Two reasons why Republicans could survive their tax bill in 2018

Last week I suggested that the GOP tax "reform" law is a "suicide pact" that will snuff them in the '18 midterm elections. But today I play devil's advocate with myself.

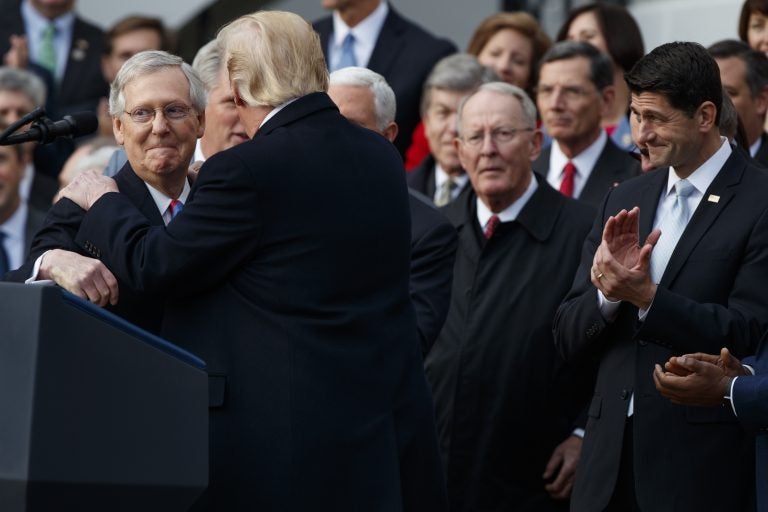

Speaker of the House Paul Ryan, R-WIs., right, applauds as President Donald Trump hugs Senate Majority Leader Mitch McConnell, R-Ky., as he speaks during an event on the South Lawn of the White House in Washington, Wednesday, Dec. 20, 2017, to acknowledge the final passage of tax overhaul legislation by Congress. (AP Photo/Evan Vucci)

One week ago I suggested that the plutocratic Republican tax “reform” law, which serves corporations and fat cats at the expense of average citizens, is a “suicide pact” that will snuff the GOP in the ’18 midterm elections. But today I plan to play devil’s advocate with myself, pitching the counter-argument for the GOP’s midterm survival.

Make no mistake, the bill that Trump inked yesterday is a predictably nasty piece of work. As I watched the Republican Visigoths celebrate their pillaging of the land and the pocketing of its riches, I was reminded of a passage from Shakespeare’s “King John,” Act IV, Scene 2: “To gild refined gold, to paint the lily … is wasteful and ridiculous excess.”

Logic suggests that they’ll pay a heavy political price for what they have wrought. So goes the current conventional wisdom, and who knows, maybe it will prove correct. In the latest national poll, registered voters favor a Democratic Congress by 56 to 38 percent — the widest margin in two decades. And support for the Republican tax law is consistently below 30 percent (here, it’s 26 percent), which means that even lots of Trumpkins dislike it. So logic suggests a Democratic tsunami next November.

But public perception is not always logical, and if we’ve learned anything in recent decades, it’s that Republicans are masters at messaging, masters at manipulating public perception.

Setting aside the Democrats’ frequent propensity for screwing things up, there are two big reasons why the GOP could even turn the tax law to political advantage, and thus retain control of both congressional chambers:

Minimal pain will be felt in 2018. The law is cleverly crafted to screw the average person in the future, circa 2027. That’s when the minimal tax cuts to the working and middle classes are set to expire; that’s when many will actually find that their taxes have been hiked. Nancy Pelosi is already talking about 2027, but, for most people, 2027 is merely an abstraction. Most people live in the here and now. They vote based on what’s in front of them, and the nonpartisan Tax Policy Center has crunched the numbers and concluded that eight in 10 Americans will pay lower taxes in 2018.

Republican messaging groups plan to hit that hard. American Action Network, which runs ads on behalf of the congressional GOP, is bullish about ballyhooing the tax law in 2018. AAN director Corey Bliss tells the press: “You know what you paid in taxes this year. You will know next year whether it’s going up or down … One party cut middle class taxes. Another party spends all their time trying to impeach the president. That’s really a nice contrast.”

Party activists always voice that kind of bravado, so maybe he’s just whistling in the dark. But, as Bliss points out, it’s about having “control over the narrative,” and for Republicans, there’s a second potential narrative:

The economy is relatively healthy. As conservative think-tanker James Pethokoukis points out, “Often in politics, it is far better to be lucky than good.” And the GOP could luck out with the economy.

Timing is everything. The economy is growing at a decent pace, and it’s projected to continue that way in 2018. Which means that Republicans could have the wind at their backs. That wouldn’t be fair, of course, since credit for the economy’s recovery from the Great Recession could easily go to the Obama administration. But voters living in the here and now tend to credit the current party in power. And whoever said life, or politics, was fair?

So, conceivably, Republicans could minimize the tax law’s political damage, and keep the House and Senate, by weaving two narrative threads into one:

“In this time of economic growth, you’re keeping more of your own money.”

Granted, this is a short-term message, but we live in a short-term messaging environment. Pethokoukis says, “Many voters might just believe the GOP line given that the upturn is happening at the same time their taxes are being cut. Correlation is good enough to assume causality.” I suppose I could dismiss his observation as cynical. But, given how human nature tends to exhibit itself in the political realm, his observation strikes me as realistic.

OK, maybe this is all wrong. Maybe the Republicans have dug themselves a hole from which there is no escape. Maybe a landslide share of voters are hip to the tax law’s plutocratic underpinnings and will sustain their anger for another 11 months. In other words, maybe people have woken up.

On the flip side — and hence my hesitance about foreseeing a blue wave in 2018 — look who they’ve put in the presidency.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.