Wolf OKs tax credits to preserve $100 milion in Pa. scholarships

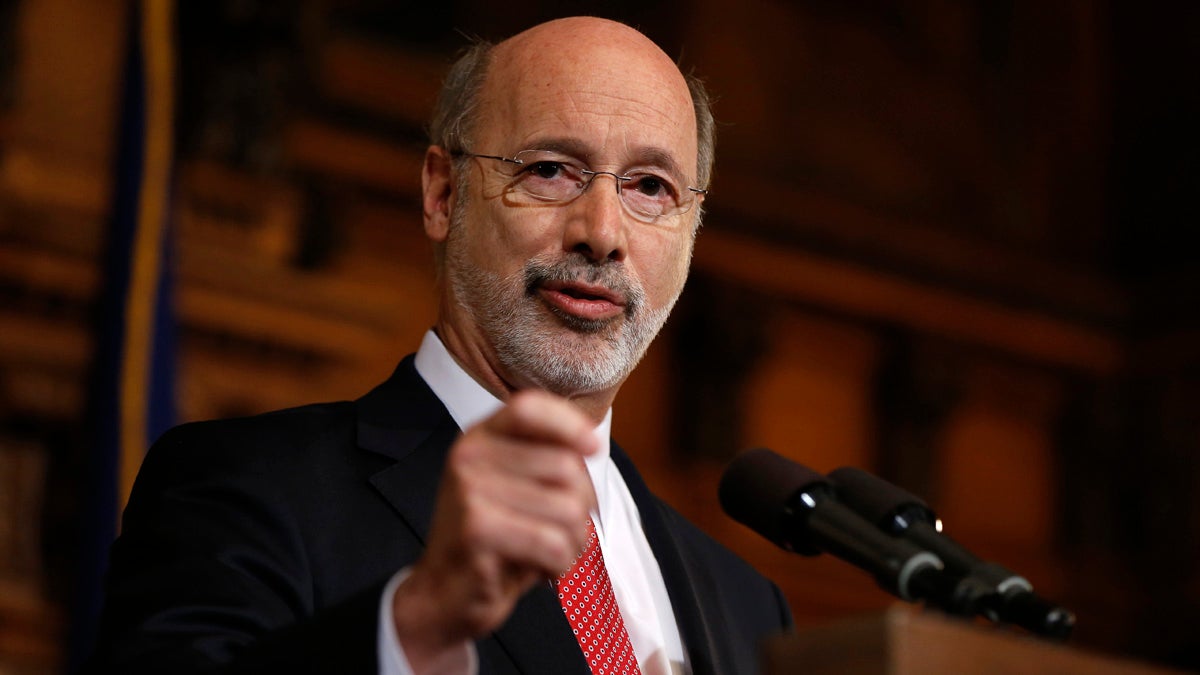

Pennsylvania Gov. Tom Wolf answers questions about his partial approval of a state budget Tuesday at the state Capitol in Harrisburg. Wolf rejected parts of a $30.3 billion state budget plan that's already a record six months overdue, but he's freed up more than $23 billion in emergency funding. (AP Photo/Matt Rourke

Thousands of Pennsylvania students who rely on scholarships through tax credit programs have gotten a last-minute gift from Gov. Tom Wolf.

Wolf has authorized $100 million in tax credits for businesses that fund scholarships across the state — aid that was at risk of disappearing completely if not approved by the end of the year.

On Christmas Eve, Wolf released approximately 3,000 conditional approval letters for the tax credits. Those letters became official Wednesday, and the credits were authorized when the governor signed parts of the 2015-16 budget Tuesday.

Businesses earn the credits when they fund K-12 scholarships for low-income students to attend private or parochial schools,

Schools and organizations have been lobbying for the release of the tax credits ahead of a finalized budget.

Because of the half-year budget impasse, the Wolf administration had said it could not OK the credits — forcing corporations facing a Dec. 31 deadline to earn a credit for 2015 into a quandary.

“The impasse went on longer than anyone expected,” said Jeffrey Sheridan, Wolf’s press secretary. “Because the Legislature had not sent us a budget as of last week, we released these letters so that people could use them for tax filing purposes. It was only conditional approval. We were not releasing the credits or authorizing the credits.”

Officials weren’t able to release the letters sooner because, without a budget, they didn’t know what the award limits were.

“The governor wanted to make sure the letters went out because the Legislature left town without finishing the job,” Sheridan said. “No one expected the Republican-controlled Legislature to make agreements about the budget and then go back on those agreements.”

The $100 million for the tax credit programs is the same amount as last year.

Ina Lipman, executive director of the Children’s Scholarship Fund Philadelphia, said she’s thrilled with the governor’s good will.

“The fact that the governor did step up and listen to last-minute pleas by our organization and others about the irreparable harm that would result, I was just grateful,” she said.

Though her organization prepared regular donors for last-minute giving, Lipman said they probably lost first-time donor applicants.

“I think that newer donors are probably most vulnerable,” Lipman said. “This is something that was supposed to be easy and simple, the tax credit program, and it became more complicated.”

Lipman, who estimated a loss of more than $1 million in newer gifts, said the scholarship fund is only halfway to its annual $10 million in year-end giving at this point.

Lipman said her organization will continue trying to change how and when tax credit letters are distributed.

“At the end of the day, you can have good legal arguments, but there’s the practical problems we have seen resulted,” she said. “We are working to get legislation through that you don’t need a state budget to go ahead and issue the letters.”

The Educational Improvement Tax Credit and Opportunity Scholarship Tax Credit programs are administered by the Department of Community and Economic Development.

Companies should get their donations in as soon as possible, Sheridan said, and the department will work with organizations to make sure they receive donations in a timely manner.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.