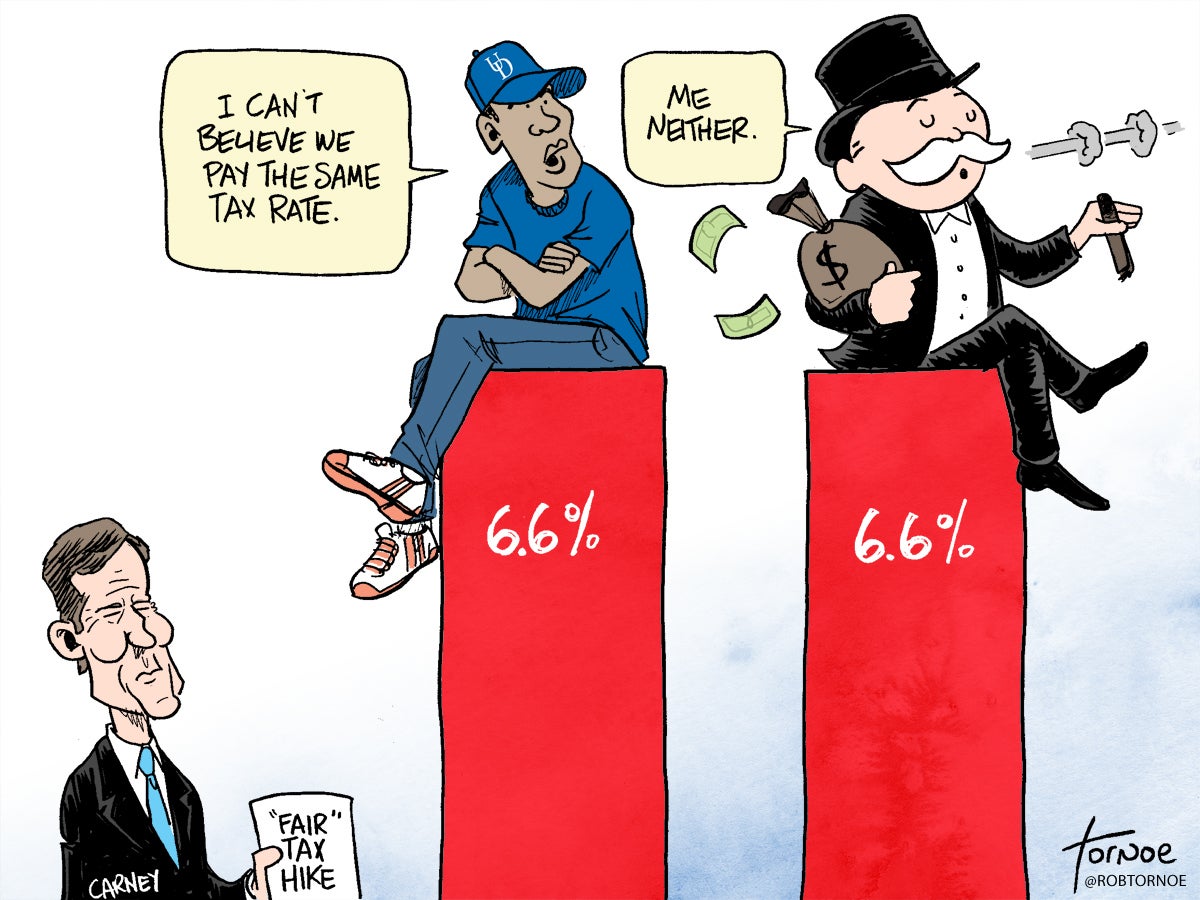

The Tornoe Spin: Delaware’s stupid, no-good, unfair tax code

Let me say this as technically and astutely as I possibly can – Delaware’s tax code is stupid.

We’ve been hearing a lot about taxes ever since Gov. John Carney proposed raising them on just about everyone to help plug his massive (and constantly growing) $395 million budget deficit.

Carney’s plan, which the legislature may or may not take up, would spread the burden across everyone, in all sectors of Delaware life. State workers would get dinged. Funding for schools would be cut. Cigarette smokers would pay more. Seniors would lose their break on property taxes.

You get the picture.

Frankly, I largely agree with Carney’s strategy to spread the pain as far and as thin as he can, even if it ends up pissing off a number of constituents. I have a few minor quibbles about his plan, but where the governor and I really differ is on income taxes.

Carney’s plan on income taxes isn’t all bad. He’d double the standard deduction (which helps lower income people) while cutting itemized deductions (which benefits some middle income earners, but mostly benefits the wealthy).

What bothers me is any lack of ambition dealing with the biggest problem in our tax code – the top income tax bracket.

Currently, our tax code defines “wealthy” earners as anyone earning more than $60,000 a year. Seems small, does’t it? That’s because in 2015, Delaware’s household median income was just $61,000. So either half of Delawareans are in the 1 percent and never knew it, or we have a problem with how we define and tax rich people.

So basically, someone earning $60,000 a year pays the same tax rate as someone who earns $400,000 a year.

For the record, I don’t think we need to tax the wealthy more as some form of punishment, or because I hate rich people (except the so-called “Real Housewives”), or any of the other hundreds of straw-man arguments I see made every day on Fox News. I think we need to tax wealth properly because it harms our economy the least. Taxing poor people more is the silliest economic argument one can make, considering lower income earners tend to put nearly all their earnings right back into the economy, rightly or wrongly.

Our neighbors understand this. New Jersey’s highest tax bracket is $500,000, while Maryland defines the wealthy as anyone earning $250,000 or mote.

Many critics of raising taxes on the wealthy point out that Pennsylvania’s tax rate is just 3.7 percent, compared to 6.6 percent for top earners in Delaware. They claim raising taxes on the wealthy even more would cause them to flee to Pennsylvania.

I say two things to that. First, when did we decide to start treating the most successful people in our society as delicate tulips that needed to be coddled and protected?

And secondly, I doubt prideful Delawareans who have benefited from living in our great state will suddenly jump ship and go through the trouble of selling their estates to move across the border, where they’ll be eaten alive by Pennsylvania’s much-higher property taxes.

So I think the solution is very simple – Carney should propose a new tax code that taxes income at the top more fairly and in the most economic viable sense as possible.

Though sense- as I’ve often pointed out- is often left out of the equation in Legislative Hall. Gas tax increase anyone?

—-

Rob Tornoe is a cartoonist and a WHYY contributor. Follow Rob on Twitter @RobTornoe

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.