What happens to your taxes under Wolf’s budget plan?

Listen

Gov. Tom Wolf delivers his budget address for the 2015-16 fiscal year to a joint session of the Pennsylvania House and Senate Tuesday in Harrisburg. Wolf is seeking more than $4 billion in higher taxes on income

So what does Gov. Tom Wolf’s proposed budget mean for the average Pennsylvanian living in the Philadelphia area? Let me introduce you to two of my friends.

Suburban Joe

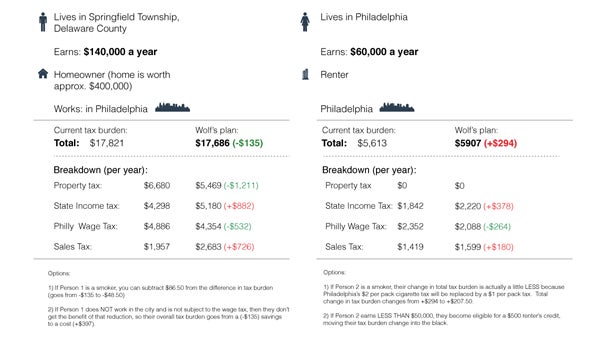

First, let me tell you about Suburban Joe. Now Joe, as his name would suggest, lives in the suburbs— specifically, Springfield, Delaware County. Joe earns $140,000 a year as an associate at Schnader Harrison. He owns his home, which is worth about $400,000 on the open market.

Joe is subject to four major taxes that would be affected by Wolf’s budget.

The property tax. And since Joe lives in Springfield Township, he can expect his property tax bill to go down by about 20 percent under Wolf’s plan.

The state income tax. Under Wolf’s plan, this goes up for everyone earning income in Pennsylvania.

Since Joe works in Philadelphia, he’s subject to the Philadelphia wage tax. This will go down under Wolf’s plan.

The sales tax. This one is complicated, but it’s definitely going to go up for Joe — though just how much is a little difficult to say.

So back to the property tax. A typical tax bill for a homeowner in Joe’s town is about 1.67 percent of the home price, which for Joe is $6,680 a year. Under the new plan, he’d save about $1,200 on that total.

But Joe’s state income taxes are going to get jacked up about $900 a year.

However, Joe gets a more than $500 break on his Philadelphia wage tax.

Which brings us back to that fluid sales tax. Under Wolf’s plan, sales tax moves up from 6 percent to 6.6 percent. I went to the Bureau of Labor Statistics to crunch these numbers — they have average spending for someone with Joe’s income. What makes this complicated is that Wolf proposes adding a whole bunch of taxable categories — including candy, newspapers, textbooks and caskets.

And while the statistics break down spending into categories such as restaurant meals and appliances, it’s tough to get a handle on what the average American spends each year on, say, caskets.

But I tried as best I could to fit these items into the categories that do exist, and I come up with an extra $720 Joe will spend in sales tax.

By the way, under Wolf’s plan, legal services like those Joe provides might be taxed for the first time in Pennsylvania. The partners at his firm probably aren’t too happy about that.

When I balance everything out, Joe actually saves a little bit of money — about $135 a year.

But Joe is what we might call a double dipper. Since he pays both the property and wage tax, he gets a break on both.

If he didn’t work in the city, he wouldn’t be getting that roughly $500 savings. Instead of a tax reduction, he’d pay about $400 more. Also, if Joe is a smoker, he’ll pay even more because Wolf is proposing a $1 a pack tax on smokes.

Urban Jane

OK, moving on now to my other friend, Urban Jane.

Jane lives and works in Philadelphia. She’s an associate public relations specialist at the Kimmel Center, making about $60,000 a year. And she has her sights set on career advancement. She rents a two-bedroom apartment in Center City, where she lives with her fixed-gear bike and her dog, Miss Flufkins.

Unlike Joe, Jane is a renter, so she’s not subject directly to the property tax – though that certainly factors into the rent she pays. So here, we’re really talking about the state income tax, city wage tax, and sales tax.

State income tax, once again, goes up. Wage tax goes down. Sales tax goes up, but not much, because we’re only talking about the added categories driving up the total. That’s because, unlike the rest of the state, Philadelphia’s sales tax rate isn’t going up; it’s staying at 8 percent.

In this case, Jane is going to pay a bit more, a little less than $300 total. A couple of notes here, though: Jane is a relatively high earner for a renter. If she earned less than $50,000 a year, she’d get a $500 renter’s credit. That moves her from a total increase of about $300, to a decrease of around $200.

Also, interestingly, if Jane is a smoker, her total burden is going down because Philadelphia currently levies a $2 per pack tax on cigarettes. Under the Wolf plan, that reverts to just $1.

Looking at Pennsylvanians more broadly, we can say that low- to middle-income property owners will do well under this plan because of the property tax reduction — even better if they work in Philadelphia.

Many seniors will benefit from this plan if they’re retired and own property because, in many cases, their retirement income isn’t subject to the state income tax. High earners will pay more because property taxes won’t be cut that much in wealthy areas, but those homeowners will still take a hit to their income and sales taxes. Renters do OK if they qualify for the credit.

But the big wild card here is the sales tax — it’s just not clear how these added categories will shake out.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.