FEMA accused of fraud in Hurricane Sandy insurance claims reviews

Listen

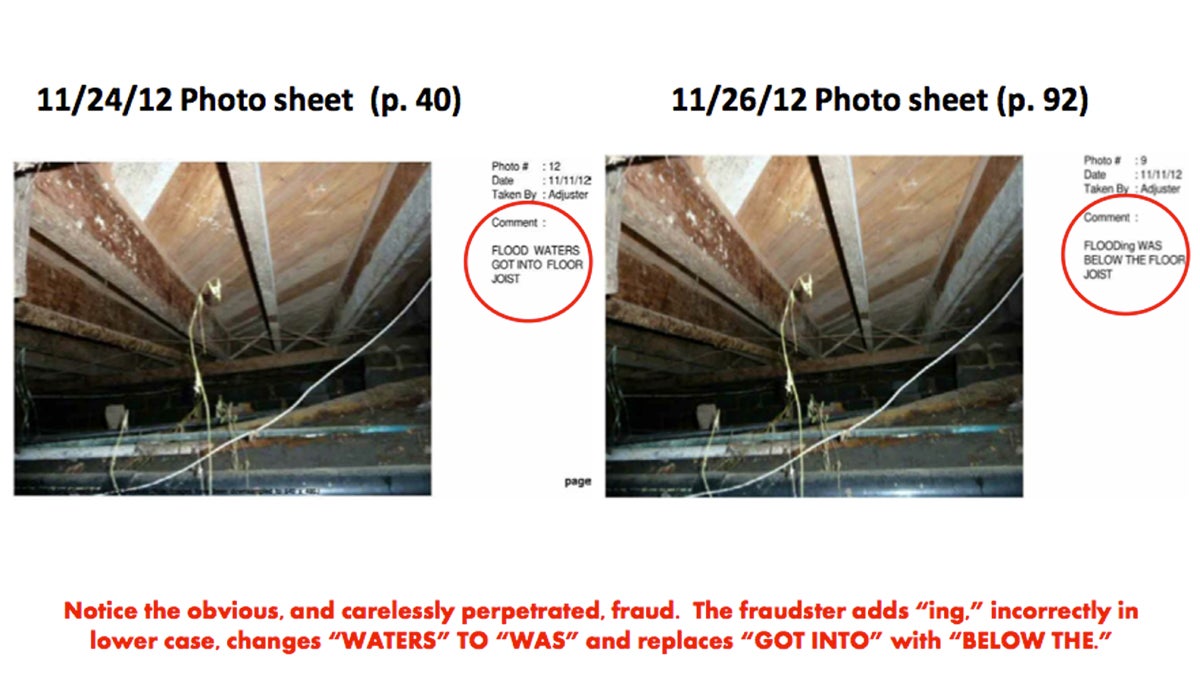

Policyholders that claimed FEMA and a contractor doctored insurance claim reports after Hurricane Sandy, such as the one above. Now they allege that reviews of those claims have also been plagued by fraud. (Image courtesy of Augie Matteis)

In October, the Federal Emergency Management Agency offered to review insurance claims made after Hurricane Sandy due to allegations of fraud and abuse by government contractors.

Six months later, new allegations suggest that FEMA’s review process may also be rife with abuse.

“This review process is just a second round of massive fraud,” said Augie Matteis, an attorney representing 1,300 homeowners and business owners who are having their Sandy claims reviewed by FEMA.

“It’s not just government incompetence. When they hear that it’s intentional fraud, and then FEMA is covering up the intentional fraud, they’re shocked and horrified,” he said.

According to Matteis, seven people who worked on the Sandy review process for FEMA have come forward to detail the ways the agency is allegedly underpaying claims on a systematic basis.

Affidavits from three former employees of OST, Inc., the company contracted by FEMA to oversee the Sandy review process, allege that their superiors at FEMA and OST calculated what they would expect to pay a homeowner based on the specifications of the property and then asked employees to tailor their damage assessments to meet those estimates.

In other words, the former employees said FEMA and OST calculated what they wanted to pay policyholders and then figured out how to justify it.

The three employees also said they were instructed not to pay for damage that should have been covered under FEMA’s Standard Flood Insurance Policy.

At a press conference hosted by New Jersey U.S. Rep. Tom MacArthur Thursday, one of the whistleblowers, former OST flood manager Jeff Coolidge, detailed how higher-ups enforced the low-balling of claims.

“If we saw more damage than this threshold allowed, we were told not to pay for it,” said Coolidge, who managed a team of auditors. “If I or one of my reviewers recommended that FEMA pay more on a claim than the threshold predicted, FEMA would not approve it and told us to change our estimates.”

But FEMA spokesman Rafael Lemaitre, who said he could not discuss specific allegations of fraud, claimed the agency had no reason to low-ball policyholders.

“I can tell you right now that there is no incentive to underpay any claim,” he said. “The system is not set up to underpay claims. In fact, quite the opposite — the system is set up to make sure that every policyholder gets every dollar they are due.”

Lemaitre said any allegations of wrongdoing would be referred to the U.S. Justice Department.

Around 144,000 insurance claims were filed with the National Flood Insurance Program after Hurricane Sandy.

More than 19,000 of those claims were “deemed eligible” for review by the deadline in mid-October. (People who received the maximum payout their policy allowed were not eligible for reviews.)

Since then, FEMA said it has reviewed 11,000 claims and disbursed $50 million to underpaid policyholders.

“We are working as quickly as possible — literally in shifts — to review any claim that a policyholder might think was underpaid,” said Lemaitre. “Here we are three years after Hurricane Sandy, and these policyholders frankly have been through too much already.”

But MacArthur, a Republican, has called for the resignation of FEMA director Craig Fugate as well as congressional hearings into the claims of systematic low-balling in the review process.

“Every American deserves to know that their government is going to be there to support them,” said MacArthur, “not to take advantage of them.”

Matteis said not a single one of his 1,300 clients has had a review completed by FEMA, adding that he may sue the agency depending on the results of the review process.

DV.load(“https://www.documentcloud.org/documents/2819749-FEMA-Whistleblower-1-Affidavit.js”, {

width: 600,

height: 600,

sidebar: false,

text: false,

container: “#DV-viewer-2819749-FEMA-Whistleblower-1-Affidavit”

});

FEMA-Whistleblower-1-Affidavit (PDF)

FEMA-Whistleblower-1-Affidavit (Text)

DV.load(“https://www.documentcloud.org/documents/2819751-FEMA-Whistleblower-2-Affidavit.js”, {

width: 600,

height: 600,

sidebar: false,

text: false,

container: “#DV-viewer-2819751-FEMA-Whistleblower-2-Affidavit”

});

FEMA-Whistleblower-2-Affidavit (PDF)

FEMA-Whistleblower-2-Affidavit (Text)

DV.load(“https://www.documentcloud.org/documents/2819753-FEMA-Whistleblower-3-Affidavit.js”, {

width: 600,

height: 600,

sidebar: false,

text: false,

container: “#DV-viewer-2819753-FEMA-Whistleblower-3-Affidavit”

});

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.