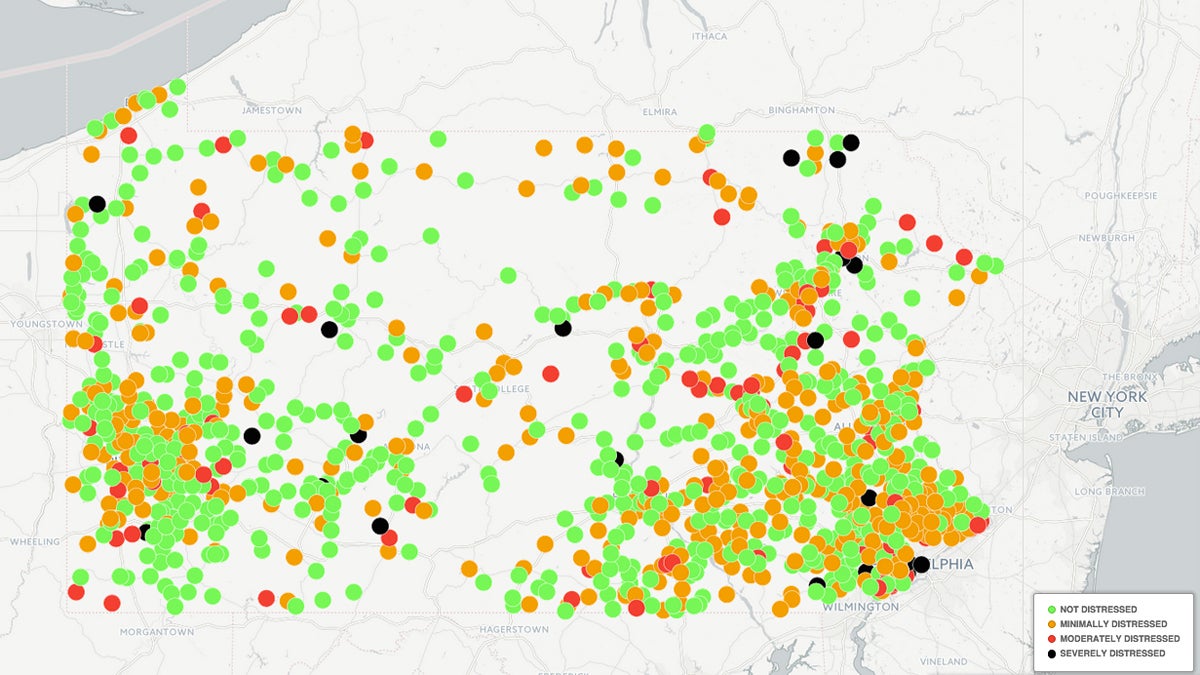

Mapping out Pennsylvania’s distressed municipal pension plans

Data Source: Pennsylvania Public Employee Retirement Commission's 2014 report.

Zoom in on the map to find the municipalities with distressed pension plans near you.

In the United States, only about 4 percent of the country’s total population live in Pennsylvania. But more than 25 percent of the nation’s public pension plans are based in the Commonwealth.

Of those local governments that have municipal pension plans, nearly half are considered “distressed” by the state Auditor General’s office.

“Distressed,” by the state’s standards, means that the municipality is projected to run out of money before paying pensions already promised to public employees. The projection relies on a bunch of assumptions: rates of return on investments, employer and employee contributions, retiree longevity, etc.

Municipalities may be considered:

Severely distressed: pension liabilities are funded at less than 50 percent

Moderately distressed: liabilities are funded between 50-69 percent

Minimally distressed: liabilities are funded between 70-89 percent

Not distressed: liabilities are funded are at 90 percent or greater

Zoom in on the map above to find the municipalities with distressed pension plans near you. The map was compiled based on reports from the Pennsylvania Public Employee Retirement Commission’s 2014 report.

The map shows 1,200 municipalities and their local pension distress, in some cases combining the public safety and non-uniform worker pension funds that are managed separately but partly funded by the same group of taxpayers.

It includes more than 2,200 defined benefit plans, not the 800 or so defined contribution plans.

It does not reflect pension funds for municipal entities serving multiple jurisdictions. Statewide, 120 of those have pension funds—85 of which weren’t distressed as of January 2013, the most recent data available.

It also does not reflect liability for the statewide retirement systems for teachers and state workers.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.