Pa. natural gas tax passes House committee, may hit a wall before full vote

Advancing the plan is a big step for Democrats and moderate Republicans, who have pushed for years to levy the severance tax.

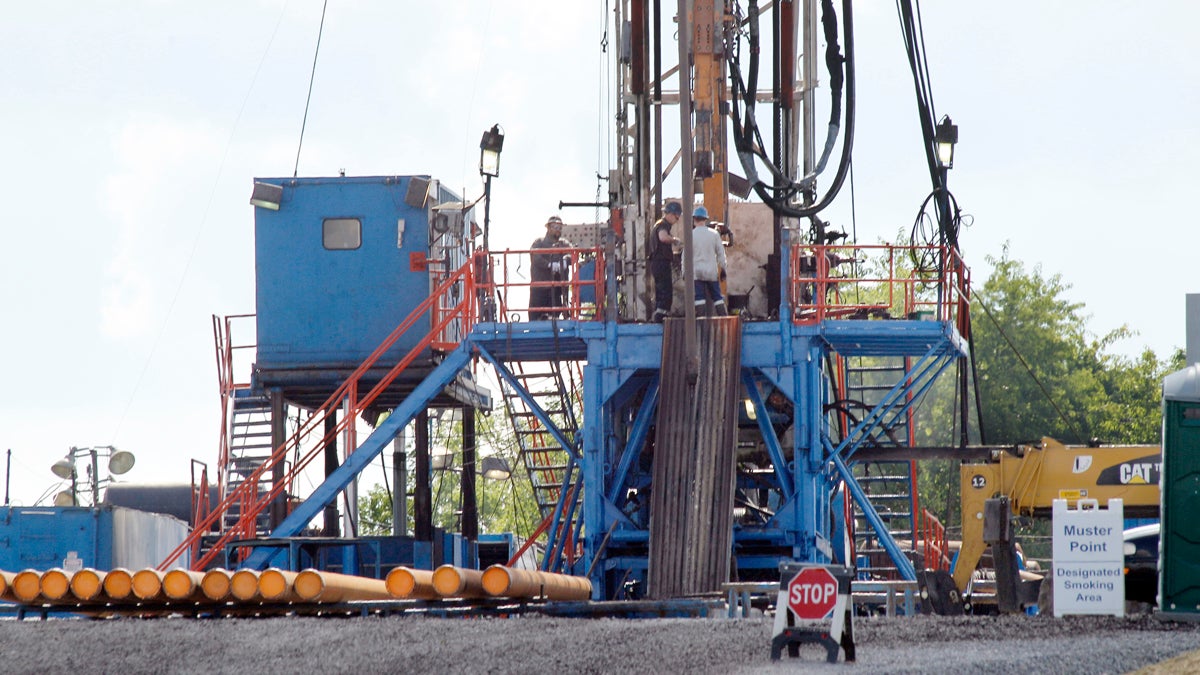

A crew works on a drilling rig at a well site for shale-based natural gas in Zelienople, Pennsylvania, in 2012. A plan for a severance tax on drillers had advanced in the state House.. (AP file photo)

Pennsylvania State House lawmakers have moved a bill onto the floor calling for a severance tax on natural gas drilling.

It’s a big step for Democrats and moderate Republicans, who have pushed the tax for years. But there’s a good chance the measure will languish without a vote for the foreseeable future.

It would create a tax on the volume of gas taken from the ground, on top of an existing fee for new wells drilled.

Its sponsor, Rep. Gene DiGirolamo (R-Bucks) estimated annual revenue between $200 million and $250 million, depending on gas prices.

The last time the House moved a severance tax bill was in 2009, when the chamber was briefly controlled by Democrats. Other than that, despite being a major campaign priority for Gov. Tom Wolf, numerous attempts have stalled in committee.

Following the vote, which saw six Republicans support the tax, DiGirolamo was triumphant.

“It’s been almost 10 years that we’ve been talking about doing this,” he said. “I mean we’ve still got a ways to go, but this is an official vote in committee. I’m just very excited.”

He said it would be a reasonable addition to the House’s budget package — the current version is based mostly on borrowing and includes negligible recurring revenue apart from a proposed gambling expansion.

“I think it’s fair, and it’s reasonable, and it’s absolutely the right thing to do — especially when you consider the budget problem we have right now,” DiGirolamo said.

But that might not be enough to make the severance tax a factor in ongoing budget talks.

The chamber’s more-conservative leaders say they aren’t inclined to bring the bill to a floor vote. Asked if its committee passage changes things, Majority Leader Dave Reed (R-Indiana) was blunt.

“No,” he said.

He elaborated later.

“Look, I just think folks make this out to be far more simple than it is,” Reed said.

“Everybody wants to focus on the dollar amount, on the tax. But you’ve got the environmental regulation policy, you’ve got the actual distribution model — how much is still going back to the local communities? The environmental programs versus the general fund, you have the landowner protections, the minimum royalty act, you have the forced pooling issue that most folks don’t know what it means, but is a very controversial side of that equation,” said Reed.

House spokesman Steve Miskin said the House is dedicated to its current revenue plan.

“I don’t really think that anyone actually likes it or thinks that it’s optimal,” he said. “But it doesn’t raise taxes, which is really one of the key things that’s very important.”

The Senate previously passed a smaller severance tax as part of its budget proposal. That version of the tax also tied in several changes to make it easier for industries to get pollution-control permits.

Senate Republican Majority Leader Jake Corman said his chamber would be happy to consider the DiGirolamo bill if it passed the House, but he added the Senate won’t support a severance tax that doesn’t include permitting changes.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.