Helen Gym wants to increase the parking tax to pay for schools. Is that a good idea?

At a time when many of the 2015 candidates for office are casting about, with varying degrees of success, for credible funding ideas for Philadelphia’s beleaguered public schools, At-Large City Council candidate Helen Gym is treading where few others will dare: parking taxes.

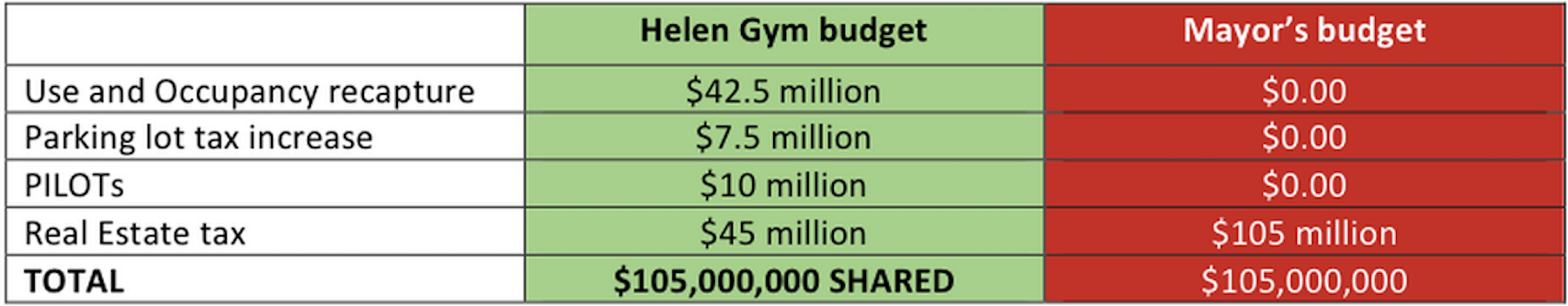

In her campaign’s education funding plan, Gym says she would cut Mayor Michael Nutter’s proposed 9.34% real estate tax increase in half, and raise the other half of his $105 million spend number from three other sources:

- “recapturing” $42 million of the real estate tax windfall commercial and industrial real estate owners saw from the Actual Value Initiative reassessment by raising the tax Use & Occupancy Tax.

- negotiating a $10 million Payment In Lieu of Taxes agreement with large non-profits.

- raising $7.5 million from an increase in the “parking lot tax”

Gym frames this proposal as asking parking lot owners, large nonprofits, and commercial building owners to chip in their “fair share” (obviously a subjective concept), and provides this chart contrasting her plan with the Mayor’s budget.

Gym’s parking plan is politically noteworthy for bucking the trend in recent years of politicians trying to lower the city’s 20% parking tax at the behest of the Philadelphia Parking Association, an industry group comprised of parking lot and garage business owners.

The recent history of this issue is that Michael Nutter raised the parking tax from 15% to 20% in 2008, and the Philadelphia Parking Association has been trying to lower it ever since. They got closest in 2011, when Councilman Jim Kenney’s office sponsored a bill to lower the parking tax back to 15% over 5 years, paid for by more aggressive auditing of rogue parking lot operations. Here’s an op-ed from Robert Zuritsky, the President of Parkway Corp. and the Parking Association, making the case for the bill.

Kenney’s bill passed City Council 12-5, but Michael Nutter vetoed it, disputing the Parking Association’s revenue projections and saying the tax cut would cost the city $24 million over five years. Council did not have the votes for an override. The tax cut then made it into Councilman Bill Green’s 2013 BIRT reform bill, which did not ultimately pass.

Despite these legislative losses, though, the political winds had seemed to be blowing in the direction of a parking tax cut on Council, mostly due to sustained advocacy from Zuritsky and the Parking Association.

The significance for the 2015 elections, of course, is that Zuritsky is one of the business owners behind the Philadelphia 3.0 independent expenditure group that’s supporting candidates for City Council. To be clear, reducing the parking tax is not on the group’s official agenda, and no questions about parking appeared in their candidate questionnaire, though surely the candidates who sought their endorsement are not unaware of Mr. Zuritsky’s position on parking taxes.

I connected with Rob Zuritsky by phone yesterday afternoon to get his reaction to Gym’s proposal to raise the parking tax, and he was disappointed to say the least.

“It doesn’t surprise me. I’m sure Helen is a wonderful person and has the best intentions, but you have somebody who’s really out of touch with what’s going on in the business climate for the city, if this is her idea of how to solve things. She doesn’t realize that the parking industry has been hit with 5 successive tax increases, or fee increases, during a recession, and we have the highest tax burden of any industry in the city. We pay, in city and state taxes, between 30 and 45 percent of what we charge.”

For Gym, the issue comes down to practicality, economics, and aesthetics.

“Parking lots don’t move, they’re ugly, and we should tax them more,” she says.

