Schwartz pushes tax incentive for investment in clean-energy innovations

U.S. Rep. Allyson Schwartz is part of a bipartisan coalition advocating legislation that would provide 30 percent tax incentives to companies that install new clean-energy technologies.

Schwartz, one of the co-sponsors who introduced the measure last week, describes the Power Efficiency and Resiliency Act bill as a way of reducing carbon emissions, reducing energy costs for business, and improving the economy, particularly in Pennsylvania.

“We’re seeing it across the country, but in Pennsylvania we have seen industries that are particularly interested,” said Schwartz, who represents the Philadelphia region. “This could really generate $3 billion or $4 billion in new investment.”

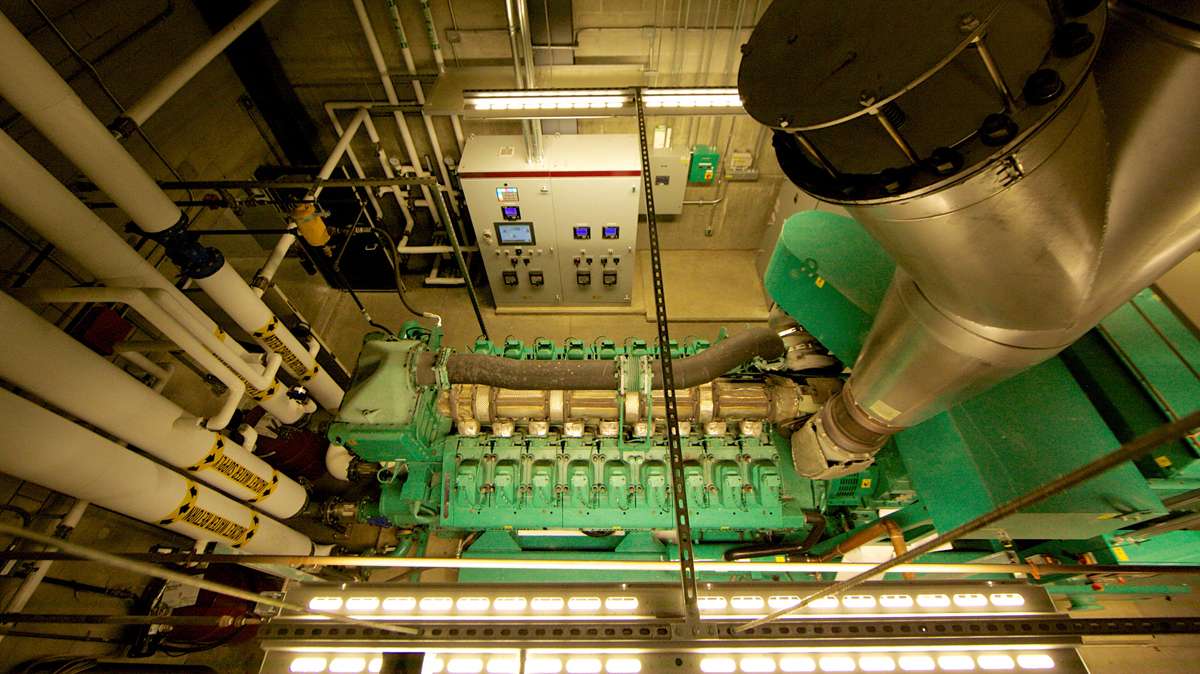

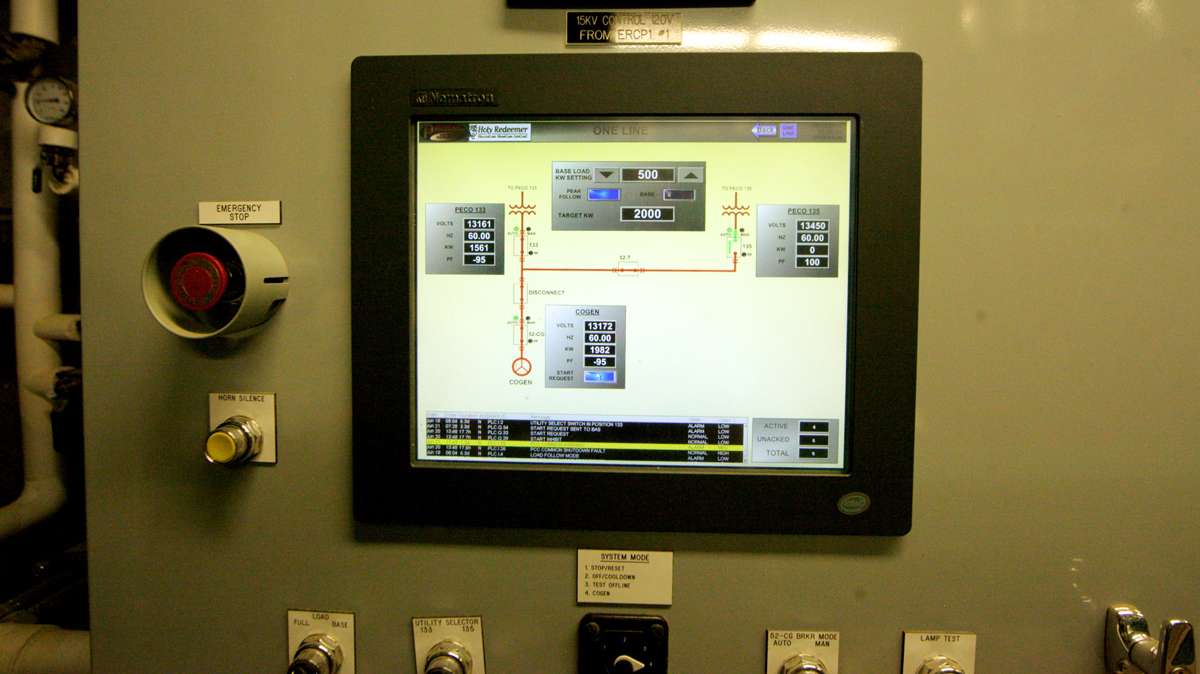

The two clean-energy technologies that would qualify for tax breaks under the new bill are Combined Heat and Power and Waste Heat to Power. The former generates electricity and heat from a singe fuel source such as natural gas; the latter collects wasted heat such as steam from industrial smoke stacks and uses it to run generators.

“The combination of natural gas and the capturing of waste heat can be very cost efficient for our many hospitals and universities, and our manufacturing base,” said Schwartz.

Currently CHP technology qualifies for only a 10 percent tax incentive, and WHP doesn’t qualify at all. Other clean-energy initiatives such as solar power are eligible for he 30 percent tax reward Schwartz is seeking.

The two technologies are expensive to install, a reason that Schwartz is proposing the increased reward. One upside of CHP and WHP is that institutions such as hospitals that incorporate it wouldn’t have to rely solely on the grid — meaning they could remain open during natural disasters that disrupt power.

