‘Brazen lie after brazen lie’: Unraveling $9M pandemic relief scam masterminded by Delaware tax adviser

The 43-year-old man leased a flashy McLaren sports car while preparing bogus documents for 62 shell companies. He reaped $1.3 million himself.

Listen 1:51

Jady Solano often parked his leased McLaren sports car in front of his tax office on Maryland Avenue on Wilmington's outskirts. (Google Maps)

What are journalists missing from the state of Delaware? What would you most like WHYY News to cover? Let us know.

Jady Solano appeared to be rolling at the height of the COVID-19 pandemic.

Solano drove a bright green luxury McLaren sports car that he often parked in front of Rocket Income Tax, the business he ran from an old house in a rundown stretch of Maryland Avenue on Wilmington’s outskirts.

A few miles away, Solano lived with his wife and young son in a comfortable brick home.

Solano’s entrepreneurial spirit also drove him to start an e-commerce company and a social media marketing company.

All that time, however, the man everybody called “Jay” was committing a massive fraud.

In 2021, as the coronavirus ravaged through Delaware and the world, Solano began orchestrating what mushroomed into a $9.1 million ripoff of the federal government.

Solano’s victim was the nearly $1 trillion Paycheck Protection Program that helped businesses avoid layoffs while they shut down or limited operations and customers to prevent the spread of the deadly virus.

Under the pandemic relief initiative known as PPP, businesses with fewer than 500 employees could apply for a loan of up to 2.5 times their monthly payroll.

Using a Facebook group called New Beginnings Credit, Solano and a Michigan man named Carl Lawrence, who prosecutors called his “lieutenant,” recruited people across the country who owned shell companies — but had no employees — to participate in the audacious scam.

Solano filed hundreds of false documents on their behalf, taking a minimum of 10% of the loan proceeds, directed them in how to write checks to bogus employees and even helped them apply for loan forgiveness, according to hundreds of pages of court documents reviewed by WHYY News.

Solano personally received $1.3 million of the $9.1 million, including loans he obtained for two of his own shell companies — Accounting and Tax Partners Inc. and Solano Auto Transport LLC. That’s how he could afford to lease the McLaren that looked so out of place in the parking lot of the tax office.

Solano, 43, and Lawrence, 48, have pleaded guilty in U.S. District Court in Wilmington to running the wide-ranging bank fraud, wire fraud and money laundering conspiracy. Solano was sentenced last month to six years, eight months behind bars, and Lawrence is scheduled to be sentenced in October.

Six other defendants whose shell companies allegedly received hundreds of thousands of dollars from the programs, have also been indicted. They live in Pennsylvania, New Jersey, Oregon, Florida and South Carolina.

One of them, Shatoya Moss, a New Jersey resident, was sentenced in June to 18 months in prison. Moss got $285,000 for two shell companies, 101 Properties LLC and Eastern Global Nonprofit, and helped two New York residents, who were not charged, fleece taxpayers of another $292,000.

Federal authorities in Delaware would not agree to be interviewed about the cases because some remain pending. But Julianne Murray, Delaware’s acting U.S. attorney, said in a statement that “American taxpayers work hard for their money. And we will work hard to ensure that, when taxpayer money is misused—through waste, fraud, or abuse — the wrongdoers are brought to justice.”

William J. DelBagno, who heads the FBI’s Baltimore office that oversees Delaware, condemned Solano’ actions.

“Sixty-two times — over and over and over again — Solano fabricated, embellished and lied to steal millions from the government and ultimately, every taxpaying citizen. Now he will pay for each of those lies with this lengthy sentence,” DelBagno said in a written statement.

New York attorney Todd Spodek, who represented Solano, said that while his client’s network was the largest that originated in Delaware, it was one of dozens nationwide that stole billions of dollars from the U.S. Treasury during the pandemic.

Spodek speculated that his client “kind of lost his mind” while concocting and then continuing a scheme that the attorney said was destined to be uncovered by authorities.

