When calculating care costs, online estimators can fall short

Listen

Under their insurance plan

When making any purchase, the responsible thing to do is check the price first. But when it comes to figuring out the price of a medical procedure before going under the knife, that cost might be harder to determine than just finding the price tag.

That quest for such information has led to the emergence of all types of cost estimator tools for consumers. But as one couple has found, finding accurate costs amid a system that has historically hidden prices is proving to be a challenge.

One couple’s uphill quest

This story begins with a couple who was recently thrown into the thick of that dilemma. Kate and Scott Savett live about an hour north of Philadelphia with their pug, Frankie. Scott is a chemist and designs software for labs, and Kate works in life insurance, which she jokes is “just as exciting as it sounds.”

The couple hadn’t used their insurance much, but that all changed this year.

“For me it’s been relatively minor stuff, but certainly the costs do add up,” Scott, 43, said. “For Kate…”

For Kate, 37, it hasn’t been minor stuff. She was diagnosed with multiple sclerosis in January, after she started having trouble feeling certain parts of her body. The doctors figured out what was going on pretty quickly because of all of the symptoms she displayed with her first attack.

But they did have to do a lot of tests. And then follow-up tests. On top of that, Scott needed some imaging tests for a spinal issue.

Under their insurance plan, the two have to pay in full for the first $3,000 of their combined care. After that, they still have to pay 20 percent of the cost, until they reach a total of $8,000 in out of pocket expenses.

That experience made them want to find the best care for the best deal. But how?

They did some investigating, using a cost estimator offered through their insurance.

Scott logs in to the tool and searches a procedure — an MRI scan — and the tool cranks out the average cost in the area, the lowest cost, and the highest.

In one example, the average cost was $1,270; the lowest was $512 and the above average was deemed to be $1,790.

The tool then produced a list of different providers, and an estimate of how much they will specifically charge under his plan.

At first, the cost calculator seemed great. But it quickly proved to be quite the headache.

A few days before Kate was scheduled to have her first MRI, the couple got a call from the provider saying that it would cost them $2,400. They were shocked — the cost calculator told them it would only be about $500.

So, where is the disconnect?

They recall being told from the facility that a hospital had bought them, and the prices had all gone up. That change hadn’t been reflected in the estimator.

That wasn’t the only time they were misquoted for procedures. In several instances, which they learned the hard way after receiving a bill, the estimate was off by more than $1,000. Once, they couldn’t find any listings for the procedure they were looking for.

They quickly plowed through their $3,000 deductible. Financial planning became increasingly difficult. They pushed back buying a new water heater for their house.

“It’s hard for us to pull the trigger on that knowing that another bill could be coming around the corner,” Kate says.

The rise of estimator tools

It’s unclear how common these inaccuracies with estimator tools are, but such products are becoming more popular as more people are shouldering the cost of their care. Outside companies are developing them, and most insurers offer them.

“Each one of them, whether it’s Aetna, United, Cigna, they all have something,” says Francois de Brantes, the director of the Health Care Incentives Improvement Institute, a non profit based in Connecticut that’s focused on improving the quality of care.

De Brantes has been paying close attention to price transparency tools. They’re really hit or miss, he explains.

“There’s lots and lots of variability in the information that’s provided to consumers,” he says.

Some of the estimators reflect an aggregate range of possible costs, some are based on historic pricing or claims data from varying sources. Many, he says, are also limited in what procedures they include. And as reflected in Scott and Kate’s experience, tools may struggle to keep up with a fast-changing health care ecosystem.

As for UHC’s cost estimator, which Scott and Kate used, Craig Hankins of UnitedHealthcare gives it an eight out of 10 in terms of accuracy. But he says that there is room for improvement.

“Right now, I would say if we look at our tool relative to others that are offered, I would say ours is average, if not above average in terms of breadth of services as well as accuracy,” he says.

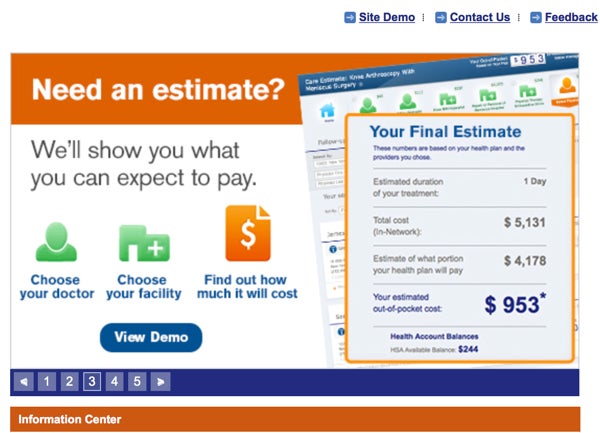

Their cost calculator was launched in 2012, and is based on their actual payment agreements with doctors and hospitals. It’s updated regularly because, Hankins says, it’s in UnitedHealthcare’s interest that it works. If members get care at an acceptable cost, it saves everyone money.

