Mapping tax delinquent properties in Philadelphia

Taxes in Philadelphia

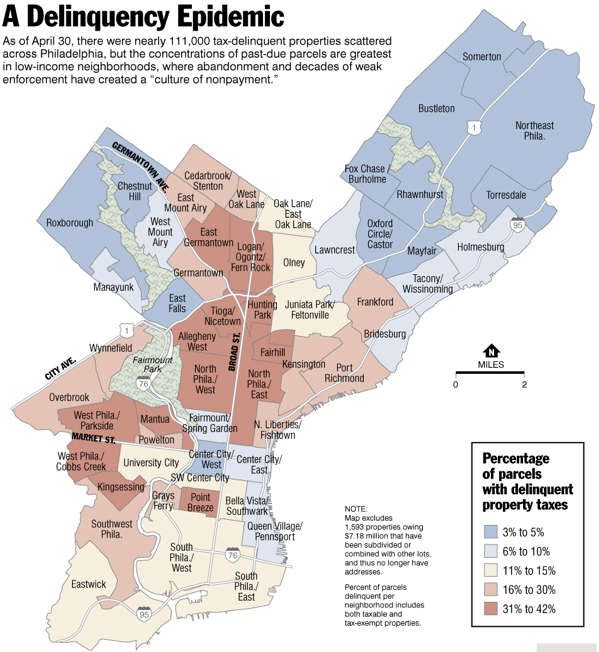

After decades of weak collection efforts, property tax delinquency has become epidemic in Philadelphia. There are about 111,000 tax delinquent accounts in the city, or nearly one out of every five properties. Collectively, they owe the city and school district $472 million.

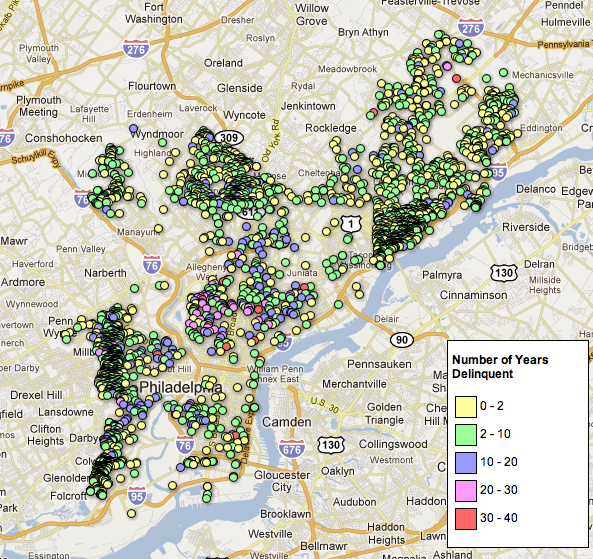

In Philadelphia, a property is considered tax delinquent nine months after the city’s March 31 payment deadline passes. Delinquent parcels are assessed interest and fees, which over time can grow larger than the principal. By law, properties can be sold at public auction as quickly as nine months after they become delinquent. In practice, that rarely happens, and many properties are allowed to linger on the delinquency rolls for decades.

About this map

This interactive map and searchable database reflects the city’s delinquency records as of April 30, 2011. Some properties listed as delinquent on this map may have since paid their debts. To see the latest payment status of any property, click the link labeled “current city records” that appears whenever an individual property is selected, or query the city’s database at http://www.phila.gov/revenue/RealEstateTax/

The map excludes properties that owe $125 or less, as well as 1,593 properties owing $7.18 million that have been subdivided or combined with other lots, and thus cannot be accurately mapped. A small number of other tax delinquent parcels may not appear on the map due to geocoding limitations. The Inquirer and PlanPhilly have added latitude and longitude to this data set for mapping purposes and, in some cases, estimated property values. Those values were developed using a formula developed by Kevin Gillen, PhD, a leading expert in the value of Philadelphia real estate and an Econsult vice president.

The Inquirer and PlanPhilly make no warranty or representation, express or implied, to the accuracy, quality or currency of this data.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.