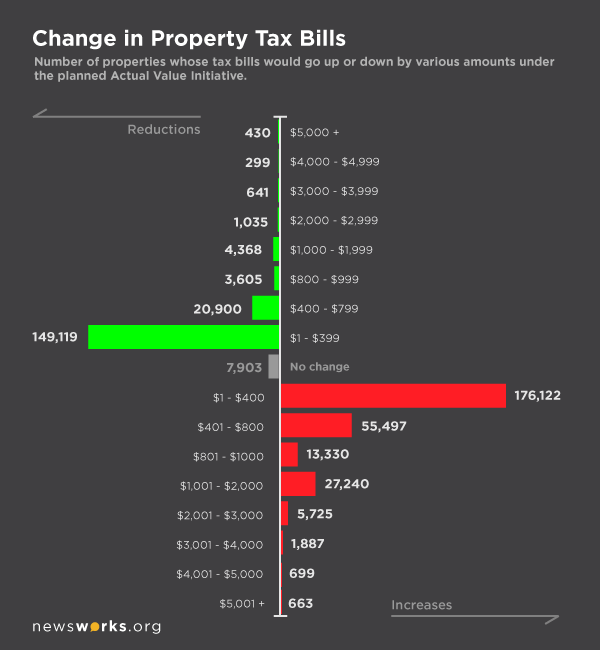

Graphic: How tax bills would change under AVI

Philadelphia residents have been waiting with bated breath for more information about the city’s looming property-tax overhaul, known as the Actual Value Initiative (AVI).

Philadelphia residents have been waiting with bated breath for more information about the city’s looming property-tax overhaul, known as the Actual Value Initiative (AVI).

Under AVI, the city is reassessing every last property in Philadelphia — and that means some people’s property tax bills will go up, while others’ will go down.

This week, Philadelphia Mayor Michael Nutter released its most detailed data yet to City Council, of which “It’s Our Money” obtained a copy. While it is preliminary and subject to change, it does reveal some fascinating stuff.

The Nutter administration’s data show that AVI might not be as much of a horror show as everyone expected. Under the overhaul, 40 percent of properties would see their tax bills decrease or stay the same, according to the analysis. Only 8 percent would see their bills increase by more than $1,000.

However, it’s important to keep in mind that those figures were calculated using a 1.25 percent property-tax rate, which does not include a homestead exemption. (That’s a tax break for homeowners.) The tax rate could change depending on what property-tax relief measures are ultimately used.

For instance, the property-tax rate would be about 1.35 to 1.4 percent with a $30,000 homestead exemption, according to the analysis. Plus, this analysis is being called “preliminary” for a reason. The figures could change as the city finalizes its assessments.

Our graphics are based entirely on this preliminary analysis.

As expected, the data also show that the property-tax burden would shift from businesses to homeowners under AVI. The value of all of Philadelphia’s residential properties would increase by more than 200 percent under AVI, according to the Nutter administration’s analysis — while the value of all commercial properties would increase by about 99 percent.

But even if Council members don’t like that — and many don’t — there’s precious little they can do about it this year. The court’s interpretation of Pennsylvania’s uniformity clause bars cities from taxing residential and commercial properties at different rates.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.