“This is an opportunity to save millions of dollars in terms of the initial cost through tax credits, but then it also really does move us in the direction of lower cost energy, and energy that is off the grid in a way that really would matter in Pennsylvania and the Philadelphia area in particular,” said Schwartz.

In Pennsylvania, about 150 facilities incorporate CHP technology, said Phyllis Cuttino, the director of the Pew Charitable Trust’s Clean Energy program, and she can see many more signing up.

“Businesses are looking for a way to cut their energy costs,” said Cuttino. “In many cases, it’s the most expensive cost that they have. The bill has a lot of industry support; these companies want to invest in this technology but at the moment it’s just a little too tough for them.”

“If you can capture this waste heat and recycle it, you can reduce costs, and that’s money poured back into new machinery or worker benefits or just anything else that might benefit the company,” added Cuttino.

Despite the nation’s growing pessimism toward Congress, Cuttino said she can see a bill like this being passed.

“I have to tell you, there aren’t that many bipartisan energy bills that are currently pending in Congress, and this is a good one,” said Cuttino. “We’d really like to see Congress take this up and pass it. We think this is something the public would be interested in.”

Schwartz said she already has support from four or five House lawmakers from both sides of the aisle, something she said doesn’t usually happen very quickly with other co-sponsored bills.

“We all agree that if we can reduce carbon emissions, reduce cost for industries, and become more competitive, this is good for our state, it’s good for our economy, it’s good for growing jobs in Pennsylvania and across the country,” said Schwartz.

The Pew Charitable Trusts support WHYY.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.