Hankins, who oversees UniteHealthcare’s digital services, says the tool has its limitations — it’s hard to predict what a doctor will actually do and how they will bill for it.

For David Newman, director of the nonprofit Health Care Cost Institute in Washington D.C., which is using lots of claims data shared with them from UnitedHealthcare and other insurers to create a searchable database of average health care prices for certain services, that gets at a deeper challenge with estimators: the way billing and reimbursements work in health care is extremely complicated.

There are 8,000 procedure codes, tens of thousands of diagnostic codes, a million different providers, and hundreds of insurance companies, says Newman. Even a straightforward MRI has several variables, including the type and use of dye, not to mention the additional interpretation fees.

Newman sees the biggest challenge in that calculators are often based on one specific procedure, so they may not reflect all that happens and is billed for during a visit.

In that way, “this is going to be probably as good as it gets,” he says.

While a review of state mandated cost estimators by insurers in Massachusetts did not focus on accuracy, it found that they weren’t easy to use.

“Their grades were pretty poor, C’s and D’s were frequent,” says Margo Michaels, director of consumer engagement with the consumer advocacy group, Massachusetts Health Care for All.

Michaels cautions that consumers need more information than price alone when deciding on where to go for a procedure. Quality is just as important, so successful tools need to incorporate both.

Moving toward transparency

Coming up with an accurate tool may seem like a really big task, but de Brantes, with the Connecticut based nonprofit, thinks it shouldn’t be brain surgery.

“It’s not that difficult. It really technologically is not that difficult at all,” he says.

The information that people like Kate and Scott are seeking exists in the health care system, even if in some cases it is hidden behind contract agreements. The bigger problem, de Brantes says, is that there is no internal pressure to make it work. Health care has thrived in an opaque environment where costs are hard to find, so who would want to shake that up?

“Right now, there’s still this reticence, this fear that it’s too disruptive. There are going to be too many unintended consequences — meaning networks are going to blow up, people are going to be unhappy,” he says.

Outside entities, though, are starting to move the needle, according to de Brantes. Employers that manage the costs of their group health plans are turning to new kinds of tools to help their employees choose a better-value option.

“There’s a reason why Castlight ended up being valued at $2 billion, which is an outrageous amount of money,” he says, referring to a company that works with employers.

Plus, there are several states that mandate public reporting of price information.

All of this has de Brantes and others feeling hopeful about the future. Michaels says insurers in Massachusetts have pledged to make improvements.

“The train has left the station,” says de Brantes, though he doesn’t expect big changes overnight.

The emergence of a new kind of health care consumer

As for Scott and Kate Savett, the current climate has turned them into a new breed of health care consumer: a savvy one.

Kate Savett says scheduling treatments will be a way of life for her now, but she’s trying not to lose perspective. Cost was the last thing on her mind last winter, when she suddenly couldn’t move her right hand. When her legs went numb.

“I actually think it has made me grateful for the health that I’m enjoying when I don’t have a flair-up,” she says.

As for her husband, he knows they’re now nearing their $8,000 out of pocket cap, which means insurance will soon cover the entire cost of their care. But he doesn’t want to give in. He wants to see improvements.

“I would rather crawl to that $8,000 cap than sprint to it, he says. “I’d rather get their slowly, I know we’re going to get there this year, unfortunately, but to blow it all in an MRI that’s excessively priced rubs me the wrong way.”

He realizes someone is going to pay for it, perhaps in the form of higher insurance premiums in the future.

*Bonus chapter: Scott’s latest MRI*

In prepping for his most recent MRI, Scott Savett didn’t put his trust in the estimator tool for where to go. But he did review some of the listed costs for different providers. He also factored in the type of MRI he wanted, direct calls to facilities, and knowledge about billing practices from previous experiences with certain providers. The place he decided on was listed in the tool as $1,100, though he was not able to confirm that with the facility.

“That’s what the cost estimator says, but who knows,” he says. “Roll the dice!”

A few weeks later, Savett received the bill. Turns out, it was pretty close to what the estimator had predicted it would be. He says in that way, these tools are a starting point. But just that. They may offer clues into what a procedure will cost, but his overall experience and frustrations reminds him that they can be really murky, imperfect ones, and just part of what’s involved when it comes to navigating through the mysteries of health care.

UnitedHealthcare has offered members a cost estimator tool since 2012. (Elana Gordon/WHYY)

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.