Critics slam PSEG’s notice of nuclear shutdown on eve of subsidy decision

Foes say it’s an effort to intimidate Board of Public Utilities as it decides whether big subsidies are merited for three nuclear units in South Jersey.

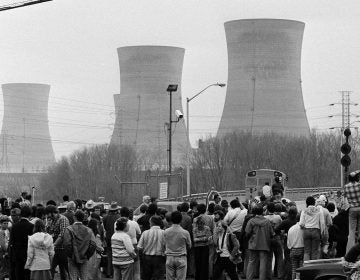

This file picture shows a cooling tower at the Salem nuclear power plant owned by the Public Service Energy Group and a building on a small farm in Lower Alloways Creek Township, N.J., in rural Salem County. (Mel Evans/AP Photo)

This article originally appeared on NJ Spotlight.

—

Two days before it learns whether its nuclear plants will win lucrative subsidies, PSEG Nuclear filed notices with regulatory authorities to shut down the three units.

Ostensibly, the retirements are linked to a deadline yesterday to file commitments to provide electricity from the plants to the regional power grid, the PJM Interconnection, without the company knowing whether the units would obtain subsidies of up to $300 million annually.

But foes called the move a hardball tactic designed to intimidate the state Board of Public Utilities, which is expected to decide tomorrow whether the economic challenges facing the nuclear plants qualify them to receive the financial incentives, also called zero emission certificates (ZECs).

“Either they don’t think they deserve the subsidy or they are trying to bully the commissioners into awarding them,’’ said Dennis Hart, executive director of the Chemistry Industry Council of New Jersey. He argued the company has failed to demonstrate the plants — located in South Jersey — are not profitable, a stance echoed by the New Jersey Rate Counsel and the Independent Market Monitor for PJM.

Those two organizations are the only ones which have had access to detailed financial information about the plants, other than BPU staff and a consultant, Richard Levitan, hired by the agency to study their profitability. That report has yet to be made public, despite pressure from consumer advocates and business groups.

No comment from PSEG

PSEG yesterday declined to comment on its decision, referring only to its filings with Federal Energy Regulatory Commission and the PJM. In it, the company noted that “if the ZECs are awarded to all three plants, the retirement submittals would be unnecessary.’’

The company had sought a waiver from authorities to extend a deadline to submit offers for the next capacity auction held by PJM in August. The annual auction is designed to ensure enough power is available to keep lights of if electricity demand spikes. Power suppliers submit bids to provide power and face stiff fines for failing to deliver what they promise.

In this case, PSEG apparently decided it did not want to commit nuclear units in the future without knowing whether the subsidies would make that decision profitable or a money-losing proposition.

“It is certainly a tactical move,’’ said Stefanie Brand, director of the Rate Counsel. “I hope the board remembers they are there to protect the public and to exercise independent judgment.’’

Others were less diplomatic. “I think it’s blackmail,’’ said Jeff Tittel, director of the New Jersey Sierra Club. “Basically, they are going to DEF-COM 5 and the threat of nuclear war to get their subsidy.’’

One of the biggest bones of contention in the mostly behind-the-scenes debate about the issue center on whether the state is required to award the full $300 million in annual subsidies to the plants if it determines they are in financial jeopardy.

Rates are meant to be ‘affordable, reasonable and just’

The company insists the legislation creating the ZEC program gives the BPU no leeway. Brand argues the legislation is trumped by existing utility law that requires utility rates be affordable, reasonable and just.

PSEG has threatened to close all the units unless each is awarded the subsidy, a process it has said may begin this fall with a refueling outage at Hope Creek. The nuclear units provide about 40 percent of power in the state and 90 percent of its carbon-free electricity.

Nuclear plants across the country are in dire economic straits, largely because of cheap natural gas. It has made it hard for nuclear to compete in competitive energy markets, leading to the premature closure at least six facilities. Other plants have averted closing by similar subsidies awarded in New York and Illinois.

The debate over the nuclear subsidies occurs at a time when New Jersey ratepayers, already saddled with some of the highest monthly bills in the country, are facing steep increases. By some projections, utilities in New Jersey are seeking up to $12 billion to invest in programs to modernize the grid, spur new spending on renewable energy, and electrify the transportation sector.

Some environmentalists argue the subsidies to nuclear plants will crowd out investments that more appropriately should be spent on clean-energy programs. The administration of Gov. Phil Murphy wants New Jersey to have 100 percent clean energy by 2050.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.