She is looking for funding sources that are local and sustained, and could go into effect soon. She also wants to use city tax policy to achieve other policy goals, like reducing blight and hastening infill construction on surface parking lots.

“I think that the bigger question of how we value land, and the fact that land is severely under-assessed, is a big issue and Council’s got to take that on,” she said, “It’s unlikely that we’ll be able to establish a land value tax in the next four weeks, but to me one of the most obvious examples of what happens when you severely undervalue land, and you allow people to exploit that, is the number of hideous surface parking lots and garages that are out there. I think it’s important to start some place to make it clear that we’re not valuing land appropriately, that we’re letting the built environment of our city suffer because of that.”

Isaiah Thompson looked at the land assessment issue for AxisPhilly after the AVI reassessments came out, and explained how inaccurately low land valuations encourage land speculation. Jim Kenney has also identified correcting land values as one potential source of revenue to fund education.

To Zuritsky, the parking industry is already paying more than its fair share of taxes, and wants to see the city to do a better job of collecting taxes owed before considering any tax rate increases.

“Helen is trying to make a name for herself and throw whatever good businesses are left in the city that actually do pay their taxes under the bus, and say ‘f— them.’ My taxes have gone up five years out of six. We’re not talking about 2 percent increases, we’re talking about laying off staff, and this is somebody who wants to come in and save the schools, but she says ‘the f— with anybody who’s employing anybody here.’ She’s coming in shooting blind and saying ‘let’s screw the parking operators.'”

How do you budget long term and try to understand what your tax burden is, when five of the last six years … who … is paying the real estate taxes? You are taxing the businesses in the city when you increase the real estate taxes.”

There are dozens of places the city can go to raise school revenue. It’s unconscionable that anyone would talk about increasing taxes again on business when the city does not collect the taxes that are due already on the books. They do not police themselves well. We are the worst tax collectors in the country. So for someone to recommend another tax when we have the second highest tax burden of any city in the country, on business again, it shows that they have not done their research and they are out of touch with the business concerns and jobs for the city.

Are higher parking taxes bad for the city’s economy overall, or just bad for parking businesses? We checked with someone who has done his research, and Zuritsky’s, too: Dr. Dick Voith, a president and principal of Econsult Solutions.

In September 2010, the Parking Association commissioned a study from Econsult on the effects of Philadelphia’s parking tax that came to an interesting conclusion: in the short term, higher parking tax rates would actually be pretty difficult for parking owner/operators to pass on to parking consumers.

“The economics are clear that raising the parking tax will not particularly raise parking prices in the short run as the operators are already charging the maximum the market will bear,” Voith said, “Note that parking owner/operators are definitely hurt, especially in the short run. In the longer term, it will raise parking prices as former parking areas are converted to more profitable uses—i.e. developed into things we want.”

Here’s what Econsult’s study had to say about this subject:

In the short run, a change in the parking tax has no impact on the parking rates paid by the consumer. Consequently, the parking facility operator pays the entire amount of a parking tax increase. Parking facility operators face the same short run problem every day – how to maximize revenue. In other words, parking operators are already charging as much as they can and the price consumers pay is determined by the number of spaces and the demand for parking, not by the level of taxes. The level of taxation and the other costs of operating a facility do not affect the price charged or the number of spaces available unless the costs are so great that the operator shuts down the facility.

In the long run the story is quite different. An increase in parking taxes discourages the rejuvenation of aging facilities, the replacement of facilities lost to development, and the construction of additional facilities. Thus higher parking taxes will decrease the long-run supply of parking, will increase the cost to the public of parking, and will decrease profits to owners of parking facilities. Further, should an additional parking facility be required, a higher parking tax implies that the facility will require larger subsidies to develop than it would in the absence of the parking tax increase.

Zuritsky’s case that the parking tax increases the cost of parking is based on the second paragraph. The way that’s supposed to work is that the higher tax makes building new parking lots and garages less profitable as an investment proposition, so over time, fewer parking facilities will be developed and parking prices will rise. Here’s how the study says that would work:

“With a 15 percent parking tax, only the above ground garage is profitable to construct. With a 20 percent tax, none of the facilities is profitable to construct. The increase in the parking tax decreases profitability by between $0.7m and $2.9m.The parking tax increase decreases the [internal rate of return] by between 3.9 percent and 6.4 percent. The increase in tax decreases the amount a developer can afford to pay for land by between $0.6m and $2.9m. If parking is the highest and best use for the land, the increase in tax leads to a decrease in the value of the land.”

Dr. Voith’s statement that higher parking taxes push parking lots toward being “developed into things we want” gets at the idea that whether this is good or bad for the city really depends on the eye of the beholder.

If you think that the highest and best use for land in appreciating areas is parking facilities, then the prospect of stagnant parking construction over the several years is upsetting. It will be harder for Parkway Corp. to buy more land for parking lots. To Gym’s way of thinking though, the disincentive to build more parking is a feature, not a bug, as she’d prefer to see surface parking lots developed into buildings.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.