A tale of two companies: how changes to health insurance in Delaware are putting some small businesses in a bind [video]

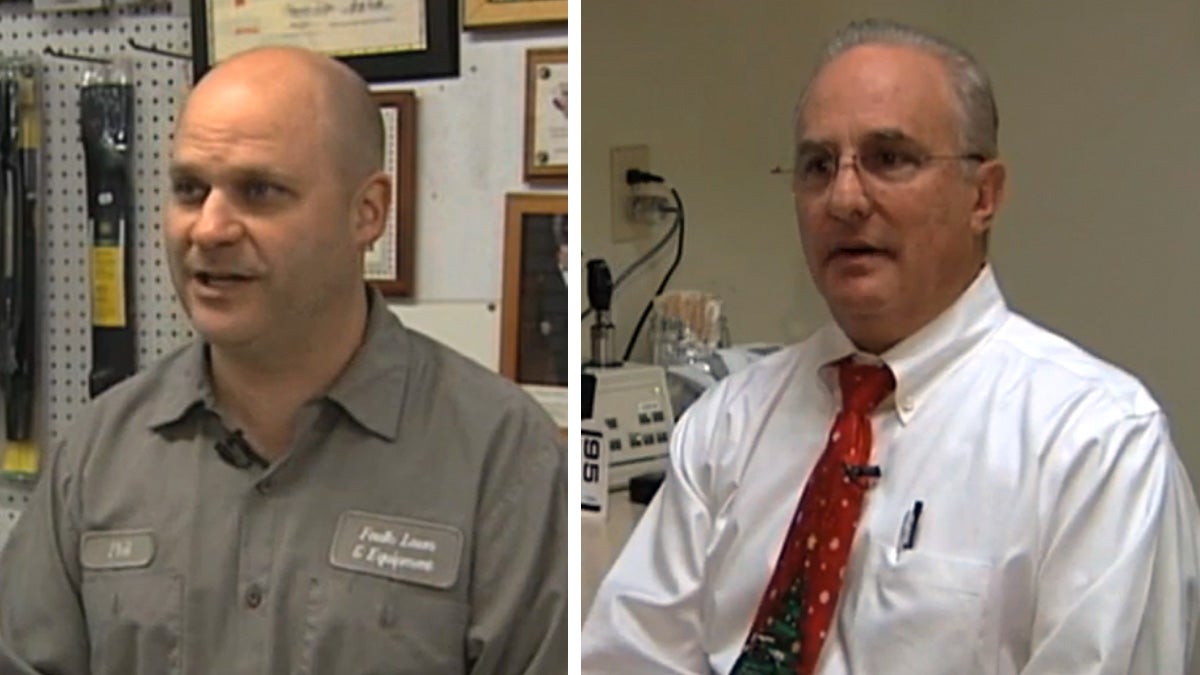

Nick Socorso, left; Dr. Douglas Lavenburg, right (Gene Ashley/WHYY)

Many small businesses, especially in Delaware, are going through tough transitions when it comes to renewing employee health benefits for this coming year.

That includes Foulk Lawn & Equipment in Wilmington and Lavenburg Medical Group, which has a location in Newark.

Both are “small” in that they employ fewer than 50 workers. The size means they’re not required to offer health insurance, but they do. In contrast, larger businesses may face certain penalties, depending on their size, for not offering coverage.

Two businesses with a “pride” in employee health benefits, Foulk Lawn & Equipment has grown from a mom and pop shop to an 8-man operation, says general manager Phillip Socorso. His grandfather started the business in 1954, and the company has always offered those workers health insurance.

“It was something we were pretty proud of,” says Socorso. “I mean, we don’t make a lot of money in this business, but it was something we always thought was an incentive to stay at Foulk lawn. We always provided what was a generous plan.”

Dr. Douglas Lavenburg, meanwhile, started his multi-specialty ophthalmology practice called Lavenburg Medical group two decades ago. He, too, says he has always taken pride in offering benefits to his 29 workers. “They’re very valuable to me, they’re like my family,” says Lavenburg.

Some “sticker shock” and tough choices

Both Lavenburg and Socorso faced some difficult decisions this past year, when they received their new estimates for health insurance.

For Lavenburg and his employees, premiums almost doubled. “And they [employees] just got sticker shock,” he says. “We just didn’t realize why this [the insurance rates] would jump so much.” Lavenburg says he has shouldered the insurance price increases in past years, but he can no longer shoulder that amount.

Over in Wilmington, Socorso was also in for a rude awakening when his rates came in. “You’re kind of nervous when you’re opening it, and when you open it and you see what’s there, it was a bit of a shock,” he says. “It was a bit of a shock.” Socorso was facing about a 40 percent increase, or about $1,000 more a month in expenses.

