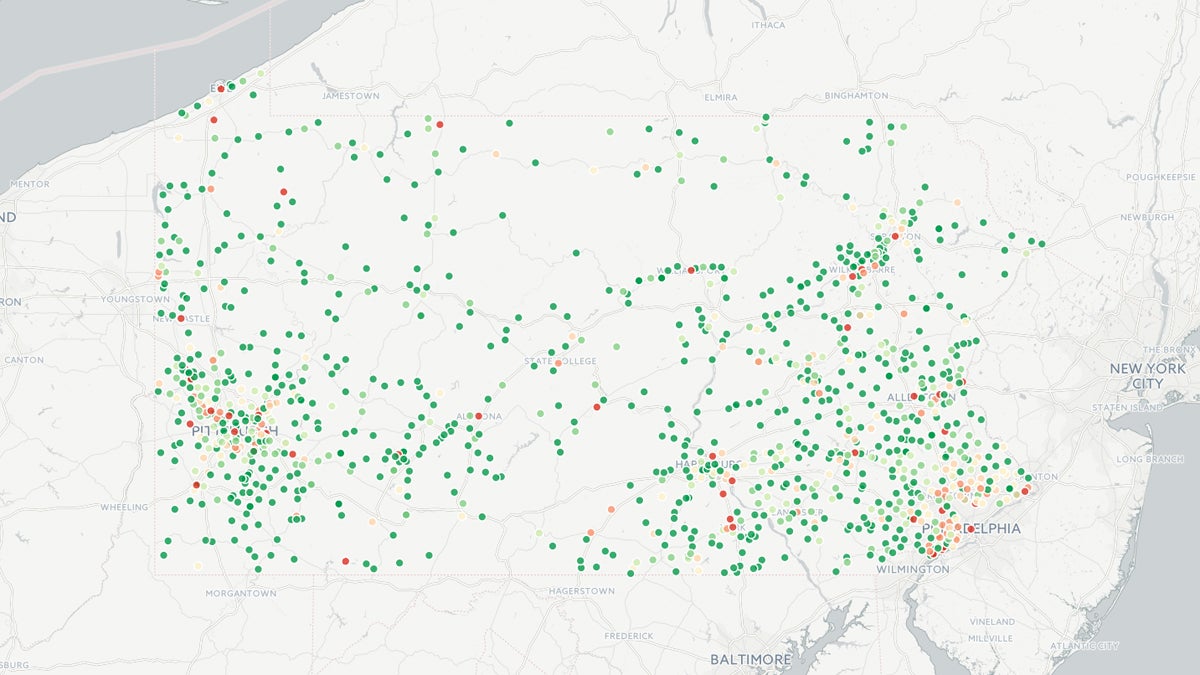

Municipal pensions burden throughout Pennsylvania

Editors note: In the map, unfunded actuarial liabilities are listed as $0 for retirement systems projected to have more than enough money to pay pensions to retirees and vested workers.

Search the map to see a municipality’s pension liability, relative to population.

Editors note: In the map, unfunded actuarial liabilities are listed as $0 for retirement systems projected to have more than enough money to pay pensions to retirees and vested workers.

About two-thirds of the Commonwealth’s defined-benefit retirement funds are on track to run dry before retirees and vested workers have been paid their pensions, according to the latest numbers from the Public Employees Retirement Commission.

Contributing factors include poor investment returns, systems fed by contributions from fewer workers than retirees receiving pensions, minimum retirement ages that have remained fixed despite increasing life expectancies, and pension payouts that are unsustainable, in excess of what the law allows, or both.

And taxpayers foot the bulk of the bill. But similarly-sized liabilities might be more manageable, split enough ways. In other words, if we look at the per capita pension obligation, are some municipalities’ burdens markedly lighter or heavier?

Keystone Crossroads crunched the numbers and found unfunded liabilities range from $1 per person (Milford, Pine Grove, Berwick, Charlestown and South Huntingdon townships) up to $3,400 per person in Philadelphia. Scranton ($1,982) and Pittsburgh ($1,584) are next. Search the map to see a municipality’s pension burden, relative to population.

Philly, Scranton and Pittsburgh also have the three highest total unfunded liabilities in the state. In other words, the cities’ populations don’t do much to ease their pension burden, relatively speaking.

The same often held true elsewhere, with 13 cities appearing the top 20 for both total and per capita unfunded actuarial liability.

Altoona, meanwhile, ranked in the 30’s for per capita pension liability ($571) despite its 13th-highest total liability.

Lancaster’s $411 per capita ranking is at 61; its total liability ranking is 16.

The city of Titusville was one that fared worse with population considered. Just 11 municipalities have unfunded pension liabilities of more than $1,000 per capita. Titusville has the fewest residents (about 5,400) and the lowest-ranking total liability (42nd) of the group.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.