Philly Saves retirement program will go to voters for approval on May ballot

The program would automatically sign people up without a company-supported retirement program and deduct 3–6% for a Roth or traditional IRA.

Listen 1:11

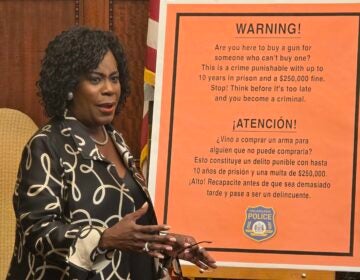

Philadelphia Mayor Cherelle Parker signs the Philly Saves bill January 20, 2026. (Tom MacDonald/WHYY)

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

Mayor Cherelle Parker signed a bill Tuesday afternoon that would let voters decide on whether to approve the Philly Saves program, which is designed to automatically enroll workers who don’t have access to a retirement program into a city-sponsored IRA.

Voters will weigh in on the idea in May.

Under Philly Saves, workers would have 3–6% of their wages automatically deducted from their paychecks and put into either a traditional or Roth IRA. They would be allowed to opt out or change their contribution at any time.

The move was applauded by elected officials and others who say it’s a way to help move people into financial independence as they age, keep them in their homes and reduce the need for financial assistance programs.

“Philly Saves would benefit not just Philadelphia’s workers, but also its businesses and taxpayers,” said John Scott of the Pew Charitable Trusts. “Philly’s employers, especially small businesses, would at no cost to them be able to attract and retain workers by providing a retirement savings program. And taxpayers would also benefit because the more people save, the less likely they will need social assistance in the future.”

An August report from Pew’s Philadelphia Research and Policy team found that the median income for older households in Philadelphia is just over $39,000, but for older Black households, it’s even lower, at $30,931.

Scott said even though some people are able to make ends meet while they are working, when they retire, they need savings to supplement their Social Security income. Without the savings, people fall behind on things such as home repairs and medical bills.

“That’s the potential of Philly Saves,” Scott said of its potential to help workers at companies that do not offer retirement programs.

Tiffany Chavous, CEO of Somerset Academy, told the story of her workers who admit how difficult it can be to think about long-term planning when life is so full and savings isn’t a priority.

“Not because they lack discipline or drive, but because many working people today are navigating complex financial demands,” she said. “Saving for the future, while important, it may not always be a priority.”

Mayor Cherelle Parker said the program is about making sure people who are retiring can afford to comfortably live their lives independently.

“While Philadelphia is attracting young adults, we have a significant population that is aging into their golden years and we want them to have economic security and self-sufficiency as well,” she said.

Council President Kenyatta Johnson said the program would help seniors be able to pay their expenses when they retire.

“Because it provides individuals an opportunity, a path with self-sufficiency, and so I’m urging Philadelphia voters to vote ‘yes’ on the Philly Saves ballot in the May 19 primary election,” he said.

To launch the program, the Philadelphia Home Rule Charter needs to be changed to allow the creation of the Philadelphia Retirement Savings Board, which would oversee the program.

Seventeen states have already set up similar programs. Philly’s version would offer a retirement program to approximately 208,000 private sector workers who don’t have an opportunity to take part in one at work.

According to AARP, more than 1 million private sector workers have enrolled in state retirement savings programs.

If the ballot question is approved, Philadelphia would be the first city to approve an automatic IRA program, according to Johnson.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.