“There were 62 loans processed and they were across the board all fictitious,’’ Spodek said. “There were no legitimate loans. So eventually, there was going to be some scrutiny that the employees don’t exist, the tax documents don’t exist.”

‘$500 upfront to prepare the docs, and 10% of the loan amount’

Court documents filed by Assistant U.S. Attorney Ben Wallace revealed how Solano’s flim-flam worked by describing how he helped a woman steal from the program.

The woman, identified only as Business Owner 1, was introduced to Solano through the Facebook group, and asked him for help getting pandemic relief money. The woman communicated with Solano through Facebook Messenger, and later shared the exchanges with prosecutors.

When the woman said she was seeking $50,000 to $100,000, Solana replied that to “get 100K,’’ she should list a monthly payroll of $45,000 and include employees’ names on tax documents.

Asked how much he charged for preparing applications, Solano responded: “$500 upfront to prepare the docs, and 10% of the loan amount.”

Days later, the woman said she wanted to get $140,000 and Solano replied that he would “try for around that amount.’’

He never asked her how many employees she had or to produce records to document them. Indeed, like all recipients, the woman had no employees.

Solano ultimately filed an application with a bank that was authorized to provide PPP loans. The filing listed eight employees and a monthly payroll of $56,509. The loan amount sought was $141,272.50 — 2.5 times the fictitious payroll amount.

The application included a bogus Internal Revenue Service form for 2019 that was used to substantiate the purported payroll. Authorities said the form’s metadata showed that it was actually created in March 2021, on the day the application was submitted to the bank.

The bank granted the loan and Solano instructed the woman to wire him $14,627 — a fee equal to 10% of the loan plus $500, prosecutor Wallace wrote.

Recipients also were instructed to “falsely mark the payment as being for ‘tax’” or “bookkeeping’’ and to split it into pieces and send it to multiple accounts Solano controlled.

‘Each week give them a check under your business name.’

Wallace also documented instances where Solano or Lawrence instructed people with shell companies to change dates on bogus documents.

In one case, the business provided a form showing it had been incorporated in 2021 but Solano pointed out that it could not have been paying employees in 2020. So, Lawrence altered the form to claim that the company was formed in 2011, court records showed.

After applicants received loans, Solano “coached them on how to make it look like they were using the funds to pay employees when they were not, in fact, doing so,” Wallace wrote.

