Pa. counties on track to get millions for blight demolition

SB486 proposes adding a $15 fee for recording deeds and mortgages. The money would be earmarked for counties to use for blight remediation. Gov. Tom Wolf's spokesman says Wolf's still evaluating the bill and hasn't decided yet whether he'll sign it. (Emily Previti/WITF)

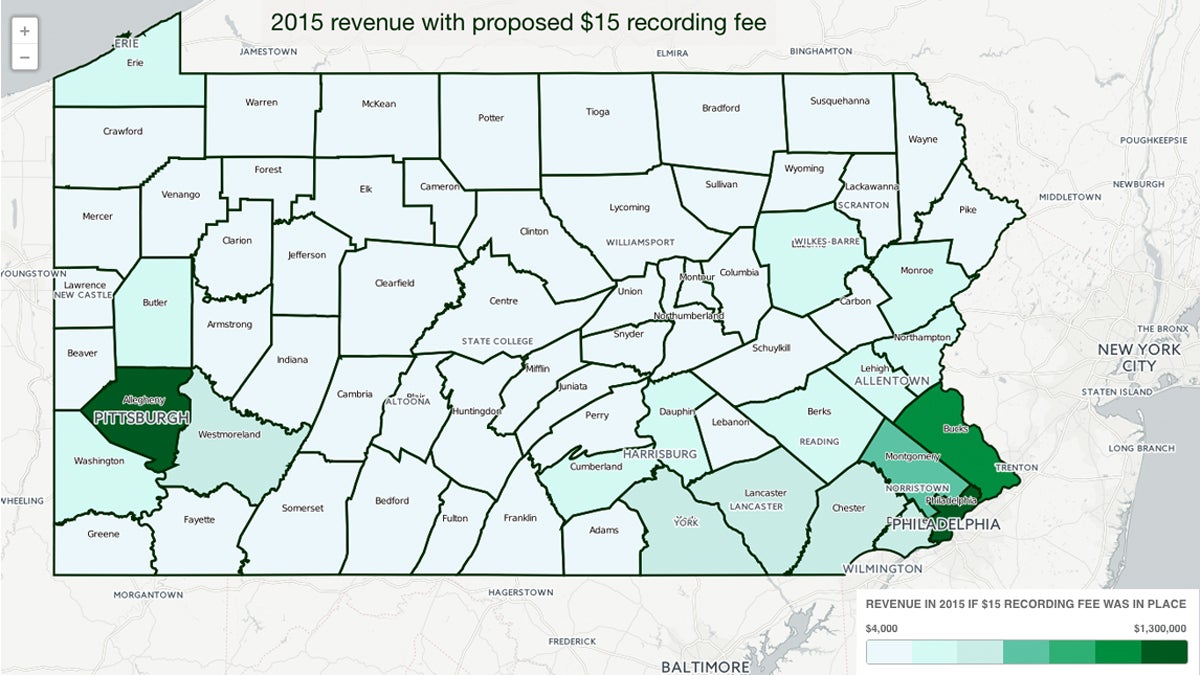

A proposal for a $15 deed and mortgage recording fee awaits Gov. Tom Wolf’s signature.

The fees collected would go to counties, which would have to use the money to demolish blighted structures.

Communities often struggle to deal with abandoned buildings. Some are left to deteriorate after owners die; others are a casualty of absentee landlords. The dilapidated structures detract from neighborhood aesthetics, property values, and safety.

The bill’s suggested fee would’ve generated $14 million statewide in 2013 and nearly $12 million last year, according to estimates from the Department of Revenue.

The measure cleared the state Senate without opposition over a year ago and got through the House with a 164-25 vote last week.

State Rep. Dan Truitt, R-West Chester, voted against it.

“You shouldn’t charge everyone in the area a fee to pay for a demolition of someone else’s property,” Truitt says. “It just doesn’t make sense to me that the cost should be distributed among people who have little to gain from the demolition.”

A blighted property on the 1100 block of Market Street near Cameron Street in Harrisburg, Pa. (Lindsay Lazarski/WHYY)

A blighted property on the 1100 block of Market Street near Cameron Street in Harrisburg, Pa. (Lindsay Lazarski/WHYY)

Truitt says he might prefer diverting funds to municipalities where the properties that generate the proceeds from deed and mortgage recording are located. But either system presents the potential for abuse. The revenue might be used for political favors, he says.

The bill also provides for counties to file annual spending and demolition activity reports to the state Department of Community & Economic Development, for publication on the DCED’s website.

In the bill, the law would sunset after a decade. At that point, legislators would presumably use the DCED data to decide whether to keep the initiative going as is, make changes or let it expire for good.

Truitt says it would be more impactful to change state law so it’s easier for municpalities to take over properties from owners who abandon them, let them fall into disrepair or rack up high tax delinquencies.

Another recent blight measure aims to do that by giving new property owners less time to remedy code violations. Right now, they have 18 months from the date of purchase; it would be one year under the legislation, subject to an extension at a municipality’s discretion. The measure wouldn’t apply in cases where a municipality cracks down on a property owner for certain reasons, such as letting utility accounts fall into delinquency or ignoring court orders to address serious code violations for six months or longer.

A prior version of the bill clarified that municipalities can act even faster, if desire. But lawmakers removed those provisions from the legislation before final passage, according to the Housing Alliance of Pennsylvania’s Policy Director Cindy Daley.

Wolf signed the enforcement timeline bill Nov. 3 and recording fee measure Nov. 4.

Editor’s note: This post was updated to reflect bills signed into law after story’s original publication and to add information from the Housing Alliance of Pennsylvania

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.