’s tax back when Republican Chris Christie was governor, during Murphy’s tenure top Democrats in the legislature had balked at the idea until now. He got a partial victory when legislators agreed to increase the tax rate on those making more than $5 million.

But lawmakers who had been trying to avoid hiking taxes on millionaires said it is now the best way to offset the financial woes brought on by the coronavirus pandemic, which disproportionately impacts lower-income residents.

“I’ve vocally resisted the millionaire’s tax for years. And it wasn’t a political thing about the governor or me,” said state Sen. Pres. Steve Sweeney (D-Gloucester), who has regularly clashed with Murphy. “But the pandemic hit, and things have changed. We have to face the reality that a lot of families are hurting here.”

Republican lawmakers and business groups, which have opposed the millionaire’s tax proposal in the past, slammed the deal announced Thursday.

“Governor Murphy’s plan to raise taxes is a gift for the Florida economy and a nightmare for New Jersey,” said Assembly Minority Leader Jon Bramnick (R-Union). “Passing another ill-conceived tax will make outmigration worse and shift the tax burden onto the middle-class when others leave.”

The proposal, which is part of the nine-month fiscal year budget Murphy announced in August, would increase the income tax rate on people making between $1 million and $5 million from 8.97% to 10.75%. People who make more than $5 million already pay the higher rate.

The state treasury estimates that the millionaire’s tax could raise $390 million in the coming fiscal year.

The tax hike on millionaires will enable the state to give rebates of up to $500 to two-parent households with incomes below $150,000 and single-parent households with annual incomes below $75,000 who have at least one child. Officials said 800,000 New Jersey households would qualify for the rebate.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.

![CoronavirusPandemic_1024x512[1]](https://whyy.org/wp-content/uploads/2020/03/CoronavirusPandemic_1024x5121-300x150.jpg)