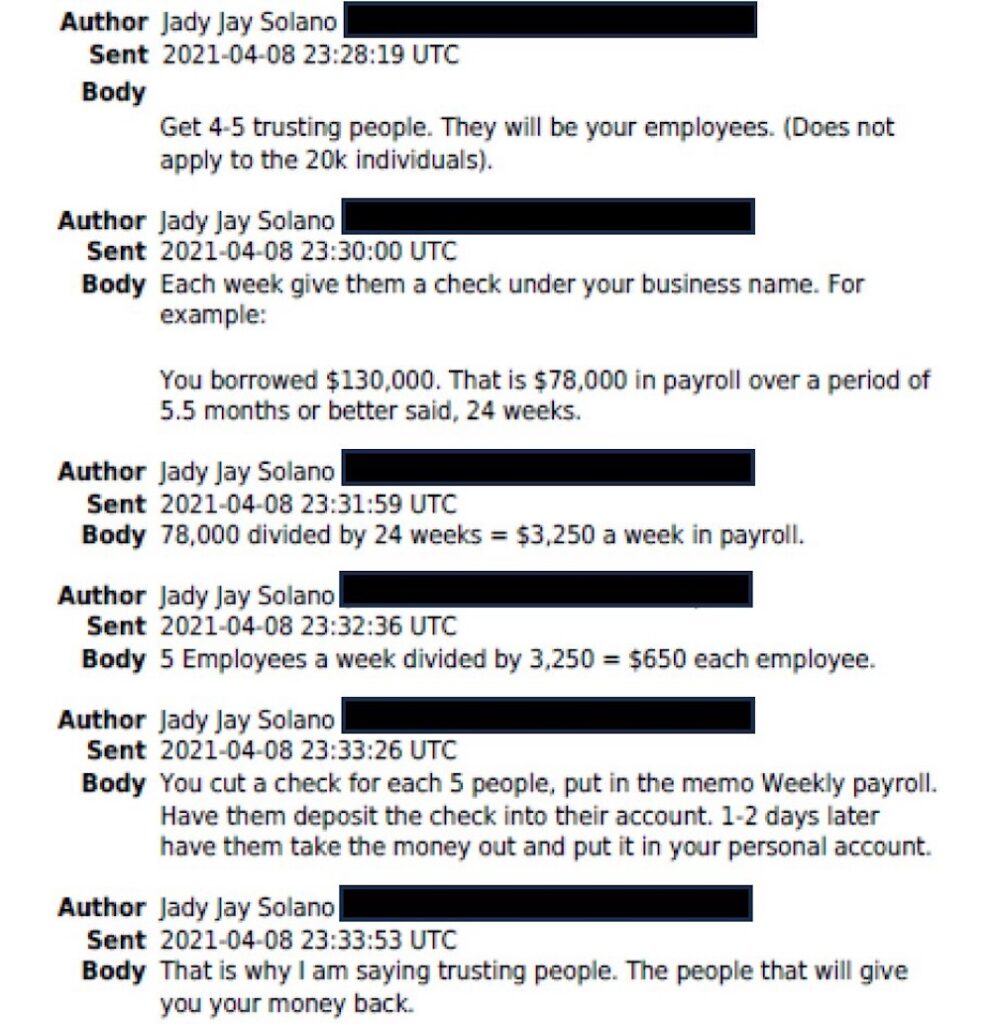

For example, in one message to a group of recipients, he urged them to “get 4-5 trusting people. They will be your employees.”

In another message, he wrote: “Each week give them a check under your business name.”

He later urged recipients to have the bogus employees deposit the money into their personal accounts, then return it within days. “That is why I am saying trusting people,’’ Solano wrote. “The people who will give you your money back.”

Most of the recipients sought and received loans under $150,000, which served another purpose that attracted scammers to the scheme.

The PPP had a provision that let recipients receive loan forgiveness if they spent at least 60% on payroll. If the loan was under $150,000, they didn’t have to provide documentation to have the loan forgiven. Solano also helped recipients prepare the paperwork to seek forgiveness, Wallace wrote.

“Solano told brazen lie after brazen lie,’’ Wallace wrote in his sentencing memo last month. “He lied every time he pulled a payroll figure out of thin air for inclusion in a loan application. He lied every time he created a false tax form in support of one of those applications.”

“Worse still, the millions that Solano and his co-conspirators stole were disaster-relief funds—money that was meant to keep bread on the table for millions of Americans during a deadly pandemic.”

Solano, who has no previous criminal history, pleaded guilty less than three months after he was charged in July 2024 and apologized profusely at his sentencing.

“I did something reprehensible, for which there is no excuse or justification,’’ he told U.S. District Court Judge Jennifer Hall. “I diverted money that was intended for Americans, who worked for small businesses, during a time of unprecedented crisis in this nation’s history.”

“I lined my own pockets with this money, and my deliberate efforts were responsible for lining the pockets of people who were also undeserving of this money. I knew what I was doing was illegal and morally wrong, but that did not stop me.”

Spodek questioned why the Trump and then Biden administrations didn’t have systems in place to identify fraudulent applications but acknowledged that the government’s lax approval process didn’t absolve Solano for his greed and opportunism.

“What I think happened is that he made one mistake and it worked,” Spodek said. “And then it was just like a sequence of events that kind of was on autopilot, like he wasn’t actually thinking.

“Because if you took a second and stepped back, you would know that you’re going to eventually get caught.”

This story was supported by a statehouse coverage grant from the Corporation for Public Broadcasting.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.