Capitol recap: payments in lieu of taxes to schools doubled over past two decades

Keystone Crossroads analyzed two decades of financial data starting in 1993 for school districts across the Commonwealth, focusing on payments in lieu of taxes by nonprofits – the subject of a statewide campaign by Pennsylvania’s Auditor General Eugene DePasquale.

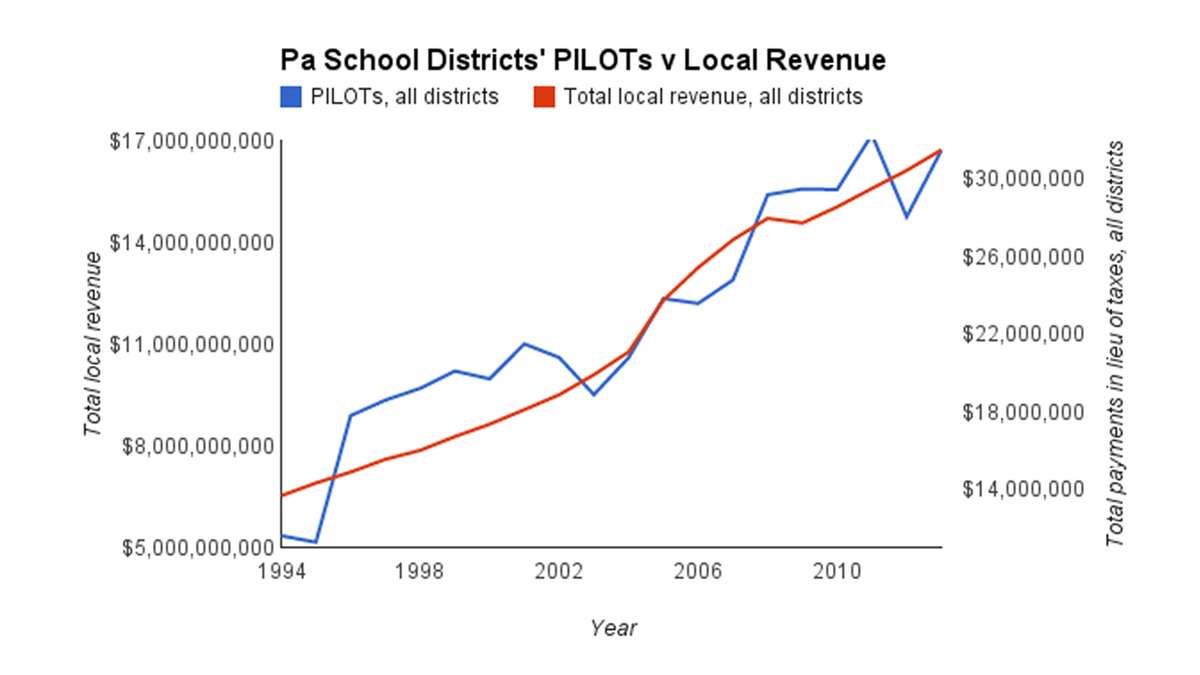

Growth of total payments in lieu of taxes to schools statewide during the past couple of decades has outpaced all local revenue sources.

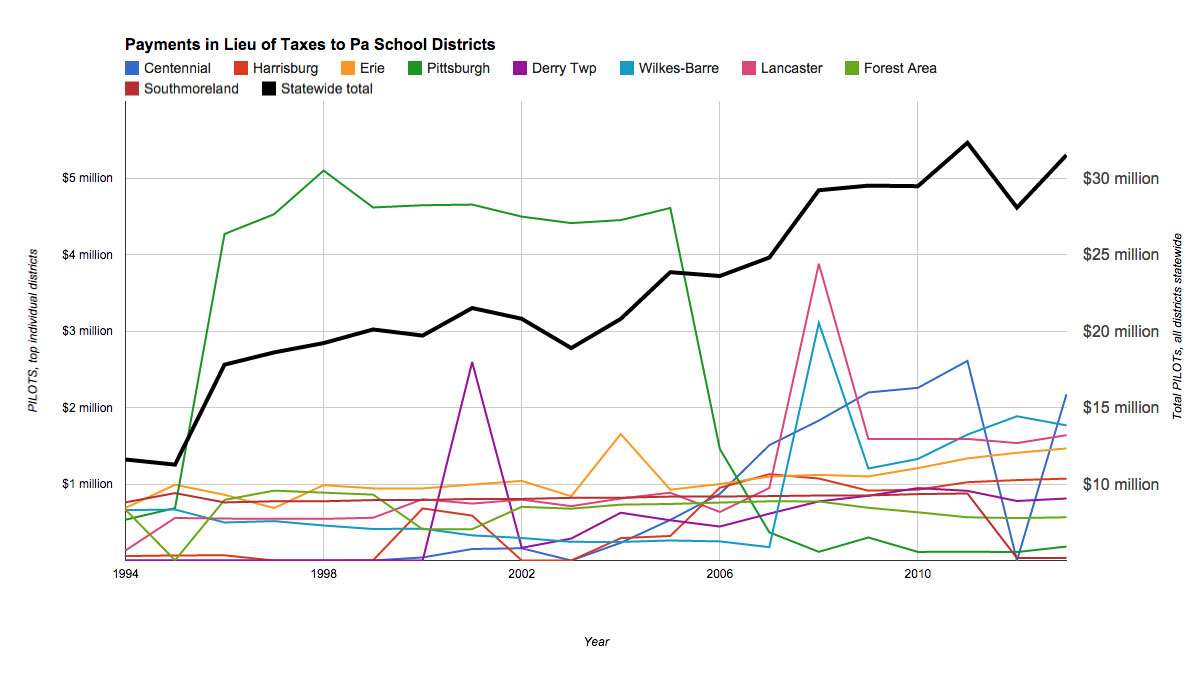

But that’s not necessarily the case for the individual districts getting the biggest PILOTs, the voluntary agreements made to by nonprofits exempt from property taxes to public bodies like schools and municipal governments.