“I was mad as hell,” Socorso says. “For me, that’s the difference between – that’s the difference between life and death sometimes for a small business.”

Why rates are changing

Nick Moriello, with Health Insurance Associates in Newark, says a big reason some businesses like Lavenbug’s and Socorso’s are experiencing rate increases is that as of 2015, Delaware will no longer allow health care underwriting for small group coverage.

That’s where insurers offer cheaper plans to businesses with healthier employees. The formula is different now, and with that, insurers for the first time are calculating rates, predicting risks in a new way. The change is a provision of the Affordable Care Act that’s kicking in everywhere, including in neighboring Pennsylvania. New Jersey already bans it.

“Delaware was a state that allowed health underwriting pre-ACA, and so businesses that had healthy employees got a better rate,” Moriello said. “Businesses with employees that had high claims exposure got a worse rate. In the new world, health is irrelevant.”

Instead, only age and smoking habits matter. While Socorso and Lavenburg are seeing big increases, Moriello says their experiences don’t not represent the full picture.

“So we’ve seen increases as high as 110%, and we’ve seen some that decreased, and everything in between,” says Moriello, who has several hundred small business clients. “There hasn’t been a norm or average yet.”

Grant Lahmann, eastern director for Small Business Majority, an advocacy organization, says that while the impact of the ACA changes on small businesses varies, a lot of insurance options exist. Those with fewer than 25 workers and an average salary of under $50,000 may be eligible for tax credits for health insurance through the SHOP or Small Business Health Options Program.

Moreover, he says, a lot of businesses struggled with the past underwriting method for determining rates.

“Yes, if you [a business] were healthy, you could be rated on that health. We’ve seen stories in other states like in Colorado and Missouri where business owners were just being put out of business because of the exorbitant rates that the pre-existing condition fees and things of that nature were being tacked on to their group rates because of who they had as employees …So it kind of bites both ways.”

At least in Delaware, Moriello says most of the small businesses he’s worked with are struggling with the higher rates resulting from the policy change this coming year. One third of his small business clients, or about 100, are dropping coverage, and he expects that number to go up.

A much smaller contributor to overall rate increases this coming year has to do with the Affordable Care Act’s new requirement that all health plans cover certain essential benefits, such as pediatric dental and vision coverage, Moriello says. That was supposed to take effect last year, but the federal government gave states the option to postpone the requirement for one year.

Moriello believes that while many business’ health insurance rates jumped a lot this past year, they’ll likely level off in future years, as insurers get better at predicting costs with the new formula. Such was the case in other states that changed the formula earlier on.

New federal rules also require insurers that spend less than 80 percent on medical care in a year to issue refunds.

Two companies, two outcomes

Facing the jump in health expenses, Dr. Lavenburg says he was in a bind. Dropping coverage and risking losing his employees was not an option. “A good certified optometrist technician can have a job anywhere in a day,” he says.

Instead, he found a plan works, price wise, but it covers less for employees. “We’ve had to ask them to shoulder some of the cost,” says Lavenburg. “Some of the employees are single moms, just getting by, and it hurt.”

As a medical practice, Lavenburg also sees the flip side of high deductible plans, where patients have more out of pocket expenses. He says more are postponing visits or procedures, which could wind up costing them more in the long term.

Over at Foulk Lawn, Socorso says the decision was incredibly difficult: he stopped offering health insurance. Instead, his eight employees will have to find health insurance elsewhere. “It’s not the best. It’s something we did for so long,” says Socorso. “My dad did it, My grandpa. You hate to be the one that has to do that.”

In response, Socorso is raising their wages, which he notes is taxable for the employer and employee, unlike health benefits. But the change, he says, isn’t all that bad. All of his employees were able to find coverage through the individual health insurance marketplace, and many were surprised with the coverage they were able to find.

“That’s where it got interesting,” Socorso said. “If you’re young and you’re single, they were actually able to get pretty good plans for less money than I was able to offer them.” On concern is that insurance is a lot more expensive for his older employees, but overall, Socorso says he’s OK with how everything turned out. “This is not a one size fits all answer,” says Socorso. “What works for me may not work for everyone else, for sure.”

Unlike large businesses, those with fewer than 50 workers don’t face any penalties for not offering health coverage. Individuals, however, may face a fine for not having insurance.

The deadline for individuals to sign up for health coverage through Delaware’s online marketplace is February 15. Officials have reported that to date, about 20,000 people have signed up or re-enrolled in plans.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.