Capitol recap: In a state with local underfunded pensions, not everywhere is equal

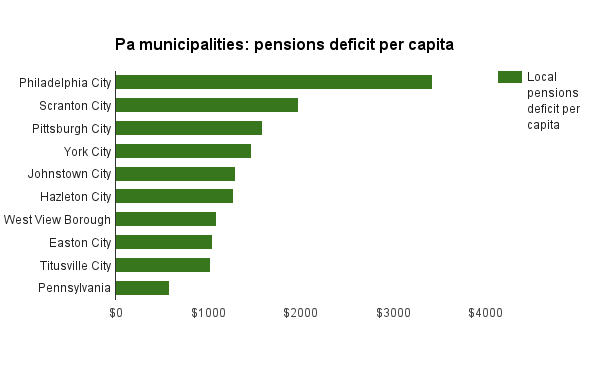

Top 10 Pennsylvania municipalities ranked by their pensions' unfunded actuarial liability per capita as of 2013. Source: Keystone Crossroads analysis of data from the U.S. Census Bureau and Pennsylvania Public Employees Retirement Commission

Public employee retirement funds are indeed worse off in urban areas, but there are a few things you should know.

Some rural and suburban elected officials said recently that their public worker pension funds are, on the whole, healthier than their urban counterparts.

We wondered whether that was actually true. So we crunched the numbers, and found that it is.

Cities’ combined pension funded ratio is 54 percent, according to an analysis by Keystone Crossroads of data from the state Public Employees’ Retirement Commission. The funded ratio shows how much of the money promised to cover present and future pensions is actually expected to be available.

A retirement system that’s 54 percent funded is considered moderately distressed by the state Auditor General’s office.

Townships collectively have an 85 percent funded ratio; boroughs, 81 percent. Those numbers fall in the “mildly distressed” category. (Although a few years ago, the bar was lower and neither would have been considered distressed).

But consider that Philadelphia has 1.5 million residents, five times more than the next-largest city, Pittsburgh. Allentown and Erie have more than 100,000 each, and populations decrease from there.

Philly’s estimated $5.3 billion unfunded actuarial liability represents about 70 percent of the entire state’s collective municipal shortfall (nearly $7.7 billion), according to Keystone Crossroads’ analysis.

It accounts for 78 percent of the cities’ combined unfunded actuarial liability.

If you discount Philadelphia, cities’ combined funded ratio rises to 67 percent. Better, but still moderately distressed. Without Philly and Pittsburgh, cities’ cumulative funded ratio is 81 percent, the same as the boroughs.

Nine of the ten communities with the highest per capita pensions deficit are cities, too.

Another point to consider: all Pennsylvania municipalities have a combined unfunded ratio of 36 percent.

Seventy-one municipalities have higher ratios. Of those, 44 are townships, 17 are boroughs and 10 are cities.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.