And not all school districts are equally reliant on them.

Keystone Crossroads crunched the state Department of Education data as the state Auditor General’s office holds a statewide meeting series this month on purely public charities and tax exemption.

The public sessions are being held to educate people in anticipation of a voter referendum seeking to elevate the General Assembly’s authority above other government branches when it comes to determining which entities should be considered charitable – and, therefore, allowed to skip paying property taxes.

Legislative explanation

Officials with Pittsburgh School District, which had gotten the highest PILOTs by far for years, attribute the decline there to state laws dealing with tax exemption.

Pittsburgh School District Solicitor Ira Weiss attributes that to Pennsylvania’s Act 55 of 1997. “That ended any ability of taxing bodies to exert any leverage on the large nonprofits.” Weiss says.

State lawmakers say Act 55 codified the HUP test, so-called for the state Supreme Court Hospital Utilization Project v. Commonwealth case that set out a five-part list of considerations to determine charitable status.

Weiss characterized that description as “a gross exaggeration,” and says it enabled bigger nonprofits to more easily get out of paying taxes.

Pittsburgh schools consistently got the biggest PILOTs of all 500 Pennsylvania districts – between $4 million and $5 million – starting in 1996, according to Keystone Crossroads analysis of PDE data.

Act 55 went through the following year, but it took nearly a decade for PILOTs to Pittsburgh schools to taper off. That’s because the nonprofits were locked into 10-year contracts, which none of them renewed, Weiss says.

Since 2008, Pittsburgh’s PILOTs have totaled between $100,000 and $300,000 – as little of 2 percent of the total during peak years.

University of Pittsburgh Medical Center, which alone gave $1.5 million, has since launched the Pittsburgh Promise program expected to provide $10 million of post-secondary tuition aid to city public high school graduates annually for 10 years.

Pressure still applies

An analysis of data by Keystone Crossroads shows that Wilkes-Barre often cracked the top 10 list of Pennsylvania public school districts getting PILOT money. Along with Blue Cross Blue Shield, Mohegan Sun Pocono casino is a major contributor to Wilkes-Barre’s total PILOT.

The company agreed to pay $1.5 million per year in PILOTs, rather than take its chances before a judge hearing the challenge initially filed prior to the inception of casino gaming in Pennsylvania in 2006, when the property was owned by Pocono Downs racetrack, according to school Solicitor Ray Wendolowski. The track remains, now adjacent to a spa, 238-room hotel, convention center and 82,000-square-feet casino – the first in the Commonwealth to have slots and, when approved by state lawmakers in 2010, table games.

Several other districts have similar deals in place.

After battling in court for the better part of a decade, PECO pledged $1.5 million or more per year to Spring Ford area School District in Montgomery County. Ann’s Choice, a retirement community in Warminster Township, Bucks County, pays the same amount to Centennial School District.

Balancing tax-breaks – if temporarily?

School districts miss tax revenue in other ways, too. That happens when properties are subject to tax breaks meant to entice corporate investment.

Redevelopment authorities sometimes incentivize companies by leasing authority-owned land to them, eliminating the up-front cost of buying the property. Authorities also are tax exempt, saving the company even more money.

That’s worked out so far for Derry Township schools. Along with Hershey Medical Center, the Giant Center arena is a major contributor relatively high PILOT: both total and relative (3 percent) amounts.

A similar agreement was benefiting Southmoreland School District in Westmoreland County, too – until 2010.

Sony closed its East Huntingdon Township site rather than exercise its option to purchase, under a 10-year lease agreement with the Regional Industrial Development Corporation of Southwestern Pennsylvania.

The district’s PILOT plummeted from $876,000 to just over $30,000.

Pennsbury and Harrisburg districts meanwhile get PILOTs from owners of real estate in Keystone Opportunity Zones, where properties aren’t fully taxed on value-increasing improvements for a decade.

It’s all relative

The federal Department of the Interior also pays municipalities that host national parks and protected land.

Forest, Kane and Warren area school districts get the most money— between $200,000 and $800,000 annually each—that way, Department of Education data show.

These districts also consistently ranked in the top 20 for PILOT amounts, and the top five or 10 for PILOTs as a percentage of local revenue (theirs made up between 5 and 29 percent in any given year), the data analysis shows.

During the years Southmoreland got money from Sony, its PILOTs accounted for between 9 and 13 percent of local revenues; without that, it’s about 2 percent.

That’s certainly less, but still relatively high compared to most Pennsylvania districts.

Harrisburg, Pennsbury, Wilkes-Barre and Pittsburgh (during its peak) PILOTs also account for about 2 percent of local revenues.

Those percentages might seem small, but they ranked in the top 10 or 20.

Erie and Lancaster school districts get about 2 or 3 percent of their local revenues from PILOTs, too. Erie’s has grown consistently from $670,000 to $1.6 million since 1994, most of it from city hospitals, according to district spokesman Mike Cummings.

Lancaster General Hospital $1 million or so payment has made up the bulk of PILOTs to city schools in Lancaster since 2001.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.